Frontier Airlines 2010 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169

|

|

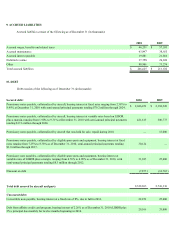

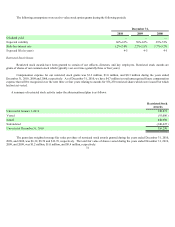

14. INCOME TAXES

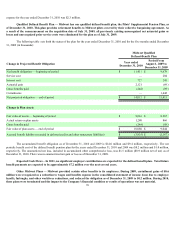

The components of the provision for income tax (benefit) expense for the years ended December 31 are as follows (in thousands):

2010 2009 2008

Federal:

Current $(2,124 ) $

—

$

—

Deferred (2,770 ) 92,931 46,616

Total Federal (4,894 ) 92,931 46,616

State:

Current 76 (1,101 ) 2,092

Deferred (1,282 ) 7,966 1,880

Total State (1,206 ) 6,865 3,972

Valuation allowance (3,421 ) (807 ) 1,404

Expense for uncertain tax positions 1,824 816 843

Income tax (benefit) expense $(7,697 ) $ 99,805 $ 52,835

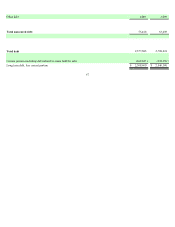

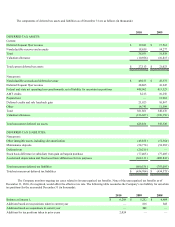

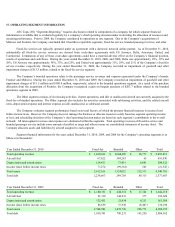

A reconciliation of income tax (benefit) expense at the applicable federal statutory income tax rate to the tax provision as reported

for the years ended December 31 are as follows (in thousands):

2010 2009 2008

Federal income tax (benefit) expense at statutory rate $(7,540 ) $ 47,667 $ 48,095

State income tax (benefit) expense, net of federal benefit (expense) (646 ) 4,086 2,569

Goodwill impairment

—

43,228

—

Valuation allowance (3,421 ) (807 ) 1,404

Other 3,910 5,631 767

Income tax (benefit) expense $(7,697 ) $ 99,805 $ 52,835

73