Frontier Airlines 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

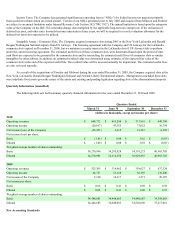

in early 2015 and continuing through 2017, and six E190 jets with a conditional firm order for 18 E190 or E195 jets. The six E190 aircraft are

expected to be delivered between August and December 2011. The Company also has a commitment to acquire nine spare aircraft engines

and expects to take delivery of one engine in 2011, two engines in 2012, two engines in 2015, and four engines beyond 2016.

During 2010, the Company entered into agreements to lease seven A320 aircraft for six years from the date of delivery. These

aircraft will be delivered between January 2011 and June 2011.

We expect to fund future capital and funding commitments through internally generated funds, third-party aircraft financings, and

debt and other financings.

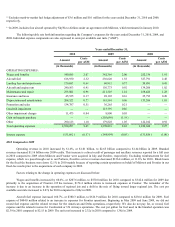

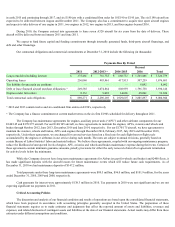

Our contractual obligations and commercial commitments at December 31, 2010 include the following (in thousands):

Payments Due By Period

Beyond

2011 2012-2013 (1) 2014-2015 2016 Total

Long-term debt (including interest) $375,486 $ 716,752 $ 688,733 $ 1,545,808 $ 3,326,779

Operating leases 256,046 495,461 417,915 507,259 1,676,681

Tax liability for uncertain tax positions

—

—

—

8,092 8,092

Debt or lease financed aircraft purchase obligations (2) 249,585 1,074,864 808,959 1,796,738 3,930,146

Engines under firm orders 8,154 9,092 14,000 28,000 59,246

Total contractual cash obligations $889,271 $ 2,296,169 $ 1,929,607 $ 3,885,897 $ 9,000,944

(1) 2012 and 2013 contain twelve and six conditional firm orders on E190's, respectively

(2) The Company has a finance commitment at current market terms on the six firm E190's scheduled for delivery throughout 2011.

The Company has maintenance agreements for engines, auxiliary power units (“APU”) and other airframe components for our

E140/145 and E170/175 aircraft. For our E140/145 aircraft, we have agreements to maintain the engines, APUs, avionics and wheels and

brakes through October 2012, June 2013, December 2016 and June 2014, respectively. For our E170/175 aircraft, we have agreements to

maintain the avionics, wheels and brakes, APUs and engines through December 2014, February 2017, July 2019 and December 2018,

respectively. Under these agreements, we are charged for covered services based on a fixed rate for each flight hour or flight cycle

accumulated by the engines or airframes in our service during each month. The rates are subject to annual revisions, generally based on

certain Bureau of Labor Statistics' labor and material indices. We believe these agreements, coupled with our ongoing maintenance program,

reduce the likelihood of unexpected levels of engine, APU, avionics and wheels and brakes maintenance expense during their term. Certain of

these agreements contain minimum guarantee amounts, penalty provisions for either the early removal of aircraft or agreement termination

for activity levels below the minimums.

While the Company does not have long term maintenance agreements for Airbus (except for wheels and brakes) and Q400 fleets, it

has made significant deposits with the aircraft lessors for future maintenance events which will reduce future cash requirements. As of

December 31, 2010 we had maintenance deposits of $147.2 million.

Total payments under these long-term maintenance agreements were $80.5 million, $96.0 million, and $101.9 million, for the years

ended December 31, 2010, 2009 and 2008, respectively.

Cash payments for interest were approximately $138.3 million in 2010. Tax payments in 2010 were not significant and we are not

expecting significant tax payments in 2011.

Critical Accounting Policies

The discussion and analysis of our financial condition and results of operations are based upon the consolidated financial statements,

which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these

financial statements requires us to make estimates and judgments that affect the reported amount of assets and liabilities, revenues and

expenses, and related disclosure of contingent assets and liabilities at the date of our financial statements. Actual results may differ from these

estimates under different assumptions and conditions.