Google 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 GOOGLE INC. |Form10-K

PART II

ITEM8.Notes to Consolidated Financial Statements

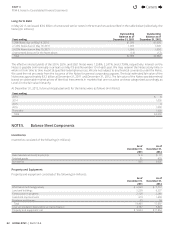

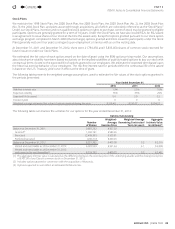

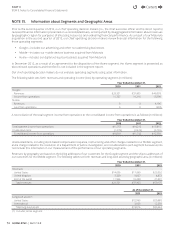

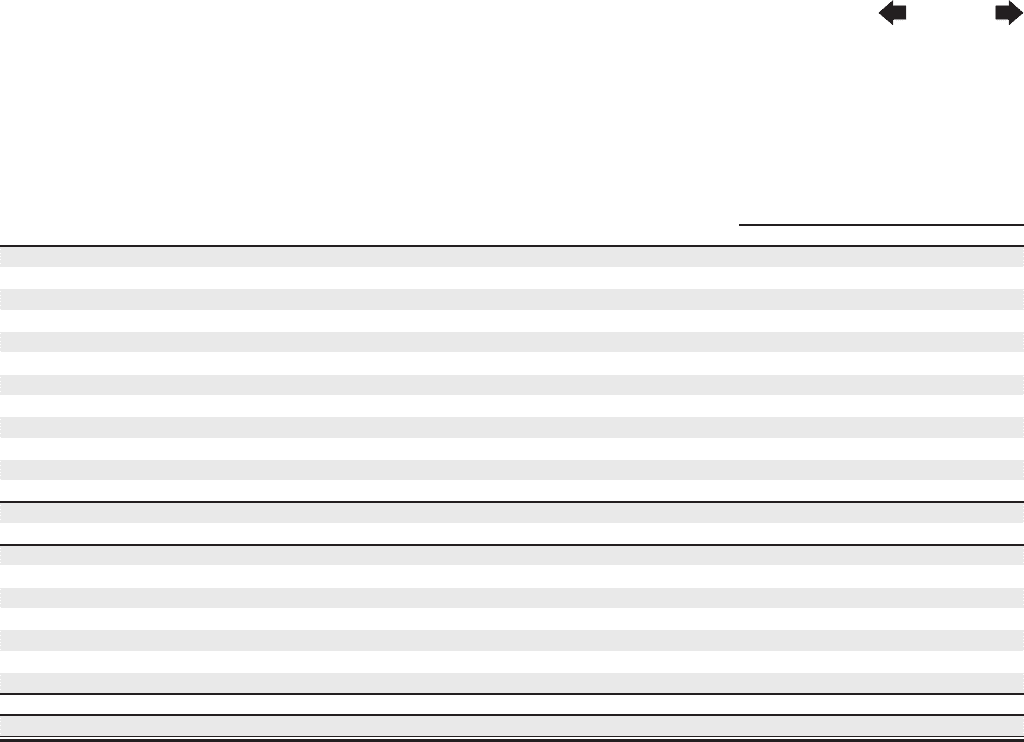

Deferred Tax Assets

Deferred income taxes refl ect the net eff ects of temporary diff erences between the carrying amounts of assets and liabilities for

fi nancial reporting purposes and the amounts used for income tax purposes. Signifi cant components of our deferred tax assets

and liabilities are as follows (in millions):

As of December31,

2011 2012

Deferred tax assets:

Stock-based compensation expense $ 288 $ 311

State taxes 138 184

Capital loss carryforward 285 236

Settlement with the Authors Guild and AAP 35 28

Vacation accruals 52 67

Deferred rent 43 50

Accruals and reserves not currently deductible 268 688

Acquired net operating losses 156 505

Tax credit 55 274

Basis diff erence in investment in Home business 0 2,043

Other 11 128

Total deferred tax assets 1,331 4,514

Valuation allowance (333) (2,629)

Total deferred tax assets net of valuation allowance 998 1,885

Deferred tax liabilities:

Depreciation and amortization (479) (761)

Identifi ed intangibles (398) (1,496)

Unrealized gains on investments and other (90) (105)

Other prepaids (70) (118)

Other (33) (133)

Total deferred tax liabilities (1,070) (2,613)

Net deferred tax liabilities $ (72 ) $ (728 )

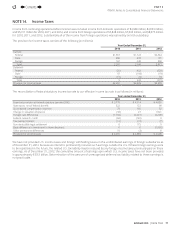

As of December31, 2012, our federal, state and foreign net operating loss carryforwards for income tax purposes were approximately

$1,048million, $333million and $384million. If not utilized, the federal net operating loss carryforwards will begin to expire in 2017

and the state net operating loss carryforwards will begin to expire in 2013. The foreign net operating loss can be carried forward

indefi nitely, however it is more likely than not that it will not be realized, therefore we have recorded a full valuation allowance.

The net operating loss carryforwards are subject to various annual limitations under Section382 of the Internal Revenue Code

and similar limitations under the tax laws of the foreign jurisdictions.

As of December31, 2012, our California research and development credit carryforwards for income tax purposes were

approximately $146million that can be carried over indefi nitely. We believe it is more likely than not that a portion of the state tax

credit will not be realized. Therefore, we have recorded a valuation allowance on the state tax credit carryforward in the amount

of $130million. We will reassess the valuation allowance quarterly and if future evidence allows for a partial or full release of the

valuation allowance, a tax benefi t will be recorded accordingly.

As of December31, 2012, our federal and state capital loss carryforwards for income tax purposes were approximately $483million

and $612million. We also have deferred tax assets for impairment losses that, if recognized, will be capital in nature. We believe

that it is more likely than not that our deferred tax assets for capital losses and impairment losses will not be realized. Therefore,

we have recorded a valuation allowance on both our federal and state deferred tax assets for these items in the amount of

$205million. We will reassess the valuation allowance quarterly and if future evidence allows for a partial or full release of the

valuation allowance, a tax benefi t will be recorded accordingly.

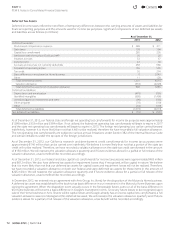

In December2012, we entered into an agreement with Arris Group Inc. (Arris) for the disposition of the Motorola Home business.

A deferred tax asset was established for the book to tax basis diff erence in our investment in the Motorola Home Business upon

signing the agreement. When the disposition event actually occurs in the foreseeable future, some or all of the basis diff erence in

the Home business will become a basis diff erence in Google’s investment in Arris. Since any future losses to be recognized upon

sale of the Home business or Arris Shares will be capital losses and Google already has an excess capital loss carryforward, a full

valuation allowance was recorded against this deferred tax asset. We will reassess the valuation allowance quarterly and if future

evidence allows for a partial or full release of the valuation allowance, a tax benefi t will be recorded accordingly.

Contents

44