Frontier Airlines 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The American Code-Share Agreement

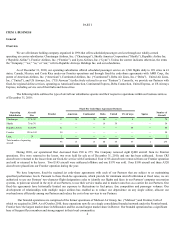

As of December 31, 2010, we operated 15 E140 aircraft for American under a fixed-fee code-share agreement and provided 113

flights per day as AmericanConnection.

Under the code-share agreement, American retains all passenger, certain cargo and other revenues associated with each flight, and is

responsible for all revenue-related expenses. We share revenue with American for certain cargo shipments. Additionally, certain operating

costs are considered "pass through" costs and American has agreed to reimburse us the actual amount of costs we incur for these items.

Beginning in May 2009 we did not record fuel expense and the related revenue for the American operations. Aircraft lease payments are also

considered a pass through cost, but are limited to a specified amount. Landing fees, hull and liability insurance and aircraft property tax costs

are pass through costs and included in our fixed-fee services revenue.

If American terminates the code-share agreement for cause, American has a call option to require that we assign to American all of

its rights under the leases of aircraft, and to lease to American the aircraft to the extent we own them, used at that time under the code-share

agreement. If American exercises its call option, we are required to pay certain maintenance costs in transferring the aircraft to American's

maintenance program.

Unless otherwise extended or amended, the term of the American code-share agreement continues until February 1, 2013. However,

American may terminate the code-share agreement without cause upon 180 days notice, provided that such notice may not be given prior to

September 30, 2011. If American terminates the code-share agreement without cause, we have the right to put the leases of the aircraft, or to

sell the aircraft to American to the extent owned by us, used under the code-share agreement to American. The agreement may be subject to

termination for cause prior to that date under various circumstances.

The Continental Code-Share Agreement

As of December 31, 2010, we operated 15 E145 aircraft for Continental under a fixed-fee code-share agreement and provided 88

flights per day as Continental Express.

Unless otherwise extended or amended, the E145 code-share agreement terminates on September 4, 2012. Seven of the aircraft are

expected to come out of service in 2011 and the final eight aircraft are expected to come out of service in 2012. Under certain conditions,

Continental may extend the term on the aircraft up to five additional years.

All fuel is purchased directly by Continental and is not charged back to Chautauqua. Under the agreement, Continental purchases all

capacity at predetermined rates and industry standard pass through costs.

The agreement may be subject to early termination under various circumstances.

Competition and Economic Conditions

The airline industry is highly competitive. Generally, the airline industry is highly sensitive to general economic conditions, in

large part due to the discretionary nature of a substantial percentage of both business and pleasure travel. In the past, many airlines have

reported decreased earnings or substantial losses resulting from periods of economic recession, heavy fare discounting, high fuel prices and

other factors. Economic downturns combined with competitive pressures have contributed to a number of bankruptcies and liquidations

among major and regional carriers and our recent acquisitions of branded carriers adds these risks to our business.

The principal competitive factors in the airline industry are fare pricing, customer service, flight schedules and aircraft types. The

airline industry is particularly susceptible to price discounting because airlines incur only nominal costs to provide service to passengers

occupying otherwise unsold seats. We face significant competition with respect to routes, services and fares. Our domestic routes are subject

to competition from carriers that provide service at low fares to destinations also served by us. In particular, we face significant competition

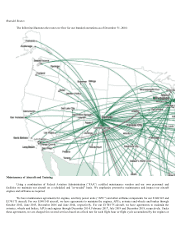

at our hub airports in Milwaukee and Denver either directly at those airports or at the hubs of other airlines that are located in close proximity

to our hubs. Certain of our competitors are larger and have significant financial resources. Our ability to compete effectively depends, in

significant part, on our ability to maintain a cost structure that is competitive with other carriers.

The growth in the fixed fee business for regional carriers which occurred over the past decade has significantly diminished in recent

times as major carriers have reduced capacity and as increased fuel prices have limited the cost efficiencies of small

11