Google 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 GOOGLE INC. |Form10-K

PART II

ITEM8.Notes to Consolidated Financial Statements

Other

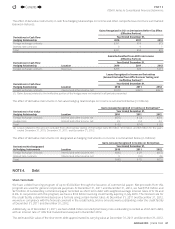

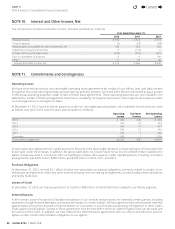

We are also regularly subject to claims, suits, government investigations, and other proceedings involving competition and

antitrust (such as the pending investigations by the FTC and the EC described above), intellectual property, privacy, tax, labor

and employment, commercial disputes, content generated by our users, goods and services off ered by advertisers or publishers

using our platforms, personal injury, consumer protection, and other matters. Such claims, suits, government investigations, and

other proceedings could result in fi nes, civil or criminal penalties, or other adverse consequences.

Certain of our outstanding legal matters include speculative claims for substantial or indeterminate amounts of damages. We

record a liability when we believe that it is both probable that a loss has been incurred, and the amount can be reasonably

estimated. We evaluate, on a monthly basis, developments in our legal matters that could aff ect the amount of liability that has

been previously accrued, and make adjustments as appropriate. Signifi cant judgment is required to determine both likelihood of

there being and the estimated amount of a loss related to such matters.

With respect to our outstanding legal matters, based on our current knowledge, we believe that the amount or range of reasonably

possible loss will not, either individually or in the aggregate, have a material adverse eff ect on our business, consolidated fi nancial

position, results of operations, or cash fl ows. However, the outcome of such legal matters is inherently unpredictable and subject

to signifi cant uncertainties.

We expense legal fees in the period in which they are incurred.

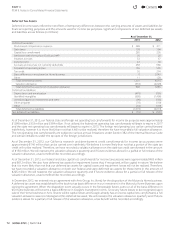

Income Taxes

We are under audit by the Internal Revenue Service (IRS) and various other tax authorities. We have reserved for potential

adjustments to our provision for income taxes that may result from examinations by, or any negotiated agreements with, these

tax authorities, and we believe that the fi nal outcome of these examinations or agreements will not have a material eff ect on our

results of operations. If events occur which indicate payment of these amounts is unnecessary, the reversal of the liabilities would

result in the recognition of tax benefi ts in the period we determine the liabilities are no longer necessary. If our estimates of the

federal, state, and foreign income tax liabilities are less than the ultimate assessment, a further charge to expense would result.

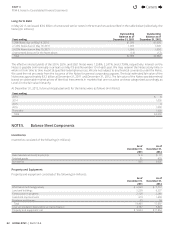

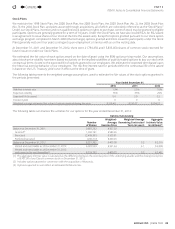

NOTE12. Stockholders’ Equity

Convertible Preferred Stock

Our board of directors has authorized 100,000,000 shares of convertible preferred stock, $0.001 par value, issuable in series. At

December31,2011 and 2012, there were no shares issued or outstanding.

ClassA and Class B Common Stock

Our board of directors has authorized two classes of common stock, ClassA and Class B. At December31, 2012, there were

9,000,000,000 and 3,000,000,000 shares authorized and there were 267,448,281 and 62,530,474 shares outstanding of ClassA

and Class B common stock, $0.001 par value. The rights of the holders of ClassA and Class B common stock are identical, except

with respect to voting. Each share of ClassA common stock is entitled to one vote per share. Each share of Class B common stock

is entitled to 10 votes per share. Shares of Class B common stock may be converted at any time at the option of the stockholder

and automatically convert upon sale or transfer to ClassA common stock. We refer to ClassA and Class B common stock as

common stock throughout the notes to these fi nancial statements, unless otherwise noted.

Stock Dividend

In April2012, our board of directors approved amendments to our certifi cate of incorporation that would, among other things,

create a new class of non-voting capital stock (Class C capital stock).The amendments authorized 3billion shares of Class C capital

stock and also increased the authorized shares of ClassA common stock from 6billion to 9billion. The amendments are refl ected in

our Fourth Amended and Restated Certifi cate of Incorporation (New Charter), the adoption of whichwas approved by stockholders

at our 2012 Annual Meeting of Stockholders held on June21, 2012. We have announced the intention of our board of directors

to consider a distribution of shares of the ClassC capital stock as a dividend to our holders of ClassA and Class B common stock

(Dividend).The Class C capital stock will have no voting rights, except as required by applicable law. Except as expressly provided

in the New Charter, shares of Class C capital stock will have the same rights and privileges and rank equally, share ratably and be

identical in all other respects to the shares of ClassA common stock and Class B common stock as to all matters.

The par value per share of our shares of ClassA common stock and Class B common stock will remain unchanged at $0.001 per

share after the Dividend. Onthe eff ective date of the Dividend, there will be a transfer between retained earnings and common

stock and the amount transferred will be equal to the $0.001 par value of the Class C capital stock that is issued.We will give

retroactive eff ect to prior period share and per share amounts in our consolidated fi nancial statements for the eff ect of the

Dividend, such that prior periods are comparable to current period presentation.

Contents

44