Frontier Airlines 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Reclassification— Certain prior-year amounts have been reclassified to conform to the current year's presentation. We

reclassified $31.4 million of on-board sales of LiveTV, liquor and food and baggage fees recorded in other revenues to passenger

revenues in our December 31, 2009 consolidated statement of income (loss). These reclassifications had no effect on previously reported

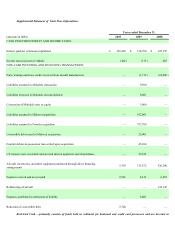

operating income or net income. We also condensed the cash flow statement to include the change in accounts payable and accrued

liabilities in one line. Further, the accrued liabilities and incomes taxes footnote was condensed in the current year.

3. FAIR VALUE MEASUREMENTS

ASC Topic 820, “Fair Value Measurements and Disclosures” requires disclosures about how fair value is determined for assets and

liabilities and a hierarchy for which these assets and liabilities must be grouped is established. The Topic establishes a three-tier fair value

hierarchy which prioritizes the inputs used in measuring fair value as follows:

Level 1 quoted prices (unadjusted) in active markets for identical assets or liabilities that the reporting entity has the ability

to access at the measurement date.

Level 2

quoted prices included within Level 1 that are observable for the asset or liability, either directly or

indirectly.

Level 3 unobservable inputs for the asset or liability.

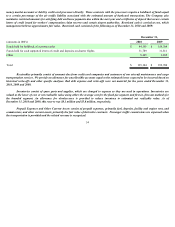

Aircraft Fuel Derivatives - Recurring - The Company's derivative contracts are privately negotiated contracts and are not exchange

traded. Fair value measurements based on level 2 inputs are estimated with option pricing models that employ observable and certain

unobservable inputs. Inputs to the valuation models include contractual terms, market prices, yield curves, fuel price curves and measures of

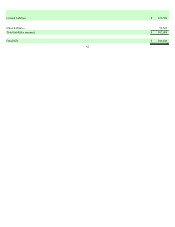

volatility, among others. The fair value of fuel hedging derivatives of $2.7 million and $2.8 million are recorded in prepaid expenses and

other current assets in the consolidated balance sheets at December 31, 2010 and 2009, respectively. The Company does not hold or issue

any derivative financial instruments for speculative trading purposes. The Company chose not to designate these derivatives as hedges, and,

as such, realized and unrealized mark-to-market adjustments are included in aircraft fuel expense in the consolidated statements of income

(loss).

Trade name Intangible - Nonrecurring - as a result of the Company's decision to unify its brand names, the Company announced its

intent to discontinue the use of the trade name Midwest Airlines. During 2010, the Company fully impaired the value of the Midwest Airlines

trade name intangible of $7.6 million to its fair value of zero based on level 3 inputs. The Company had a similar impairment charge in 2009

of $6.8 million. The estimates of fair value represent the Company's best estimate based on industry trends and reference to market rates and

transactions.

Aircraft Impairment - Nonrecurring - the Company has an agreement to sell five A318 aircraft on various dates in 2011 with a third

party. Upon entering the sale agreement with the third party, we evaluated these aircraft for impairment. We evaluated the estimated cash

flows on such aircraft through their anticipated disposal dates in 2011. The estimated cash flows were substantially less than the book values

as of December 31, 2010. The aircraft were reduced to their estimated fair values, based on the estimated selling price. We determined the

A318s were impaired by $8.5 million. The fair values were determined based on level 3 inputs.

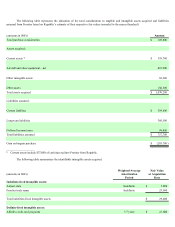

4. ACQUISITIONS AND DIVESTITURES

Frontier Airlines Holdings, Inc.

On October 1, 2009, pursuant to the terms of the amended and restated investment agreement, as amended (the “Investment

Agreement”), dated as of August 13, 2009, the Company completed its acquisition of Frontier. The Company purchased 1,000 newly issued