Frontier Airlines 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Additional laws, regulations, taxes and airport rates and charges have been proposed from time to time that could significantly

increase the cost of airline operations or reduce revenues. For instance, “passenger bill of rights” legislation was introduced in Congress that,

if enacted, would have, among other things, required the payment of compensation to passengers as a result of certain delays and limited the

ability of carriers to prohibit or restrict usage of certain tickets. This legislation is not currently active but if it is reintroduced, these measures

could have the effect of raising ticket prices, reducing revenue and increasing costs. Several state legislatures have also considered such

legislation, and the State of New York in fact implemented a “passenger bill of rights” that was overturned by a federal appeals court in 2008.

The DOT has imposed restrictions on the ownership and transfer of airline routes and takeoff and landing slots at certain high-density

airports, including New York LaGuardia and Reagan National. In addition, as a result of the terrorist attacks in New York and Washington,

D.C. in September 2001, the FAA and the TSA have imposed stringent security requirements on airlines. We cannot predict what other new

regulations may be imposed on airlines and we cannot assure you that laws or regulations enacted in the future will not materially adversely

affect our financial condition, results of operations and the price of our common stock.

The airline industry is seasonal and cyclical resulting in unpredictable liquidity and passenger revenues.

Because the airline industry is seasonal and cyclical, our revenues related to Frontier will fluctuate throughout the year. Our weakest

travel periods are generally during the quarters ending in March and December. The airline industry is also a highly cyclical business with

substantial volatility. Our operating and financial results are likely to be negatively impacted by national or regional economic conditions in

the U.S., and particularly in Colorado and Wisconsin.

We are in a high fixed cost business and any unexpected decrease in revenue would harm us.

The airline industry is characterized by low profit margins and high fixed costs primarily for personnel, fuel, aircraft ownership and

lease costs and other rents. The expenses of an aircraft flight do not vary significantly with the number of passengers carried and, as a result, a

relatively small change in the number of passengers or in pricing would have a disproportionate effect on the operating and financial results

of Frontier and possibly on us as a whole. We are often affected by factors beyond our control, including weather conditions, traffic

congestion at airports and increased security measures, and irrational pricing from competitors, any of which could harm our operating results

and financial condition.

Risks Related To Our Common Stock

Our stock price is volatile.

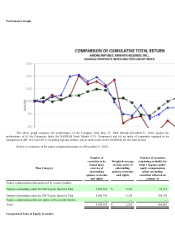

Since our common stock began trading on The NASDAQ National Market (now the NASDAQ Global Select Market) on May 27,

2004, the market price of our common stock has ranged from a low of $4.10 to a high of $23.88 per share. The market price of our common

stock may continue to fluctuate substantially due to a variety of factors, many of which are beyond our control, including:

• announcements concerning our Partners, competitors, the airline industry or the economy in general;

• strategic actions by us, our Partners or our competitors, such as acquisitions or restructurings;

• the results of our operations;