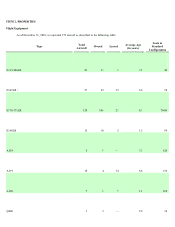

Frontier Airlines 2010 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.be able to obtain financing to acquire the additional aircraft or make other capital expenditures necessary for our expansion. If we default

under our loan or lease agreements, the lender/lessor has available extensive remedies, including, without limitation, repossession of the

respective aircraft and other assets. Even if we are able to timely service our debt, the size of our long-term debt and lease obligations could

negatively affect our financial condition, results of operations and the price of our common stock in many ways, including:

• increasing the cost, or limiting the availability of, additional financing for working capital, acquisitions or other purposes;

• limiting the ways in which we can use our cash flow, much of which may have to be used to satisfy debt and lease obligations;

and

• adversely affecting our ability to respond to changing business or economic conditions.

We may be unable to continue to comply with financial covenants in certain financing agreements, which, if not complied with, could

materially and adversely affect our liquidity and financial condition.

We are required to comply with certain financial covenants under certain of our financing arrangements. We are required to maintain

$125 million of unrestricted cash, maintain certain cash flow, debt service coverage and working capital covenants. As of December 31,

2010, we were in compliance with all our covenants.

We currently depend on Embraer and Airbus to support our fleet of aircraft.

We rely on Embraer as the manufacturer of substantially all of our regional jets and on Airbus as the manufacturer of our

narrow-body jets. Our risks in relying primarily on a single manufacturer for each aircraft type include:

• the failure or inability of Embraer or Airbus to provide sufficient parts or related support services on a timely basis;

• the interruption of fleet service as a result of unscheduled or unanticipated maintenance requirements for these aircraft;

• the issuance of FAA directives restricting or prohibiting the use of Embraer or Airbus aircraft or requiring time-consuming

inspections and maintenance; and