Frontier Airlines 2010 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

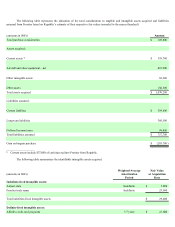

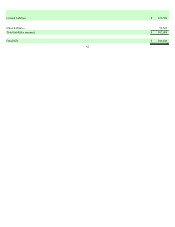

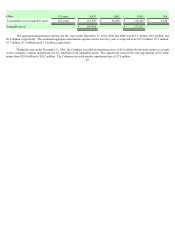

The following table summarizes the identifiable intangible assets acquired:

(amounts in 000's)

Weighted-Average

Amortization

Period

Fair Value

at Acquisition

Date

Indefinite-lived intangible assets:

Airport slots $ 21,825

Midwest trade name 11,400

Total indefinite-lived intangible assets $ 33,225

Definite-lived intangible assets:

Affinity credit card programs 2.0 years $12,100

Cargo contracts 13.0 years 2,800

Total definite-lived intangible assets 4.1 years $14,900

Total identifiable intangible assets $ 48,125

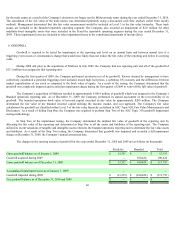

Pro forma Information (unaudited)

The following unaudited pro forma combined results of operations give effect to the acquisition of Midwest and Frontier as if they

had occurred at the beginning of the periods presented. The unaudited pro forma combined results of operations do not purport to represent

Republic’ s consolidated results of operations had the acquisition occurred on the dates assumed, nor are these results necessarily indicative of

the Company’ s future consolidated results of operations. We expect to realize significant benefits from integrating the operations of the

Company, Midwest, and Frontier. The unaudited pro forma combined results of operations do not reflect these benefits or costs.

December 31,

in (000's), except per share amounts 2009 2008

Operating revenues $ 2,683,541 $ 3,467,614

Net income (loss) of the Company 4,741 (630,942 )

Basic earnings per share $ 0.14 $ (18.10 )

Diluted earnings per share $ 0.13 $ (18.10 )

Mokulele Flight Services Inc.

In October 2008, the Company entered into a loan agreement with Mokulele under which we were to provide up to $8.0 million,

with an interest rate of 10%, payable monthly. The loan agreement was provided to Mokulele in the form of a revolving line of credit,

convertible at the Company’ s option, to as much as 45% of the common stock of Mokulele. The loan was collateralized by all of Mokulele’ s

unencumbered assets and a pledge of the equity holdings of Mokulele’ s majority shareholders. The loan was scheduled to mature in October

2010. Due to the uncertainty of whether or not the Company would receive value equal to the carrying value of the Mokulele note, the

Company recorded a valuation allowance of $1.5 million in December 2008.

In March 2009, the Company and certain shareholders of Mokulele agreed to participate in a restructuring of Mokulele. Under this

agreement, the Company agreed to convert $3.0 million of our $8.0 million loan to equity and invest an additional $3.0 million of cash in

exchange for 50% ownership of Mokulele’ s common stock and three of the five Mokulele Board of Directors’ seats. The recapitalization

effectively provided us control of Mokulele and its Hawaii inter island passenger service. Accordingly, we accounted for the recapitalization

of Mokulele as a business combination. The Company assigned fair values to the assets acquired and liabilities assumed and the transaction

resulted in no goodwill. The Company acquired approximately $4.1 million of current assets, $9.3 million of aircraft and other equipment,