Frontier Airlines 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

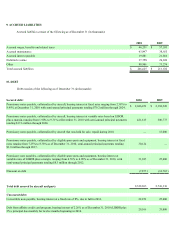

The Company has outstanding letters of credit totaling $31.8 million as of December 31, 2010 and 2009, that is collateralized by

restricted cash.

The $22.3 million convertible note is convertible at the option of the holder, in whole or in part, prior to maturity for up to

2,225,200 shares of the Company’ s common stock. The convertible debt does not allow for cash settlement, and there is no embedded

derivative.

We are required to comply with certain financial covenants under certain of our financing arrangements. We are required to

maintain a minimum unrestricted cash amount of $125.0 million and maintain certain cash flow, debt service coverage, and working capital

covenants. As of December 31, 2010, we were in compliance with all our covenants.

The discount on debt is from the application of purchase accounting from the Frontier and Midwest acquisitions. The discount will

be amortized to interest expense using the effective interest method through January 2023.

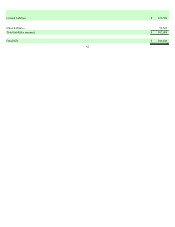

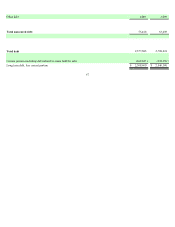

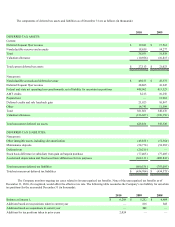

Future maturities of debt are payable, or expect debt of $28.0 million to be payable as assets held for sale are sold, as follows for the

years ending December 31 (in thousands):

2011 $269,023

2012 220,592

2013 241,897

2014 268,112

2015 264,143

Thereafter 1,313,916

Total $2,577,683

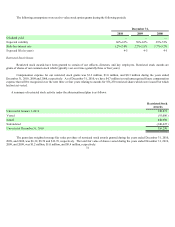

The fair value of long term debt is estimated based on discounting expected cash flows at the rates currently offered to the Company

for debt with similar remaining maturities and reflective of credit spreads. As of December 31, 2010 and 2009, the carrying value of

long-term debt was greater than its fair value by approximately $64 million and $56 million, respectively.

11. COMMITMENTS

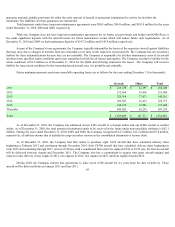

As of December 31, 2010, the Company leased 114 aircraft and 26 spare engines with varying terms extending through 2024 and

terminal space, operating facilities and office equipment with terms extending through 2033 under operating leases. The components of rent

expense for the years ended December 31 are as follows (in thousands):

2010 2009 2008

Aircraft and engine rent $240,563 $ 156,773 $ 134,206

Other 75,279 26,023 7,072

Total rent expense $315,842 $ 182,796 $ 141,278

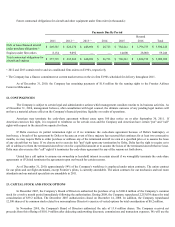

The Company has long-term maintenance agreements with an avionics equipment manufacturer and maintenance provider that has a

guaranteed minimum annual flight hour requirement. The minimum guaranteed amount based on the Company's current operations is $4.2

million per year through December 2016 for the E145 family of aircraft and $9.4 million per year through December 2014 for the E170

family of aircraft. The liability for this guarantee is immaterial.

We have maintenance agreements for engines, auxiliary power units (“APU”) and other airframe components for our E140/145 and E170/175

aircraft. For our E140/145 aircraft, we have agreements to maintain the engines, APUs, avionics and wheels and brakes through October

2012, June 2013, December 2016 and June 2014, respectively. For our E170/175 aircraft, we have agreements to maintain the avionics,

wheels and brakes, APUs and engines through December 2014, February 2017, July 2019 and December 2018, respectively. Under these

agreements, we are charged for covered services based on a fixed rate for each flight hour or flight cycle accumulated by the engines or