Frontier Airlines 2010 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Increases in our labor costs, which constitute a substantial portion of our total operating costs, will directly impact our earnings.

Labor costs constitute a significant percentage of our total operating costs, and we have experienced pressure to increase wages and

benefits for our employees. Under our code-share agreements, our reimbursement rates contemplate labor costs that increase on a set

schedule generally tied to an increase in the consumer price index or the actual increase in the contract. We are entirely responsible for our

labor costs, and we may not be entitled to receive increased payments for our flights from our Partners if our labor costs increase above the

assumed costs included in the reimbursement rates. As a result, a significant increase in our labor costs above the levels assumed in our

reimbursement rates could result in a material reduction in our earnings. Many of our employees within our Frontier operations experienced a

reduction in pay levels during the Frontier bankruptcy. Any restoration of these reductions in pay levels will increase our labor costs.

We have collective bargaining agreements with our pilots, flight attendants, dispatchers, mechanics, material specialists and aircraft

appearance agents. We cannot assure that future agreements with our employees' unions will be on terms in line with our expectations or

comparable to agreements entered into by our competitors, and any future agreements may increase our labor costs and reduce both our

income and our competitiveness for future business opportunities. As of December 31, 2010, approximately 54% of the Company's

workforce is employed under union contracts. Because of the high level of unionization among our employees, we are subject to risks of

work interruption or stoppage and/or the incurrence of additional expenses associated with union representation of our employees. We have

never experienced any work stoppages or other job actions and generally consider our relationship with our employees to be good. The union

contract for our pilots and our flight attendants, except Frontier’ s pilots, is currently amendable. The union contracts for our mechanics and

tool room attendants and our material specialists are amendable in 2011.

Our credit card processors have the ability to increase their holdbacks in certain circumstances. The initiation of such holdbacks

likely would have a material adverse effect on our liquidity.

In our Frontier business, most of the tickets we sell are paid for by customers who use credit cards. Our credit card processing

agreements generally provide for a 95% holdback of receivables. If circumstances were to occur that would allow our processor to increase

their holdbacks, our liquidity would be negatively impacted.

Our business could be harmed if we lose the services of our key personnel.

Our business depends upon the efforts of our Chief Executive Officer, Bryan Bedford, and our other key management and operating

personnel. American can terminate its code-share agreement if we replace Mr. Bedford without its consent, which cannot be unreasonably

withheld. We may have difficulty replacing management or other key personnel who leave and, therefore, the loss of the services of any of

these individuals could harm our business. We maintain a “key man” life insurance policy in the amount of $5 million for Mr. Bedford, but

this amount may not adequately compensate us in the event we lose his services.

On November 3, 2010, we and our Chief Financial Officer, Robert Hal Cooper, entered into an agreement pursuant to which Mr.

Cooper will serve as Chief Financial Officer through at least April 1, 2011. We are interviewing both internal and external candidates for the

chief financial officer position and expect to name a replacement before Mr. Cooper departs. We anticipate a smooth transition of

responsibilities from Mr. Cooper to his successor.

We may experience difficulty finding, training and retaining employees.

The airline industry is experiencing a shortage of qualified personnel, specifically pilots and maintenance technicians. In addition, as

is common with most of our competitors, we have, from time to time, faced considerable turnover of our employees. Our pilots, flight

attendants and maintenance technicians sometimes leave to work for larger airlines, which generally offer higher salaries and more extensive

benefit programs than regional airlines or other low cost carriers are financially able to offer. Should the turnover of employees, particularly

pilots and maintenance technicians, sharply increase, the result will be significantly higher training costs than otherwise would be necessary.

An inability to recruit, train and retain qualified employees may adversely impact our performance.

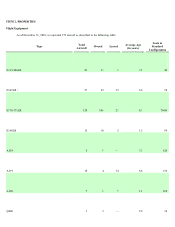

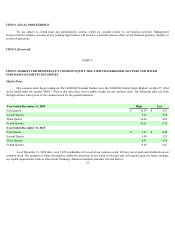

Our acquisition of Midwest and Frontier affects the comparability of our historical financial results.

Our results of operations for the year ended December 31, 2010 includes a full year impact of our Frontier and Midwest acquisitions,

while our 2009 results of operations include the results of Midwest for five months and Frontier for

18