Frontier Airlines 2010 Annual Report Download - page 88

Download and view the complete annual report

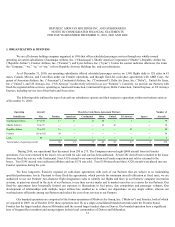

Please find page 88 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of notes receivable, provision for accrued aircraft return costs, recoverability of maintenance deposits, and valuation of deferred tax assets.

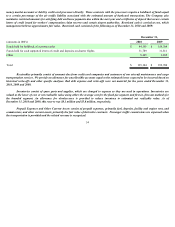

Under the code-share agreements, the Company estimates operating costs for certain “pass through” costs and records revenue based on these

estimates. Actual results could differ from these estimates.

Fixed-fee Service Revenues—Under our fixed-fee arrangements with our Partners, the Company receives fixed-fees for our

capacity purchase agreements, as well as reimbursement of specified “pass-through” costs on a gross basis with additional possible

incentives from our Partners for superior service. These revenues are recognized in the period the service is provided, and we perform an

estimate of the profit component based upon the information available at the end of the accounting period.

The reimbursement of specified costs, known as “pass-through costs”, may include aircraft ownership cost, passenger liability and

hull insurance, aircraft property taxes, fuel, landing fees and catering. All revenue recognized under these contracts is presented at the gross

amount billed for reimbursement.

Under the Company’ s code-share agreements, the Company is reimbursed an amount per aircraft designed to compensate the

Company for certain aircraft ownership costs. The Company has concluded that a component of its fixed-fee service revenues under the

agreement discussed above is rental income, inasmuch as the agreement identifies the “right of use” of a specific type and number of aircraft

over a stated period of time. The amount deemed to be rental income during 2010, 2009 and 2008 was $317.4 million, $358.2 million, and

$348.4 million, respectively, and has been included in fixed-fee service revenues in the Company’ s consolidated statements of income (loss).

Passenger Service Revenues—Passenger service revenues are recognized when the transportation is provided or after the tickets

expire (which is either immediately upon the scheduled departure of the flight or up to thirteen months after the date of issuance

depending on the type of ticket purchased), and are net of excise taxes, passenger facility charges and security fees. Passenger service

revenues that have been deferred are included in the accompanying consolidated balance sheets as air traffic liability. Included in

passenger service revenue are change fees imposed on passengers for making schedule changes to non-refundable tickets. Change fees

are recognized as revenue at the time the change is made for the passenger as these fees are a separate transaction that occur subsequent

to the date of the original ticket sale.

The Company is required to charge certain taxes and fees on passenger tickets. These taxes and fees include U.S. federal

transportation taxes, federal security charges, airport passenger facility charges and foreign arrival and departure taxes. These taxes and fees

are legal assessments on the customer, for which the Company has an obligation to act as a collection agent. Because the Company is not

entitled to retain these taxes and fees, such amounts are not included in passenger service revenue. The Company records a liability when the

amounts are collected and reduces the liability when payments are made to the applicable government agency or operating carrier. We

reclassified $31.4 million of on-board sales of LiveTV, liquor and food and baggage fees recorded in other revenues to passenger revenues in

our December 31, 2009 consolidated statement of income (loss). These reclassifications had no effect on previously reported total operating

revenues or net income.

Cargo and Other Revenues—Cargo and other revenues consist primarily of the marketing component of our co-branded credit

cards, charter and cargo revenues, interline and ground handling fees, lease revenue for aircraft subleased under operating leases and

revenue from commuter slots leased to US Airways at Ronald Reagan Washington National Airport.

Frequent Flyer Programs—The Company has a frequent flyer program that offers incentives to travel on its airlines and

promotes customer loyalty. The program allows participants to earn mileage credits by flying on Frontier and through participating

companies, such as credit card companies, hotels, and car rental agencies. The Company also sells mileage credits to nonairline

businesses. The mileage credits may be redeemed for free air travel on Frontier, as well as hotels, rental cars, and other awards.

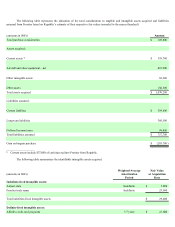

Earned Mileage Credits – The Company defers the portion of the sales proceeds that represents the estimated fair value of the air

transportation for mileage credits awarded and recognizes that amount as passenger service revenue when the mileage credit is redeemed

and the transportation is provided. The fair value of the air transportation component is determined utilizing the deferred revenue method as

further described below. The initial revenue deferral is presented as deferred frequent flyer revenue in the consolidated balance

sheets. When recognized, the revenue related to the air transportation component is classified as passenger service revenue in the

Company’s consolidated statements of income (loss).

The Company’ s accounting policy for its frequent flyer program is the deferred revenue method. The deferred revenue method is to

record the frequent flyer obligation by allocating an equivalent weighted-average ticket value to each outstanding mile based on projected

redemption patterns for available award choices when such miles are consumed. Such value is estimated assuming redemptions on our

airline and other redemption choices and by estimating the relative proportions of awards to be redeemed by class of service and redemption

choices. The estimation of the value of each award mile requires the use of several significant assumptions for which significant management

judgment is required. For example, management must estimate how many miles are projected to be redeemed on the Company’ s airline