Frontier Airlines 2010 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

secured note from Midwest, for approximately $6.0 million in cash and issued the TPG Entities an 8% convertible note having a principal

amount of $25.0 million and a five-year maturity and convertible by the TPG Entities in whole or in part, from time to time, prior to maturity

into 2,500,000 shares of the Company’ s common stock, subject to adjustment in certain circumstances.

The acquisition of Midwest provided the Company additional revenue diversity from its traditional fixed-fee services and allowed it

to expand operations into branded passenger service. The Company accounted for the acquisition in accordance with ASC Topic 805,

whereby the purchase price paid was allocated to the tangible and identifiable intangible assets acquired and liabilities assumed from

Midwest based on their estimated fair values as of the closing date. The Company completed the purchase price allocation process during

2010.

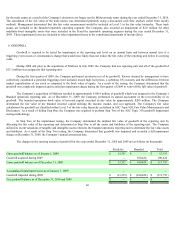

As a result of the purchase price allocation, the Company recognized goodwill of $100.4 million. None of the goodwill generated

was deductible for tax purposes. All of the goodwill was assigned to the Branded reportable segment on the date of acquisition, and all of the

goodwill was impaired as of December 31, 2009, as discussed further in Note 8.

The Company has included operating revenues from Midwest of $310.9 million and $163.2 million and net loss before income taxes

of $46.8 million and $116.4 million for the year ended December 31, 2010 and for the period from August 1, 2009 to December 31, 2009,

respectively. Transaction costs of $1.4 million for the year ended December 31, 2009, related to the Company’ s acquisition of Midwest, are

included in other operating expenses.

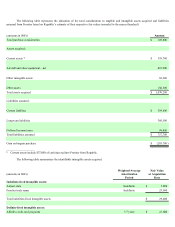

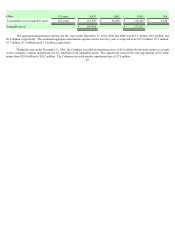

The following table represents the allocation of the total consideration to tangible and intangible assets acquired and liabilities

assumed from Midwest based on Republic’ s estimate of their respective fair values (rounded to the nearest hundred):

(amounts in 000's) Amount

Total purchase consideration

Cash $6,000

Convertible note 25,000

Assumed debt 34,300

Total purchase consideration $65,300

Assets acquired:

Current assets $81,800

Deferred income taxes 3,000

Aircraft and other equipment—net 9,800

Other intangible assets 48,100

Other assets 4,200

Total assets acquired $146,900

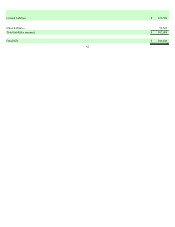

Liabilities assumed: