Frontier Airlines 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.traffic to or from these airports could have an adverse effect on our financial position and results of operations. Our Frontier operations

expose us to changes in passenger demand, fare competition and fluctuations in fuel prices. In addition, our dependence on a hub system

operating out of these airports makes us more susceptible to adverse weather conditions and other traffic delays than some of our competitors

that may be able to spread these traffic risks over larger route networks.

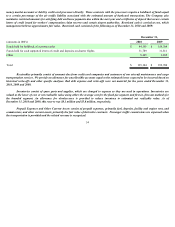

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

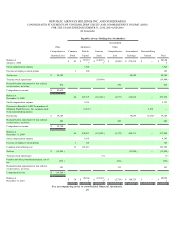

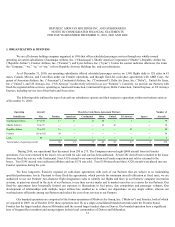

Basis of Consolidation—The accompanying consolidated financial statements have been prepared in conformity with accounting

principles generally accepted in the United States of America and include the accounts of the Company and its wholly-owned subsidiaries,

Chautauqua Airlines, Shuttle America, Republic Airline, Frontier and Midwest. The Company’s financial statements include the results

of operations and cash flows for Midwest and Frontier beginning August 1, 2009 and October 1, 2009, respectively. The Company’s

financial statements include the results of operations and cash flows for Mokulele Flight Services, Inc. (“MFSI” or “Mokulele”)

beginning April 1, 2009 through October 16, 2009. Intercompany transactions and balances are eliminated in consolidation.

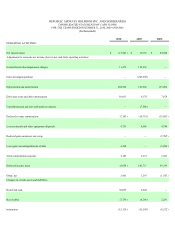

Risk Management—As part of our risk management strategy, we periodically purchase call options, enter into fuel swap

agreements, or enter into costless collars on various oil derivative commodities. Prices for crude oil are normally correlated to aircraft

fuel, making derivatives of crude oil effective at providing short-term protection against sharp increases in average fuel prices. The

Company does not hold or issue any derivative financial instruments for speculative trading purposes. The Company chose not to

designate these derivatives as hedges, and, as such, realized and unrealized mark-to-market adjustments are included in aircraft fuel

expense in the consolidated statements of income (loss).

The Company has recorded within accumulated other comprehensive loss settlements of treasury lock agreements from prior

periods. Such amounts are reclassified to interest expense over the term of the respective aircraft debt. During 2010, 2009 and 2008, the

Company reclassified $0.6 million, $0.7 million, and $0.7 million to interest expense, respectively. The Company expects to reclassify $0.6

million to interest expense for the year ending December 31, 2011.

In March 2008, in anticipation of financing the purchase of E175 aircraft on firm order with the manufacturer, the Company entered

into 21 interest rate swap agreements for a notional amount of $420 million. In April 2008, the Company terminated the interest rate swap

agreements resulting in a gain and cash proceeds of $5.8 million, which is recorded in other income (expense), net in the consolidated

statement of income (loss) in 2008.

Cash and Cash Equivalents—Cash equivalents consist of money market funds and short-term, highly liquid investments with

maturities of three months or less when purchased and approximates fair value. Substantially all of our cash is on hand with two banks.

53