Frontier Airlines 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

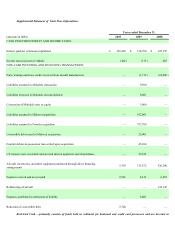

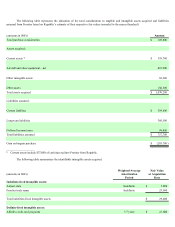

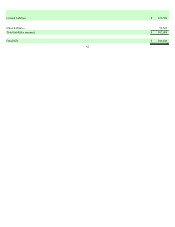

Net Income (Loss) per Common Share is based on the weighted average number of shares outstanding during the period. The

following is a reconciliation of the diluted net income (loss) per common share computations (amounts in thousands):

For the Years Ended December 31,

2010 2009 2008

Net income (loss) of the Company $(13,846 ) $ 39,655 $ 84,580

Reduction in interest expense from convertible note (net of tax)

—

517

—

Net income (loss) of the Company for diluted net income (loss) per common share

calculation $(13,846 ) $ 40,172 $ 84,580

Weighted-average common shares outstanding for basic net income (loss) per common

share 35,976 34,599 34,855

Effect of dilutive convertible note

—

1,041

—

Effect of dilutive employee stock options and warrants

—

59 94

Adjusted weighted-average common shares outstanding and assumed conversions for

diluted net income (loss) per common share 35,976 35,699 34,949

Employee stock options of 5.3 million, 4.2 million, and 3.5 million were not included in the calculation of diluted net income (loss)

per common share due to their anti-dilutive impact for the years ended December 31, 2010, 2009, and 2008, respectively. The convertible

note has a $22.3 million face value and is convertible in whole or in part, at the option of the holder, for up to 2.2 million shares of the

Company’ s common stock.

Fair Value of Financial Instruments—The carrying amounts reported in the consolidated balance sheets for cash and cash

equivalents, restricted cash, receivables, and accounts payable approximate fair values because of their immediate or short-term maturity

of these financial instruments.

Segment Information—Historically, the Company has always considered its operations as one operating and reportable segment,

fixed-fee services. During 2009, the Company acquired Frontier, Midwest, and Mokulele, and the Company reassessed the number of

segments of the Company and determined that the Company has three reportable operating segments: fixed-fee service, branded

passenger service, and other. Additional information about segment reporting is presented in Note 17.

New Accounting Standards—In October 2009, the FASB issued ASU No. 2009-13 pertaining to multiple-deliverable revenue

arrangements. The new guidance will affect accounting and reporting for companies that enter into multiple-deliverable revenue

arrangements with their customers when those arrangements are within the scope of Accounting Standards Codification (ASC) 605-25

Revenue Recognition – Multiple Element Arrangements. The new guidance will eliminate the residual method of allocation and require

that arrangement consideration be allocated at the inception of the arrangement to all deliverables using the relative selling price

method. The new guidance will be effective for the Company prospectively for revenue arrangements entered into or materially modified

on or after January 1, 2011, with early adoption permitted. We have not early-adopted the guidance and are currently evaluating the

impact that ASU No. 2009-13 will have on our consolidated financial statements.

In January 2010, the FASB issued an amendment to the Fair Value Measurements and Disclosures topic of the ASC. This

amendment requires disclosures about transfers into and out of Levels 1 and 2 and separate disclosures about purchases, sales, issuances, and

settlements relating to Level 3 measurements. It also clarifies existing fair value disclosures about the level of disaggregation and about

inputs and valuation techniques used to measure fair value. This amendment is effective for periods beginning after December 15, 2009,

except for the requirement to provide the Level 3 activity of purchases, sales, issuances, and settlements, which will be effective for fiscal

years beginning after December 15, 2010. Accordingly, the Company has adopted this amendment on January 1, 2010 by adding additional

disclosures, except for the additional Level 3 requirements which will be adopted in fiscal year 2011.

In February 2010, the FASB issued ASU No. 2010-09, Subsequent Events (Topic 855): Amendments to Certain Recognition and

Disclosure Requirements, which revised the general standards of accounting for and disclosure of events that occur after the balance sheet