Frontier Airlines 2010 Annual Report Download - page 95

Download and view the complete annual report

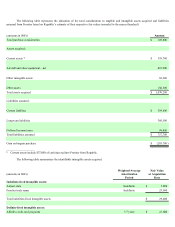

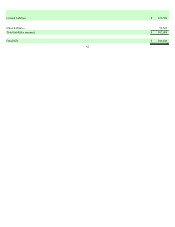

Please find page 95 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The acquisition of Frontier provided the Company additional revenue diversity from its traditional fixed-fee services and allowed

it to expand operations into branded passenger service. The Company accounted for the acquisition in accordance with ASC Topic 805,

whereby the purchase price paid was allocated to the tangible and identifiable intangible assets acquired and liabilities assumed from Frontier

based on their estimated fair values as of the closing date. During 2010, the Company completed its process of evaluating the fair value of

the air traffic liability, the deferred frequent flyer revenue, and the income tax implications of the transaction, and no adjustments were made

to the purchase price allocations.

As a result of the purchase price allocation, the Company recognized a bargain purchase gain of $203.7 million for the year ended

December 31, 2009. Management believes that the significant gain on bargain purchase from the acquisition of Frontier was due primarily to

the following factors:

•

Republic was the largest unsecured creditor with a claim of $150.0 million and Republic would have received a significan

t

portion of any payment made to the pool of unsecured creditors if another bidder would have successfully outbid Republic

during the auction process

• Frontier was in bankruptcy and operates in a heavily regulated industry

• The airline industry is highly volatile and subject to significant fluctuation in one of its largest expenses, aircraft fuel

• The Denver market is highly competitive

• The illiquidity in the credit market may have kept other bidders from potentially coming forward to bid against Republic in the

auction process because of their inability to obtain financing

• General recessionary economy

• There was only one other bidder in the auction process and their bid became nonbinding