Frontier Airlines 2010 Annual Report Download - page 70

Download and view the complete annual report

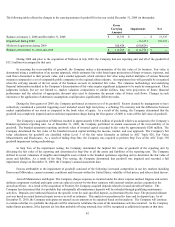

Please find page 70 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.– Multiple Element Arrangements. The new guidance will eliminate the residual method of allocation and require that arrangement

consideration be allocated at the inception of the arrangement to all deliverables using the relative selling price method. The new guidance

will be effective for the Company prospectively for revenue arrangements entered into or materially modified on or after January 1, 2011,

with early adoption permitted. We have not early-adopted the guidance and are currently evaluating the impact that ASU No. 2009-13 will

have on our consolidated financial statements.

In January 2010, the FASB issued an amendment to the Fair Value Measurements and Disclosures topic of the ASC. This

amendment requires disclosures about transfers into and out of Levels 1 and 2 and separate disclosures about purchases, sales, issuances, and

settlements relating to Level 3 measurements. It also clarifies existing fair value disclosures about the level of disaggregation and about

inputs and valuation techniques used to measure fair value. This amendment is effective for periods beginning after December 15, 2009,

except for the requirement to provide the Level 3 activity of purchases, sales, issuances, and settlements, which will be effective for fiscal

years beginning after December 15, 2010. Accordingly, the Company has adopted this amendment on January 1, 2010 by adding additional

disclosures, except for the additional Level 3 requirements which will be adopted in fiscal year 2011.

In February 2010, the FASB issued ASU No. 2010-09, Subsequent Events (Topic 855): Amendments to Certain Recognition and

Disclosure Requirements, which revised the general standards of accounting for and disclosure of events that occur after the balance sheet

date but before financial statements are issued or available to be issued. The adoption did not have a material impact on the Company’ s

consolidated results of operations or financial condition, except the Company no longer needs to disclose the date through which subsequent

events are evaluated.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

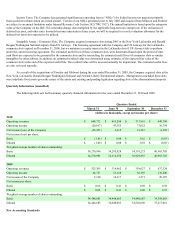

We have been and are subject to market risks, including commodity price risk (such as, to a limited extent, aircraft fuel prices) and

interest rate risk.

Interest Rates

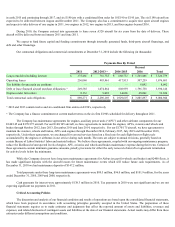

Our earnings can be affected by changes in interest rates due to the amount of cash and securities held and variable rate debt. At

December 31, 2010 and 2009, approximately $482.7 million and $506.8 million of our outstanding debt was at variable interest rates,

respectively. However, at December 31, 2008 all of our long-term debt was fixed rate debt. A one hundred basis point change in the LIBOR

rate would have increased or decreased interest expense by $4.8 million for 2010 and 2009.

We currently intend to finance the acquisition of aircraft through the manufacturer, third-party leases or long-term borrowings.

Changes in interest rates may impact the actual cost to us to acquire these aircraft. To the extent we place these aircraft in service under our

code-share agreements our reimbursement rates may not be adjusted higher or lower to reflect any changes in our aircraft rental rates.

Aircraft Fuel Price Risk

Our results of operations are materially impacted by changes in aircraft fuel prices. In an effort to manage our exposure to this risk,

we periodically purchase call options, enter into fuel swap agreements, or enter into costless collars on various oil derivative commodities.

We do not hold or issue any derivative financial instruments for speculative trading purposes. We choose not to designate these derivatives

as hedges, and, as such, realized and unrealized mark-to-market adjustments are included in aircraft fuel expense in the consolidated

statements of income (loss). A one dollar change in price per barrel of crude oil will increase or decrease our fuel expense by $5.6 million. A

one-cent change in the cost of each gallon of fuel would impact our pre-tax income by approximately $2.3 million per year based on our

current fleet and aircraft fuel consumption.

Under our fixed-fee agreements we are not exposed to changes in fuel prices. Our fixed-fee agreements provide for our partners to

purchase fuel directly or reimburse us for fuel expense as a pass-through cost.

As of December 31, 2010, our Frontier operation had hedged five percent of its anticipated volume in the second, third, and fourth

quarters of 2011. Subsequent to December 31, 2010, Frontier hedged additional volumes with swap agreements that currently have Frontier

hedged fifteen percent in the second quarter, ten percent in the third quarter, and ten percent in the fourth quarter. We will continue to

monitor fuel prices closely and intend to take advantage of fuel hedging opportunities as they become available, with the goal of at least

becoming 25% hedged in our Frontier operations.

44