Frontier Airlines 2010 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

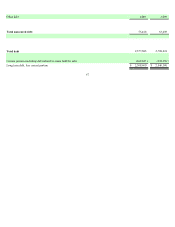

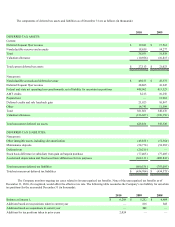

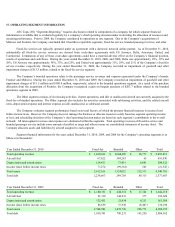

The components of deferred tax assets and liabilities as of December 31 are as follows (in thousands):

2010 2009

DEFERRED TAX ASSETS:

Current:

Deferred frequent flyer revenue $ 19,380 $ 17,561

Nondeductible reserves and accruals 18,659 14,277

Total 38,039 31,838

Valuation allowance (10,926 ) (10,815 )

Total current deferred tax assets $ 27,113 $ 21,023

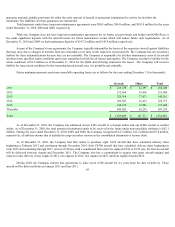

Noncurrent:

Nondeductible accruals and deferred revenue $ 49,153 $ 47,373

Deferred frequent flyer revenue 38,865 41,247

Federal and state net operating loss carryforwards, net of liability for uncertain tax positions 448,962 413,523

AMT credits 8,213 10,256

Prepaid rent

—

13,901

Deferred credits and sale leaseback gain 21,923 10,867

Other 14,745 11,509

Total 581,861 548,676

Valuation allowance (156,027 ) (190,156 )

Total noncurrent deferred tax assets 425,834 358,520

DEFERRED TAX LIABILITIES:

Noncurrent:

Other intangible assets, including slot amortization (45,838 ) (51,564 )

Maintenance deposits (54,774 ) (54,283 )

Deferred rent (20,210 )

—

Stock basis difference in subsidiary from gain on bargain purchase (77,405 ) (77,405 )

Accelerated depreciation and fixed asset basis differences for tax purposes (662,311 ) (609,843 )

Total noncurrent deferred tax liabilities (860,538 ) (793,095 )

Total net noncurrent deferred tax liabilities $ (434,704 ) $ (434,575 )

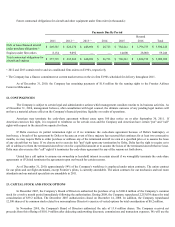

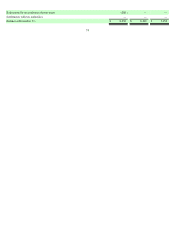

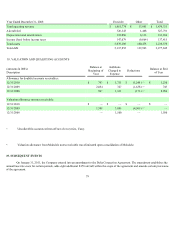

The Company monitors ongoing tax cases related to its unrecognized tax benefits. None of the unrecognized tax benefits as of

December 31, 2010, if recognized, would affect the effective tax rate. The following table reconciles the Company’ s tax liability for uncertain

tax positions for the year ended December 31 (in thousands):

2010 2009 2008

Balance at January 1, $6,268 $ 5,252 $ 4,409

Additions based on tax positions taken in current year

—

816 843

Additions based on acquisitions in current year

—

200

—

Additions for tax positions taken in prior years 2,024

—

—