Frontier Airlines 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

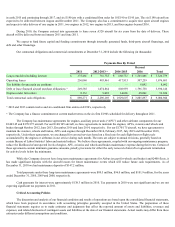

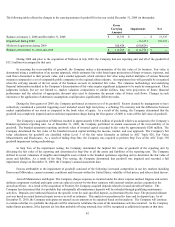

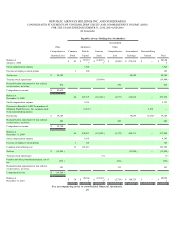

The following table reflects the changes in the carrying amount of goodwill for the year ended December 31, 2009 (in thousands):

Gross

Carrying

Amount

Impairment Net

Balance at January 1, 2008 and December 31, 2008 $13,335 $

—

$ 13,335

Impairment during 2009

—

(13,335 ) (13,335 )

Midwest Acquisistion during 2009 100,424 (100,424 )

—

Balance at December 31, 2010 and 2009 $113,759 $ (113,759 ) $

—

During 2008 and prior to the acquisition of Midwest in July 2009, the Company had one reporting unit and all of the goodwill of

$13.3 million was assigned to that unit.

In assessing the recoverability of goodwill, the Company makes a determination of the fair value of its business. Fair value is

determined using a combination of an income approach, which estimates fair value based upon projections of future revenues, expenses, and

cash flows discounted to their present value, and a market approach, which estimates fair value using market multiples of various financial

measures compared to a set of comparable public companies in the regional airline industry. An impairment loss will generally be recognized

when the carrying amount of the net assets of the business exceeds its estimated fair value. The valuation methodology and underlying

financial information included in the Company’ s determination of fair value require significant judgments to be made by management. These

judgments include, but are not limited to, market valuation comparisons to similar airlines, long term projections of future financial

performance and the selection of appropriate discount rates used to determine the present value of future cash flows. Changes in such

estimates or the application of alternative assumptions could produce significantly different results.

During the first quarter of 2009, the Company performed an interim test of its goodwill. Factors deemed by management to have

collectively constituted a potential triggering event included record high fuel prices, a softening US economy and the differences between

market capitalization of our stock as compared to the book value of equity. As a result of the testing, the Company determined that the

goodwill was completely impaired and recorded an impairment charge during the first quarter of 2009 to write-off the full value of goodwill.

The Company’ s acquisition of Midwest resulted in approximately $100.4 million of goodwill which was assigned to the Company’ s

branded operations reporting unit. As of December 31, 2009, the Company performed its annual assessment of the recoverability of its

goodwill. The branded operations reporting unit book value of invested capital exceeded its fair value by approximately $200 million. The

Company determined the fair value of the branded invested capital utilizing the income, market, and cost approach. The Company's fair

value calculations for goodwill are classified within Level 3 of the fair value hierarchy as defined in ASC Topic 820, Fair Value

Measurements and Disclosures. As a result of failing Step One, the Company was required to perform Step Two of the ASC Topic 350

goodwill impairment testing methodology.

In Step Two of the impairment testing, the Company determined the implied fair value of goodwill of the reporting unit by

allocating the fair value of the reporting unit determined in Step One to all the assets and liabilities of the reporting unit. The Company

utilized its recent valuations of tangible and intangible assets related to the branded operations reporting unit to determine the fair value of

assets and liabilities. As a result of the Step Two testing, the Company determined that goodwill was impaired and recorded a full

impairment charge on December 31, 2009, the Company’ s annual assessment date.

Factors attributable to the impairment of goodwill consisted of the following: increased competition in our key markets including

Denver and Milwaukee, current economic conditions and forecasts within the United States, volatility of fuel prices, and other related factors.

Aircraft Maintenance and Repair. The Company charges expenses as incurred under the direct expense method. Engines and certain

airframe component overhaul and repair costs are subject to power-by-the-hour contracts with external vendors and are expensed as the

aircraft are flown. As a result of the acquisition of Frontier, the Company acquired deposits related to leased aircraft at Frontier. The

Company has determined that it is probable that substantially all maintenance deposits will be refunded through qualifying maintenance

activities. Deposits are reimbursed based on the specific event for each specified deposit, as determined by the lease. The projected ultimate

cost was based on actual historical repair invoices as well as estimates. This analysis was performed by lease and by deposit type. As of

December 31, 2010, the Company anticipates no unused excess amounts to be expensed based on this analysis. The Company will continue

to evaluate whether it is probable the deposits will be returned to reimburse the costs of the maintenance activities incurred. As the Company

makes future payments, if the deposits are less than probable of being returned, they will be recognized as additional expense at that time.

42