Frontier Airlines 2010 Annual Report Download - page 87

Download and view the complete annual report

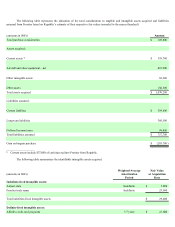

Please find page 87 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Assets Held for Sale are reported at the lower of their carrying value or estimated fair value less costs to sell. We expect to sell all

such assets during the next twelve months.

Aircraft and Other Equipment is carried at cost. Incentives received from the aircraft manufacturer are recorded as reductions to

the cost of the aircraft. Depreciation for aircraft is computed on a straight-line basis, to an estimated residual value, over the estimated

useful life of 16.5 to 25 years. Depreciation for other equipment, including rotable parts, is computed on a straight-line basis, to an

estimated residual value, over the estimated useful lives of three to 25 years. Leasehold improvements are amortized over the expected life

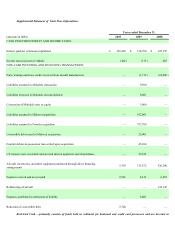

or lease term, whichever is shorter. Interest related to deposits on aircraft on firm order from the manufacturer is capitalized. The

Company capitalized approximately $0.4 million, $0.1 million, and $2.2 million of interest for the years ended December 31, 2010, 2009

and 2008, respectively.

Other Intangible Assets that have indefinite useful lives are not amortized but are tested if a triggering event occurred, or at least

annually, for impairment. Intangible assets that have finite useful lives are amortized over their useful lives to an estimated residual

value and reviewed for impairment at least annually.

Other Assets consist primarily of prepaid aircraft rent, debt issue costs, and aircraft lease and other long-term deposits. Debt

issue costs are capitalized and are amortized using the effective interest method to interest expense over the term of the related debt.

Long-Lived Assets—Management reviews long-lived assets for possible impairment, if there is a triggering event that

detrimentally affects operations. The primary financial indicator used by the Company to assess the recoverability of its long-lived assets

held and used is undiscounted future cash flows from operations. The amount of impairment, if any, is measured based on estimated fair

value or projected future cash flows using a discount rate reflecting the Company's average cost of funds.

Deferred Credits and Other Non Current Liabilities consist primarily of credits for parts and training from the aircraft and

engine manufacturers, deferred gains from the sale and leaseback of aircraft and spare jet engines, unfavorable leases assumed from

acquisitions of businesses, and deferred revenue. Deferred credits are amortized on a straight-line basis as a reduction of aircraft or

engine rent expense over the term of the respective leases. The deferred revenue is amortized as an adjustment to fixed-fee services

revenue based on the weighted average aircraft in service over the life of the respective Delta agreements.

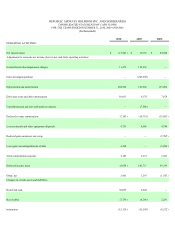

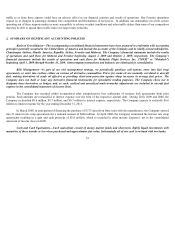

Comprehensive Income (Loss)—The Company had accumulated other comprehensive loss relating to treasury lock agreements

of $1.8 million, $2.2 million, and $2.6 million, net of tax, at December 31, 2010, 2009 and 2008, respectively and $0.9 million, net of tax,

relating to the pension plan as of December 31, 2010.

Income Taxes—The Company accounts for income taxes using the asset and liability method. Under the asset and liability

method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial

statement carrying amounts for existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are

measured using enacted tax rates expected to apply to taxable income in future years in which those temporary differences are expected to

be recovered or settled. The measurement of deferred tax assets is adjusted by a valuation allowance, if necessary, to recognize the future

tax benefits to the extent, based on available evidence; it is more likely than not they will be realized.

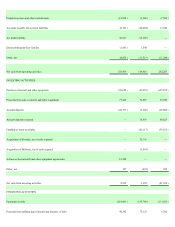

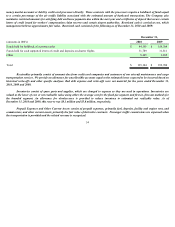

Aircraft Maintenance and Repair is charged to expense as incurred under the direct expense method. Engines and certain

airframe component overhaul and repair costs are subject to power-by-the-hour contracts with external vendors and are expensed as the

aircraft are flown. As a result of the acquisition of Frontier, the Company acquired deposits related to leased aircraft at Frontier. The

Company has determined that it is probable that substantially all maintenance deposits will be refunded through qualifying maintenance

activities. Deposits are reimbursed based on the specific event for each specified deposit, as determined by the lease. The projected

ultimate cost was based on actual historical repair invoices as well as estimates. This analysis was performed by lease and by deposit type.

As of December 31, 2010, the Company has no reserve for deposits that will not be recoverable, as we anticipate no unused excess

amounts to be expensed based on this analysis. The Company will continue to evaluate whether it is probable the deposits will be

returned to reimburse the costs of the maintenance activities incurred. As the Company makes future payments, if the deposits are less

than probable of being returned, the Company will recognize additional expense at that time.

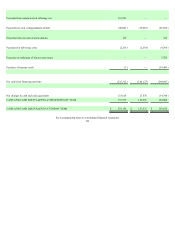

Use of Estimates—The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues

and expenses during the reporting periods. Such management estimates include, but are not limited to, recognition of revenue, including

deferred revenue from the frequent flyer program, fair value of assets acquired and liabilities assumed in business combinations, fair

value of the reporting units of the Company, valuation of intangibles and long-lived assets, valuation

55