Frontier Airlines 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

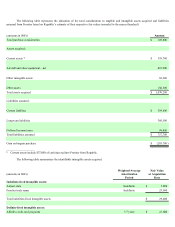

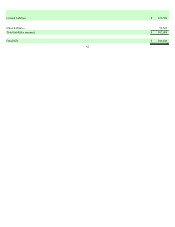

for the trade names as a result of the Company's decision to no longer use the Midwest trade name during the year ended December 31, 2010.

The calculation of the fair value of the trade names was determined primarily using a discounted cash flow analysis (relief from royalty

method). Management determined that this fair value measurement would be included as Level 3 in the fair value hierarchy. These trade

names are included in the Branded reportable operating segment. The Company also recorded an impairment of $2.0 million for other

indefinite-lived intangible assets that were included in the Fixed-fee reportable operating segment during the year ended December 31,

2009. These impairment losses are included in other impairment losses in the consolidated statements of income (loss).

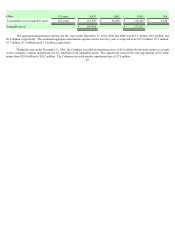

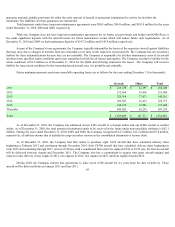

8. GOODWILL

Goodwill is required to be tested for impairment at the reporting unit level on an annual basis and between annual tests if a

triggering event occurs or circumstances change that would more likely than not reduce the fair value of the reporting unit below its carrying

value.

During 2008 and prior to the acquisition of Midwest in July 2009, the Company had one reporting unit and all of the goodwill of

$13.3 million was assigned to that reporting unit.

During the first quarter of 2009, the Company performed an interim test of its goodwill. Factors deemed by management to have

collectively constituted a potential triggering event included record high fuel prices, a softening US economy and the differences between

market capitalization of our stock as compared to the book value of equity. As a result of the testing, the Company determined that the

goodwill was completely impaired and recorded an impairment charge during the first quarter of 2009 to write-off the full value of goodwill.

The Company’ s acquisition of Midwest resulted in approximately $100.4 million of goodwill which was assigned to the Company’ s

Branded operations reporting unit. As of December 31, 2009, the Company performed its annual assessment of the recoverability of its

goodwill. The branded operations book value of invested capital exceeded its fair value by approximately $200 million. The Company

determined the fair value of the branded invested capital utilizing the income, market, and cost approach. The Company's fair value

calculations for goodwill are classified within Level 3 of the fair value hierarchy as defined in ASC Topic 820, Fair Value Measurements and

Disclosures. As a result of failing Step One, the Company was required to perform Step Two of the ASC Topic 350 goodwill impairment

testing methodology.

In Step Two of the impairment testing, the Company determined the implied fair value of goodwill of the reporting unit by

allocating the fair value of the reporting unit determined in Step One to all the assets and liabilities of the reporting unit. The Company

utilized its recent valuations of tangible and intangible assets related to the branded operations reporting unit to determine the fair value assets

and liabilities. As a result of the Step Two testing, the Company determined that goodwill was impaired and recorded a full impairment

charge on December 31, 2009, the Company’ s annual assessment date.

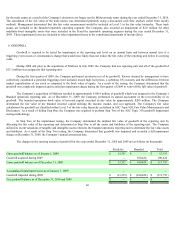

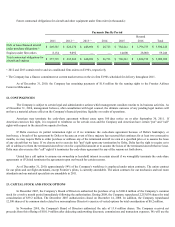

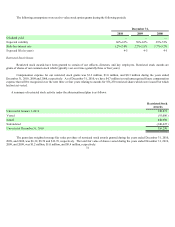

The changes in the carrying amount of goodwill for the years ended December 31, 2010 and 2009 are as follows (in thousands):

Fixed-fee Branded Total

Gross goodwill balance as of January 1, 2009 $13,335 $

—

$ 13,335

Goodwill acquired during 2009

—

100,424 100,424

Gross goodwill balance as of December 31, 2009 $13,335 $ 100,424 $ 113,759

Accumulated impairment losses as of January 1, 2009

—

—

—

Goodwill impaired during 2009 $(13,335 ) $ (100,424 ) $ (113,759 )

Net goodwill balance as of December 31, 2010 and 2009 $

—

$

—

$

—

66