Frontier Airlines 2010 Annual Report Download - page 90

Download and view the complete annual report

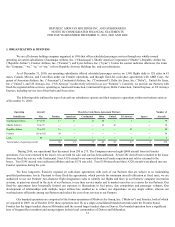

Please find page 90 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.value on miles redeemed on Frontier and other redemption choices can vary greatly, this assumption can materially affect the calculation of

the weighted-average ticket value from period to period.

Management must also estimate the expected redemption patterns of Frontier customers who have a number of different award

choices when redeeming their miles, each of which can have materially different estimated values. Such choices include different classes of

service and award levels. Customer redemption patterns may also be influenced by program changes, which occur from time to time,

introducing new award choices or making material changes to the terms of existing award choices. Management must often estimate the

probable impact of such program changes on future customer behavior, which requires the use of significant judgment. Management uses

historical customer redemption patterns as the best single indicator of future redemption behavior in making its estimates, but changes in

customer mileage redemption behavior patterns, which are not consistent with historical behavior can result in historical changes to deferred

frequent flyer revenue balances and to recognized revenue.

The Company measures its deferred revenue obligation using all awarded and outstanding miles, regardless of whether or not the

customer has accumulated enough miles to redeem an award. Eventually these customers will accumulate enough miles to redeem awards, or

their account will deactivate after a period of inactivity, in which case the Company will recognize the related revenue when the miles expire

as passenger service revenue.

Current and future changes to the expiration policy, or to program rules and program redemption opportunities, may result in

material changes to the deferred frequent flyer revenue balance as well as recognized revenue from the program.

Mileage Credits Sold – The Company also has agreements with its co-branded credit card partner that require its partner to

purchase miles as they are awarded to the co-branded partner cardholders. The air transportation element for the awarded miles is included

in deferred frequent flyer revenue at the estimated fair value of the air transportation element and the residual marketing element is recorded

as cargo and other revenue when the miles are awarded. The deferred frequent flyer revenue is subsequently recognized as passenger

service revenue when the transportation is provided.

The Company also sells mileage credits in its frequent flyer programs to third parties. The travel portion of the sale is recognized as

part of the deferred frequent flyer revenue liability. The remaining portion, referred to as the marketing component, is recognized as cargo

and other revenue in the month the miles are sold.

Promotion and Sales includes commissions, promotions, reservation system fees, advertising, and other similar costs. The

Company expenses the costs of advertising expense in the year incurred. Advertising expense was $14.2 million and $2.8 million for the

years ended December 31, 2010 and 2009, respectively. No advertising expense was incurred in the year ended December 31, 2008.

Lease Return Conditions—The Company must meet specified return conditions upon lease expiration for both the airframes and

engines. The Company estimates lease return conditions specified in leases and accrues these amounts as contingent rent ratably over the

lease term while the aircraft are operating once such costs are probable and reasonably estimable. These expenses are included in

accrued liabilities in the consolidated balance sheets.

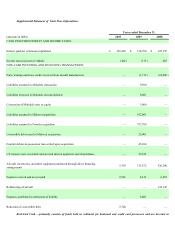

Defined Benefit Plans—Midwest has two defined benefit plans. The Pilots’ Supplemental Pension Plan is a qualified defined

benefit plan and provides retirement benefits to Midwest pilots covered by their collective bargaining agreement. The Pilot Nonqualified

Supplemental Pension Plan is a nonqualified defined benefit plan that provides Midwest pilots with annuity benefits for salary in excess

of IRS salary limits that cannot be covered by the qualified Pilots’ Supplemental Pension Plan.

57