Frontier Airlines 2010 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

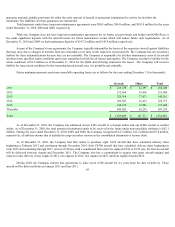

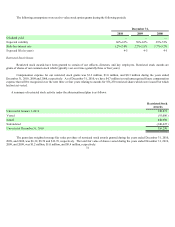

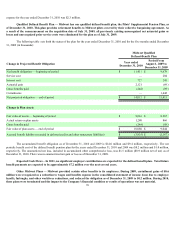

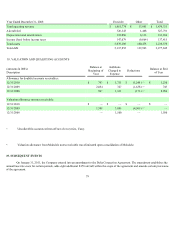

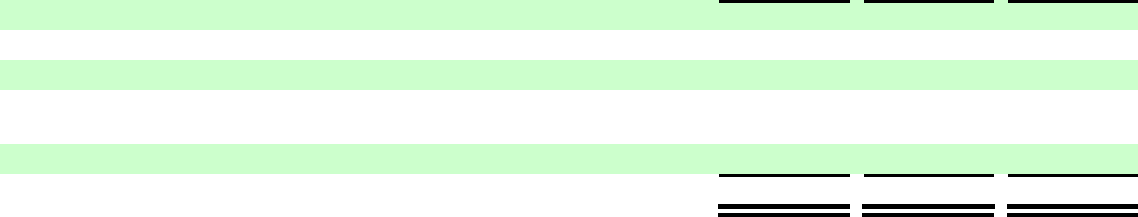

The following table reconciles the Company’ s valuation allowance for the year ended December 31 (in thousands):

2010 2009 2008

Balance at January 1, $200,971 $ 9,523 $ 8,119

Additions based on current year acquisitions and 382 limitation

—

192,255

—

Additions based on filing the final pre-acquisition tax returns for Midwest and Frontier 5,759

—

—

Reduction of net operating losses previously reserved that were forgone in tax return

filings (36,356 )

—

—

Additions (deductions) for change in current year analysis (3,421 ) (807 ) 1,404

Balance at December 31, $166,953 $ 200,971 $ 9,523

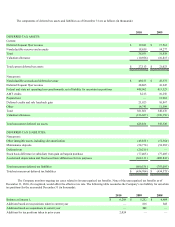

During 2009, Republic acquired Midwest and Frontier. The future use of the net operating losses (“NOLs”) acquired from both

companies are limited based on Internal Revenue Code Section 382 due to the change in control that occurred from the acquisitions.

Management evaluated the deferred tax assets and determined that more likely than not, certain deferred tax assets would not be utilized and

therefore a valuation allowance was required. The net operating losses generated by the Company after the change in control date do not have

a related valuation allowance. In conjunction with filing the 2009 tax returns during 2010 for Frontier, the Company decided to forgo $104

million of the net operating losses that were acquired from Frontier. The Company reduced the deferred tax asset for these net operating

losses as well as the related valuation allowance when the tax returns were filed during 2010. This adjustment was accounted for as an

adjustment to the opening balance sheet for Frontier as a reduction to the net operating losses acquired and a decrease in the opening

valuation allowance. As of December 31, 2010, the Company has federal NOL carryforwards totaling $1.3 billion, which begin expiring in

2015, and of which approximately $345 million are not expected to be realized prior to expiration mostly due to the limitations under Internal

Revenue Code Section 382. Therefore, a valuation allowance has been recorded for these net operating loss carryforwards.

Deferred tax assets include benefits expected to be realized from the utilization of alternative minimum tax (“AMT”) credit

carryforwards of $8.2 million, which do not expire. A valuation allowance of $8.0 million has been recorded against AMT credit

carryforwards that were acquired during 2009 as these credits are not expected to be realized.

In connection with Midwest's initial public offering in 1995 (the “Offering”), Midwest and Kimberly-Clark entered into a Tax

Allocation and Separation Agreement (“Tax Agreement”). Pursuant to the Tax Agreement, Midwest is treated for tax purposes as if it

purchased all of Midwest's assets at the time of the Offering, and as a result, the tax basis of Midwest's assets were increased to the deemed

purchase price of the assets. The tax on the amount of the gain on the deemed asset purchase was paid by Kimberly-Clark. Midwest would

pay to Kimberly-Clark 90% of the amount of the tax benefit associated with this additional basis (retaining 10% of the tax benefit). In the

event of certain business combinations or other acquisitions involving Midwest, tax benefit amounts thereafter will not take into account,

under certain circumstances, income, losses, credits, or carryovers of businesses other than those historically conducted by Midwest. These

tax benefits will not be realized by the Company as the losses are limited based on Section 382 and a full valuation allowance has been

recorded for these NOLs. Therefore, management has determined that no liability is necessary related to this Tax Agreement.

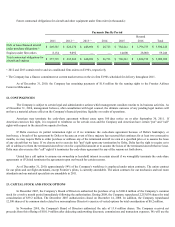

15. RETIREMENT AND BENEFIT PLANS

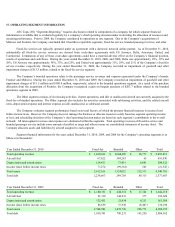

Defined Contributions Plans — The Company has defined contribution retirement plans covering substantially all eligible

employees. The Company matches up to 6% of eligible employees' wages. Employees are generally vested in matching contributions

after three years of service with the Company. Employees are also permitted to make pre-tax contributions of up to 90% (up to the

annual Internal Revenue Code limit) and after-tax contributions of up to 10% of their annual compensation. The Company's expense

under this plan was $8.2 million, $3.8 million, and $3.2 million for the years ended December 31, 2010, 2009 and 2008, respectively.

Frontier also has established the Frontier Airlines, Inc. Pilots Retirement Plan (the “FAPA Plan”) for pilots covered under the

collective bargaining agreement with the Frontier Airlines Pilots’ Association. The FAPA Plan is a defined contribution retirement

plan. Frontier contributes up to 6% of each eligible and active participant’ s compensation. Contributions begin after a pilot has reached two

years of service and the contributions vest immediately. Participants are entitled to begin receiving distributions of all vested amounts

beginning at age 59 ½. During the period from October 1, 2009 to December 31, 2009, Frontier recognized compensation expense associated

with the contributions to the FAPA Plan of $1.1 million. The recognized compensation