Google 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 GOOGLE INC. |Form10-K

PART II

ITEM8.Notes to Consolidated Financial Statements

Fair Value Hedges

We use forward contracts designated as fair value hedges to hedge foreign currency risks for our investments denominated in

currencies other than the U.S. dollar. Gains and losses on these contracts are recognized in interest and other income, net, along

with the off setting losses and gains of the related hedged items. We exclude changes in the time value for forward contracts from

the assessment of hedge eff ectiveness and recognize them in interest and other income, net. The notional principal of these

contracts was $1.0billion and $1.1billion as of December31, 2011 and December31, 2012.

Other Derivatives

Other derivatives not designated as hedging instruments consist of forward and option contracts that we use to hedge intercompany

transactions and other monetary assets or liabilities denominated in currencies other than the local currency of a subsidiary. We

recognize gains and losses on these contracts as well as the related costs in interest and other income, net, along with the gains

and losses of the related hedged items. The notional principal of foreign exchange contracts outstanding was $3.7billion and

$6.6billion at December31,2011 and December31, 2012.

We also use exchange-traded interest rate futures contracts and “To Be Announced” (TBA) forward purchase commitments of

mortgage-backed assets to hedge interest rate risks on certain fi xed income securities. The TBA contracts meet the defi nition

of derivative instruments in cases where physical delivery of the assets is not taken at the earliest available delivery date. Our

interest rate futures and TBA contracts (together interest rate contracts) are not designated as hedging instruments. We recognize

gains and losses on these contracts as well as the related costs in interest and other income, net. The gains and losses are

generally economically off set by unrealized gains and losses in the underlying available-for-sale securities, which are recorded as

a component of AOCI until the securities are sold or other-than-temporarily impaired, at which time the amounts are moved from

AOCI into interest and other income, net. The total notional amounts of interest rate contracts outstanding were $100million

and $25million at December31, 2011 and December, 31, 2012.

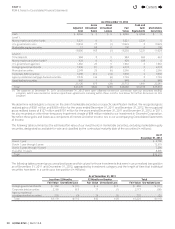

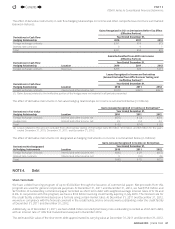

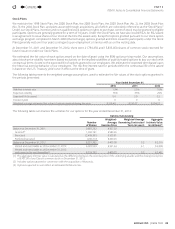

The fair values of our outstanding derivative instruments were as follows (in millions):

As of December31, 2011

Balance Sheet Location

Fair Value

ofDerivatives

Designated as

HedgingInstruments

Fair Value

ofDerivatives

NotDesignated as

Hedging Instruments

Total

FairValue

Derivative Assets:

Level 2:

Foreign exchange contracts Prepaid revenue share, expenses and

other assets, current and non-current $333 $ 4 $337

Derivative Liabilities:

Level 2:

Foreign exchange contracts Accrued expenses and other

currentliabilities $ 5 $ 1 $ 6

As of December31, 2012

Balance Sheet Location

Fair Value

ofDerivatives

Designated as

HedgingInstruments

Fair Value

ofDerivatives

NotDesignated as

Hedging Instruments

Total

FairValue

Derivative Assets:

Level 2:

Foreign exchange contracts Prepaid revenue share, expenses and

other assets, current and non-current $164 $ 13 $177

Interest rate contracts Prepaid revenue share, expenses and

other assets, current and non-current 1 0 1

Total $165 $ 13 $178

Derivative Liabilities:

Level 2:

Foreign exchange contracts Accrued expenses and other

currentliabilities $ 3 $ 4 $ 7

Contents

44