Frontier Airlines 2010 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

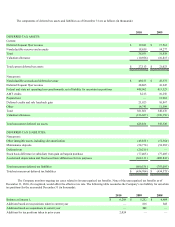

expense for the year ended December 31, 2010 was $2.3 million.

Qualified Defined Benefit Plan — Midwest has one qualified defined benefit plan, the Pilots’ Supplemental Pension Plan, as

of December 31, 2010. This plan provides retirement benefits to Midwest pilots covered by their collective bargaining agreement. As

a result of the remeasurement on the acquisition date of July 31, 2009, all previously existing unrecognized net actuarial gains or

losses and unrecognized prior service costs were eliminated for the plan as of July 31, 2009.

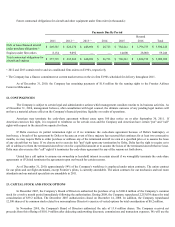

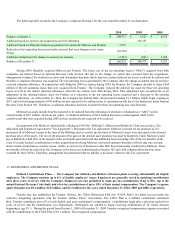

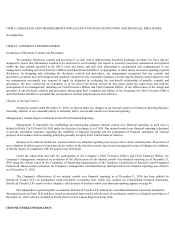

The following table sets forth the status of the plan for the year ended December 31, 2010 and for the five months ended December

31, 2009 (in thousands):

Midwest Qualified

Defined-Benefit Plan

Change in Projected Benefit Obligation Year ended

December 31, 2010

Period From

August 1, 2009 to

December 31, 2009

Net benefit obligation — beginning of period $11,411 $ 9,678

Service cost

—

204

Interest cost 727 245

Actuarial gain 2,121 (69 )

Gross benefits paid (244 )(89 )

Curtailments

—

1,442

Net projected obligation — end of period $14,015 $ 11,411

Change in Plan Assets

Fair value of assets — beginning of period $9,044 $ 8,267

Actual return on plan assets 1,280 866

Gross benefits paid (244 )(89 )

Fair value of plan assets — end of period $10,080 $ 9,044

Accrued benefit liability (recorded in deferred credits and other noncurrent liabilities) $(3,935 ) $ (2,367 )

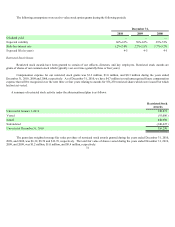

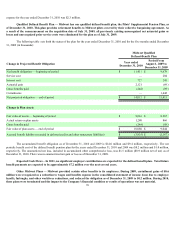

The accumulated benefit obligation as of December 31, 2010 and 2009 is $14.0 million and $9.4 million, respectively. The net

periodic benefit cost of the defined benefit pension plan for the years ended December 31, 2010 and 2009 was $0.2 million and $1.0 million,

respectively. The unamortized net loss, included in accumulated other comprehensive loss, was $1.5 million ($0.9 million net of tax) as of

December 31, 2010. There was no unamortized net gain or loss as of December 31, 2009.

Expected Cash Flows – In 2011, no significant employer contributions are expected for the defined benefit plan. Total future

benefit payments are expected to be approximately $7.2 million over the next several years.

Other Midwest Plans — Midwest provided certain other benefits to its employees. During 2009, curtailment gains of $8.6

million were recognized as a reduction to wages and benefits expense in the consolidated statement of income (loss) due to employee

layoffs, furloughs, and other workforce reductions, and reduced the obligation as of December 31, 2009 to $0.2 million. During 2010,

these plans were terminated and the impact to the Company's financial condition or results of operations was not material.

76