Google 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55GOOGLE INC. |Form10-K

PART II

ITEM8.Notes to Consolidated Financial Statements

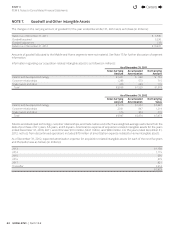

Long-Lived Assets Including Goodwill and Other Acquired Intangible Assets

We review property and equipment, long-term prepayments and intangible assets, excluding goodwill, for impairment whenever

events or changes in circumstances indicate the carrying amount of an asset may not be recoverable. We measure recoverability

of these assets by comparing the carrying amounts to the future undiscounted cash fl ows the assets are expected to generate. If

property and equipment and intangible assets are considered to be impaired, the impairment to be recognized equals the amount

by which the carrying value of the asset exceeds its fair market value. We have made no material adjustments to our long-lived

assets in any of the years presented. In addition, we test our goodwill for impairment at least annually or more frequently if events or

changes in circumstances indicate that this asset may be impaired. We found no goodwill impairment in any of the years presented.

Intangible assets with defi nite lives are amortized over their estimated useful lives. We amortize our acquired intangible assets

on a straight-line basis with defi nite lives over periods ranging from one to 12 years.

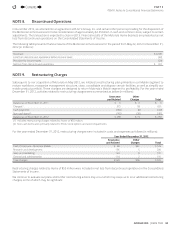

Income Taxes

We recognize income taxes under the liability method. We recognize deferred income taxes for diff erences between the fi nancial

reporting and tax bases of assets and liabilities at enacted statutory tax rates in eff ect for the years in which diff erences are

expected to reverse. We recognize the eff ect on deferred taxes of a change in tax rates in income in the period that includes the

enactment date.

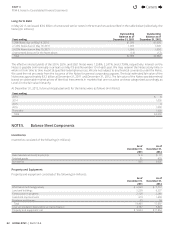

Foreign Currency

Generally, the functional currency of our international subsidiaries is the local currency. We translate the fi nancial statements

of these subsidiaries to U.S. dollars using month-end rates of exchange for assets and liabilities, and average rates of exchange

for revenues, costs, and expenses. We record translation gains and losses in accumulated other comprehensive income as a

component of stockholders’ equity. We recorded $124million of net translation losses in 2010, $107million of net translation

losses in 2011, and $75million of net translation gains in 2012. We record net gains and losses resulting from foreign exchange

transactions as a component of foreign currency exchange losses in interest and other income, net. These gains and losses are

net of those recognized on foreign exchange contracts. We recorded $29million of net losses in 2010, $38million of net losses

in 2011, and $78million of net losses in 2012.

Advertising and Promotional Expenses

We expense advertising and promotional costs in the period in which they are incurred. For the years ended December31, 2010,

2011 and 2012, advertising and promotional expenses totaled approximately $772million, $1,544million, and $2,332million.

Prior Period Reclassifi cation

Prior period balance related to inventories has been reclassifi ed to conform to the current year presentation.

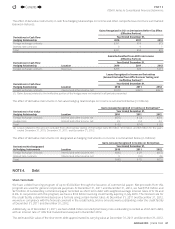

NOTE2. Net Income Per Share of ClassA and Class B Common Stock

We compute net income per share of ClassA and Class B common stock using the two-class method. Basic net income per share

is computed using the weighted-average number of common shares outstanding during the period. Diluted net income per share

is computed using the weighted-average number of common shares and the eff ect of potentially dilutive securities outstanding

during the period. Potentially dilutive securities consist of stock options, warrants issued under the TSO program, and restricted

stock units. The dilutive eff ect of outstanding stock options, warrants, and restricted stock units is refl ected in diluted earnings

per share by application of the treasury stock method. The computation of the diluted net income per share of ClassA common

stock assumes the conversion of Class B common stock, while the diluted net income per share of Class B common stock does

not assume the conversion of those shares.

The rights, including the liquidation and dividend rights, of the holders of our ClassA and Class B common stock are identical, except

with respect to voting. Further, there are a number of safeguards built into our certifi cate of incorporation, as well as Delaware law,

which preclude our board of directors from declaring or paying unequal per share dividends on our ClassA and Class B common

stock. Specifi cally, Delaware law provides that amendments to our certifi cate of incorporation which would have the eff ect of

adversely altering the rights, powers, or preferences of a given class of stock (in this case the right of our ClassA common stock to

receive an equal dividend to any declared on our Class B common stock) must be approved by the class of stock adversely aff ected

by the proposed amendment. In addition, our certifi cate of incorporation provides that before any such amendment may be put

to a stockholder vote, it must be approved by the unanimous consent of our board of directors. As a result, the undistributed

earnings for each year are allocated based on the contractual participation rights of the ClassA and Class B common shares as

if the earnings for the year had been distributed. As the liquidation and dividend rights are identical, the undistributed earnings

are allocated on a proportionate basis. Further, as we assume the conversion of Class B common stock in the computation of the

diluted net income per share of ClassA common stock, the undistributed earnings are equal to net income for that computation.

4

Contents

4