Frontier Airlines 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other liquidity initiatives

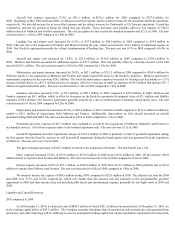

In May 2010, we successfully negotiated a new agreement to consolidate all of our Visa and MasterCard bankcard transactions to

one processor. Under the new agreement, the Company received a five percent relief of its previously 100% collateralized bankcard liability.

Upon achieving certain financial conditions, which relate to levels of operating income and cash flow coverage, the Company can attain a

lower holdback. Historically, Frontier's cash settlements were two to three weeks in arrears, but under our current relationship those

settlements occur on a daily basis. So at the end of 2010, we had received all of the cash from the year-end holiday travelers whereas at the

end of 2009 the processor still held that cash.

In November 2010, the Company completed a stock offering and received net proceeds from this offering of approximately $101.9

million after deducting underwriting discounts, commissions and estimated transaction expenses. We will use the net proceeds from this

offering of the common stock for general corporate purposes, including to finance a portion of our Embraer 190 aircraft, and to bolster our

liquidity position.

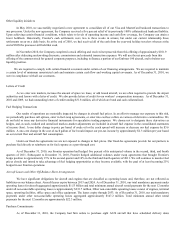

We are required to comply with certain financial covenants under certain of our financing arrangements. We are required to maintain

a certain level of minimum unrestricted cash and maintain certain cash flow and working capital covenants. As of December 31, 2010, we

were in compliance with all our covenants.

Letters of Credit

As we enter new markets, increase the amount of space we lease, or add leased aircraft, we are often required to provide the airport

authorities and lessors with a letter of credit. We also provide letters of credit for our workers’ compensation insurance. As of December 31,

2010 and 2009, we had outstanding letters of credit totaling $31.8 million, all of which are bond and cash collateralized.

Fuel Hedging Transactions

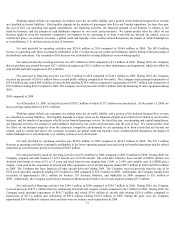

Our results of operations are materially impacted by changes in aircraft fuel prices. In an effort to manage our exposure to this risk,

we periodically purchase call options, enter in fuel swap agreements, or enter into costless collars on various oil derivative commodities. We

do not hold or issue any derivative financial instruments for speculative trading purposes. We choose not to designate these derivatives as

hedges, and, as such, realized and unrealized mark-to-market adjustments are included in aircraft fuel expense in the consolidated statements

of income (loss). A one dollar change in price per barrel of crude oil or the crack spread will increase or decrease our fuel expense by $5.6

million. A one-cent change in the cost of each gallon of fuel would impact our pre-tax income by approximately $2.3 million per year based

on our current fleet and aircraft fuel consumption.

Under our fixed-fee agreements we are not exposed to changes in fuel prices. Our fixed-fee agreements provide for our partners to

purchase fuel directly or reimburse us for fuel expense as a pass-through cost.

As of December 31, 2010, our Frontier operation had hedged five percent of its anticipated volume in the second, third, and fourth

quarters of 2011. Subsequent to December 31, 2010, Frontier hedged additional volumes under swap agreements that brought Frontier's

hedge position to approximately 15% in the second quarter and 10% in the third and fourth quarters of 2011. We will continue to monitor fuel

prices closely and intend to take advantage of fuel hedging opportunities as they become available, with the goal of at least becoming 25%

hedged in our Frontier operations.

Aircraft Leases and Other Off-Balance Sheet Arrangements

We have significant obligations for aircraft and engines that are classified as operating leases and, therefore, are not reflected as

liabilities on our balance sheet. Aircraft leases expire between 2013 and 2024. As of December 31, 2010, our total mandatory payments under

operating leases for aircraft aggregated approximately $1.53 billion and total minimum annual aircraft rental payments for the next 12 months

under all non-cancelable operating leases is approximately $233.7 million. Other non-cancelable operating leases consist of engines, terminal

space, operating facilities, office space and office equipment. The leases expire through 2033. As of December 31, 2010, our total mandatory

payments under other non-cancelable operating leases aggregated approximately $147.2 million. Total minimum annual other rental

payments for the next 12 months are approximately $22.3 million.

Purchase Commitments

As of December 31, 2010, the Company had firm orders to purchase eight A320 aircraft that have scheduled delivery dates