Frontier Airlines 2010 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

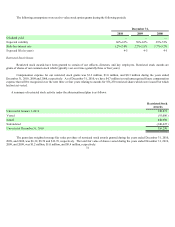

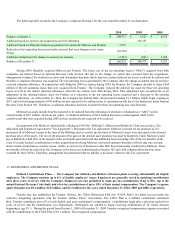

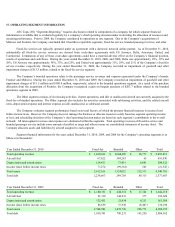

17. OPERATING SEGMENT INFORMATION

ASC Topic 280, “Segments Reporting,” requires disclosures related to components of a company for which separate financial

information is available that is evaluated regularly by a company’ s chief operating decision maker in deciding the allocation of resources and

assessing performance. Prior to 2009, the Company considered its operations as one segment. Due to the Company’ s acquisitions of

Midwest and Frontier, the Company concluded that it had three reportable segments, fixed-fee service, branded passenger service, and other.

Fixed-fee services are typically operated under an agreement with a domestic network airline partner. As of December 31, 2010,

substantially all fixed-fee service revenues are derived from code-share agreements with US Airways, Delta, American, United, and

Continental. Termination of any of these code-share agreements could have a material adverse effect on the Company’ s financial position,

results of operations and cash flows. During the years ended December 31, 2010, 2009, and 2008, Delta was approximately 18%, 19% and

29%, US Airways was approximately 38%, 33%, and 25%, and United was approximately 31%, 29%, and 21% of the Company’ s fixed-fee

service revenue, respectively. During the year ended December 31, 2009, the Company recorded an impairment of goodwill and other

impairment charges of $13.3 million, related to the fixed-fee service segment.

The Company’ s branded operations relate to the passenger service revenues and expenses generated under the Company’ s brands:

Frontier and Midwest. During the years ended December 31, 2010 and 2009, the Company recorded an impairment of goodwill and other

impairment charges of $11.5 million and $100.4 million, respectively, related to the branded operations segment. As a result of the purchase

allocation from the acquisition of Frontier, the Company recognized a gain on bargain purchase of $203.7 million related to the branded

operations segment in 2009.

The Other segment consists of slot leasing activities, charter operations, and idle or unallocated aircraft not currently assigned to the

fixed-fee or branded operations. The Other segment also includes the activities associated with subleasing activities, and the related aircraft

rents, depreciation expense and interest expense on idle, unallocated, or subleased aircraft.

The Company evaluates segment performance based on several factors, of which the primary financial measure is income (loss)

before income taxes. However, the Company does not manage the business or allocate resources solely based on segment operating income

or loss, and scheduling decisions of the Company’ s chief operating decision maker are based on each segment’ s contribution to the overall

network. All intersegment revenues and expenses are eliminated within the segments. Total operating revenues of fixed-fee service and

branded passenger service include some amounts classified as cargo and other revenue on consolidated statements of income (loss). The

Company allocates assets and liabilities by aircraft assigned to each segment.

Segment financial information for the years ended December 31, 2010, 2009, and 2008 for the Company’ s operating segments is as

follows (in thousands):

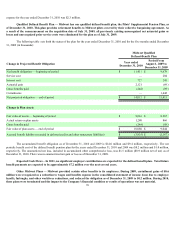

Year Ended December 31, 2010 Fixed-fee Branded Other Total

Total operating revenue $ 1,030,382 $ 1,604,490 $ 18,779 $ 2,653,651

Aircraft fuel 67,622 549,243 65 616,930

Depreciation and amortization 124,413 73,414 6,695 204,522

Income (loss) before income taxes 77,274 (99,362 ) 545 (21,543 )

Total assets 2,812,166 1,324,022 212,513 4,348,701

Total debt 2,238,663 249,705 89,315 2,577,683

Year Ended December 31, 2009 Fixed-fee Branded Other Total

Total operating revenue $ 1,180,362 $ 444,312 $ 17,544 $ 1,642,218

Aircraft fuel 91,310 144,933 377 236,620

Depreciation and amortization 132,435 21,934 9,215 163,584

Income (loss) before income taxes 86,659 57,938 (8,407 ) 136,190

Total assets 2,548,962 1,672,736 228,774 4,450,472

Total debt 1,830,701 780,231 193,250 2,804,182