Google 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57GOOGLE INC. |Form10-K

PART II

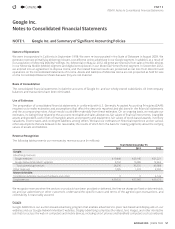

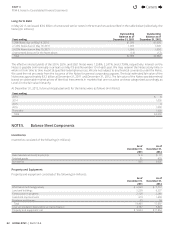

ITEM8.Notes to Consolidated Financial Statements

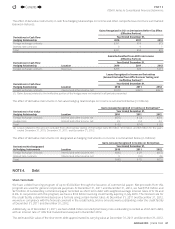

NOTE3. Financial Instruments

Fair Value Measurements

We measure our cash equivalents, marketable securities, and foreign currency and interest rate derivative contracts at fair value.

Fair value is an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants. As such, fair value is a market-based measurement that should be determined based

on assumptions that market participants would use in pricing an asset or a liability. A three-tier fair value hierarchy is established

as a basis for considering such assumptions and for inputs used in the valuation methodologies in measuring fair value:

Level 1—Observable inputs that refl ect quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level 2—Include other inputs that are based upon quoted prices for similar instruments in active markets, quoted prices for

identical or similar instruments in markets that are not active, and model-based valuation techniques for which all signifi cant

inputs are observable in the market or can be derived from observable market data. Where applicable, these models project

future cash fl ows and discount the future amounts to a present value using market-based observable inputs including interest

rate curves, foreign exchange rates, and credit ratings.

Level 3—Unobservable inputs that are supported by little or no market activities.

The fair value hierarchy also requires an entity to maximize the use of observable inputs and minimize the use of unobservable

inputs when measuring fair value.

Based on the fair value hierarchy, we classify our cash equivalents and marketable securities within Level 1 or Level 2. This is

because we value our cash equivalents and marketable securities using quoted market prices or alternative pricing sources and

models utilizing market observable inputs. We classify our foreign currency and interest rate derivative contracts primarily within

Level 2 as the valuation inputs are based on quoted prices and market observable data of similar instruments.

Cash, Cash Equivalents and Marketable Securities

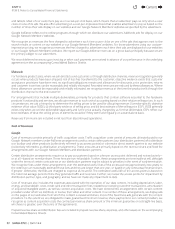

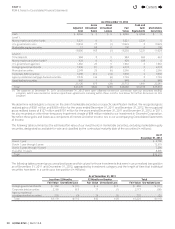

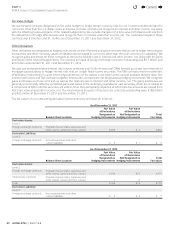

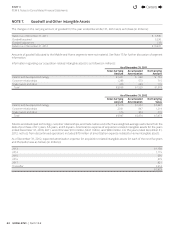

The following tables summarize our cash, cash equivalents and marketable securities measured at adjusted cost, gross unrealized

gains, gross unrealized losses and fair value by signifi cant investment categories as of December31, 2011 and December31,

2012 (in millions):

As of December31, 2011

Adjusted

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Cash

and Cash

Equivalents

Marketable

Securities

Cash $ 4,712 $ 0 $ 0 $ 4,712 $4,712 $ 0

Level 1:

Money market and other funds 3,202 0 0 3,202 3,202 0

U.S. government notes 11,475 104 0 11,579 0 11,579

Marketable equity securities 228 79 0 307 0 307

14,905 183 0 15,088 3,202 11,886

Level 2:

Time deposits 1,029 0 0 1,029 534 495

Money market and other funds(1) 1,260 0 0 1,260 1,260 0

U.S. government agencies 6,486 15 0 6,501 275 6,226

Foreign government bonds 1,608 32 (11) 1,629 0 1,629

Municipal securities 1,775 19 0 1,794 0 1,794

Corporate debt securities 6,023 187 (98) 6,112 0 6,112

Agency residential mortgage-backed securities 6,359 147 (5) 6,501 0 6,501

24,540 400 (114) 24,826 2,069 22,757

Total $44,157 $583 $(114 ) $44,626 $9,983 $ 34,643

4

Contents

4