Frontier Airlines 2010 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the Company’ s results of operations, as they were immaterial. Additionally, pro forma revenues, earnings and net income per common share

were immaterial for disclosure for each of the two years ended December 31, 2009.

In July 2009, the Company invested an additional $7.5 million in Mokulele, increasing its ownership in the operation from 55% to

an 89% interest. The change in ownership of Mokulele resulting from the July 2009 additional investment was accounted for as an equity

transaction that decreased our additional paid-in capital by $3.3 million as well as reduced noncontrolling interests by $3.3 million. In

addition, the fixed-fee code-share agreement was amended to provide for either Mokulele or us to early terminate the fixed-fee code-share

agreement with 90 days prior written notice and the remaining $1.5 million in aircraft security deposits held by us would be forfeited by

Mokulele on the termination date. The amendment also provided that no additional aircraft would be delivered and Mokulele forfeited a $0.5

million security deposit to the Company.

On October 16, 2009, the Company entered into an agreement with Mesa Air Group, Inc. (“Mesa”) to form Mo-Go, LLC

(“Mo-Go”), a new business venture that will provide commercial airline services in Hawaii. Pursuant to the agreement, Mesa will own 75%

of Mo-Go and the former Mokulele shareholders, including Republic, own the remaining 25%. Immediately prior to consummation of the

transaction with Mesa, the Company forgave certain indebtedness of Mokulele, and agreed to voluntarily terminate our existing capacity

purchase agreement with Mokulele. Additionally, current Mokulele shareholders might be obligated to fund up to $1.5 million to capitalize

Mo-Go, all of which is expected to come from Republic.

The Company deconsolidated Mokulele in the fourth quarter of 2009 and began accounting for its investment in Mo-Go under the

equity method of accounting. As of the date of the transaction, and subsequent to the forgiveness of the Mokulele note and forfeiture of the

remaining security deposits by Mokulele, Mokulele had approximately $9.9 million of assets, of which $7.3 million related to aircraft and

other equipment, and had liabilities of $6.8 million. The deconsolidation resulted in a loss of $3.1 million which is included in other

operating expenses. The fair value of the investment in Mokulele is $0.3 million which is recorded in other assets in the consolidated balance

sheet as of December 31, 2009. We do not expect any significant continuing involvement in Mo-Go.

The Company has included operating revenues from Mokulele of $15.0 million and net loss before income taxes of $12.9 million for

the period from April 1, 2009 to October 16, 2009. Transaction costs related to the Company’ s acquisition of Mokulele were immaterial for

the year ended December 31, 2009.

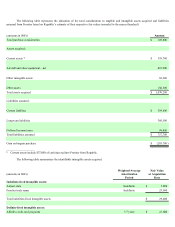

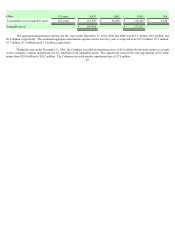

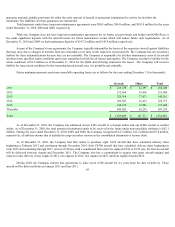

The following schedule shows the effect of changes in Republic’ s ownership interest in Mokulele on Republic’ s equity (in

thousands):

Net Income Attributable to Republic and Transfers to Noncontrolling Interests

For the year ended December 31, 2009

Amount

Net income attributable to Republic $39,655

Decrease in Republic's additional paid-in capital for purchase of Mokulele common shares (3,270 )

Change from net income attributable to Republic and tranfers to noncontrolling interest $36,385

The investment balance as of December 31, 2010 was not material.

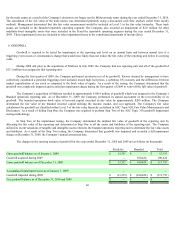

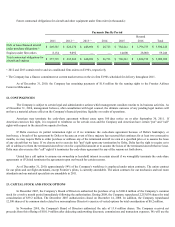

5. ASSETS HELD FOR SALE

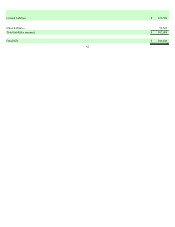

Assets held for sale consisted of the following aircraft and flight equipment as of December 31 (in thousands):

2010 2009

Four Fairchild 328 Regional Jets $

—

$ 11,520

Five McDonnell Douglas MD-80 Aircraft

—

2,300

Two Q400 Aircraft 33,210

—

Flight equipment 10,256 11,829