Frontier Airlines 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

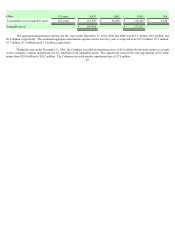

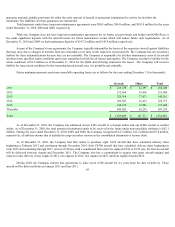

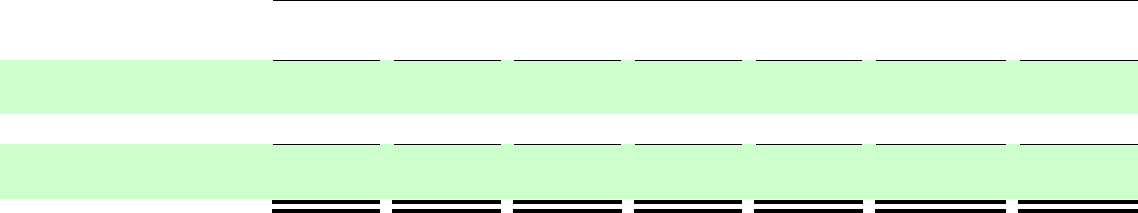

Future contractual obligations for aircraft and other equipment under firm order (in thousands):

Payments Due By Period

Beyond

2011 2012 (1) 2013 (1) 2014 2015 2016 Total

Debt or lease financed aircraft

under purchase obligations (2) $ 249,585 $ 626,170 $ 448,694 $ 26,718 $ 782,241 $ 1,796,738 $ 3,930,146

Engines under firm orders 8,154 9,092

—

—

14,000 28,000 59,246

Total contractual obligations for

aircraft and engines $ 257,739 $ 635,262 $ 448,694 $ 26,718 $ 796,241 $ 1,824,738 $ 3,989,392

(1) 2012 and 2013 contain twelve and six conditional firm orders on E190's, respectively

(2) The Company has a finance commitment at current market terms on the six firm E190's scheduled for delivery throughout 2011.

As of December 31, 2010, the Company has remaining payments of $1.8 million for the naming rights to the Frontier Airlines

Center in Milwaukee.

12. CONTINGENCIES

The Company is subject to certain legal and administrative actions which management considers routine to its business activities. As

of December 31, 2010, management believes, after consultation with legal counsel, the ultimate outcome of any pending legal matters will

not have a material adverse effect on the Company's financial position, liquidity or results of operations.

American may terminate the code-share agreement without cause upon 180 days notice on or after September 30, 2011. If

American exercises this right, it is required to reimburse us for certain costs and the Company and American have certain "put" and "call"

rights with respect to the aircraft we operate for them.

If Delta exercises its partial termination right or if we terminate the code-share agreement because of Delta's bankruptcy or

insolvency, a breach of the agreement by Delta or because an event of force majeure has occurred that continues for at least two consecutive

months, we may require Delta to either purchase or sublease any of the terminated aircraft we own at a specified price or to assume the lease

of any aircraft that we lease. If we choose not to exercise this "put" right upon any termination by Delta, Delta has the right to require us to

sell or sublease to them the terminated aircraft we own for a specified amount or to assume the leases of the terminated aircraft that we lease.

Delta may also exercise this "call" right if it terminates the code-share agreement for any of the reasons set forth above.

United has a call option to assume our ownership or leasehold interest in certain aircraft if we wrongfully terminate the code-share

agreements or if United terminates the agreements upon our breach for certain reasons.

As of December 31, 2010, approximately 54% of the Company's workforce is employed under union contracts. The union contract

for our pilots and our flight attendants, except Frontier’ s pilots, is currently amendable. The union contracts for our mechanics and tool room

attendants and our material specialists are amendable in 2011.

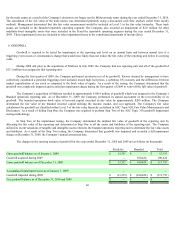

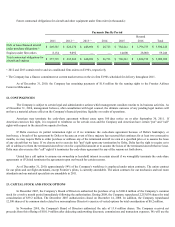

13. CAPITAL STOCK AND STOCK OPTIONS

In December 2007, the Company’ s Board of Directors authorized the purchase of up to $100.0 million of the Company’ s common

stock for a twelve month period immediately following the authorization. During 2008, the Company repurchased 2,253,039 shares for total

consideration of $39.2 million. The December 2007 authorization closed on December 14, 2008. In addition, the Company repurchased

12,500 shares of its common stock related to a non-employee Director’ s exercise of vested options for total consideration of $0.2 million.

In November 2010, the Company's Board of Directors authorized the sale of 13.8 million shares. The Company received net

proceeds from this offering of $101.9 million after deducting underwriting discounts, commissions and transaction expenses. We will use the