Express Scripts 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2013 Annual Report 96

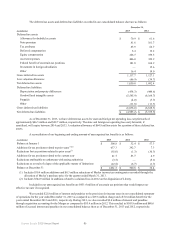

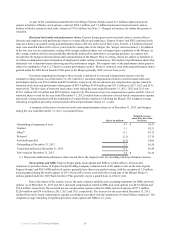

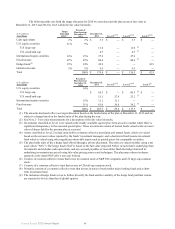

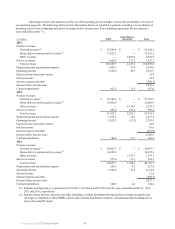

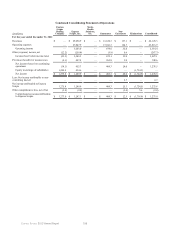

Purchase commitments. As of December 31, 2013, we have certain required future purchase commitments for

materials, supplies, services and fixed assets related to the normal course of business. We do not expect potential payments

under these provisions to materially affect results of operations or financial condition based upon reasonably likely outcomes

derived by reference to historical experience and current business plans. These future purchase commitments (in millions),

excluding the facilities of the discontinued operations of our held for sale entities of our European operations, are summarized

below:

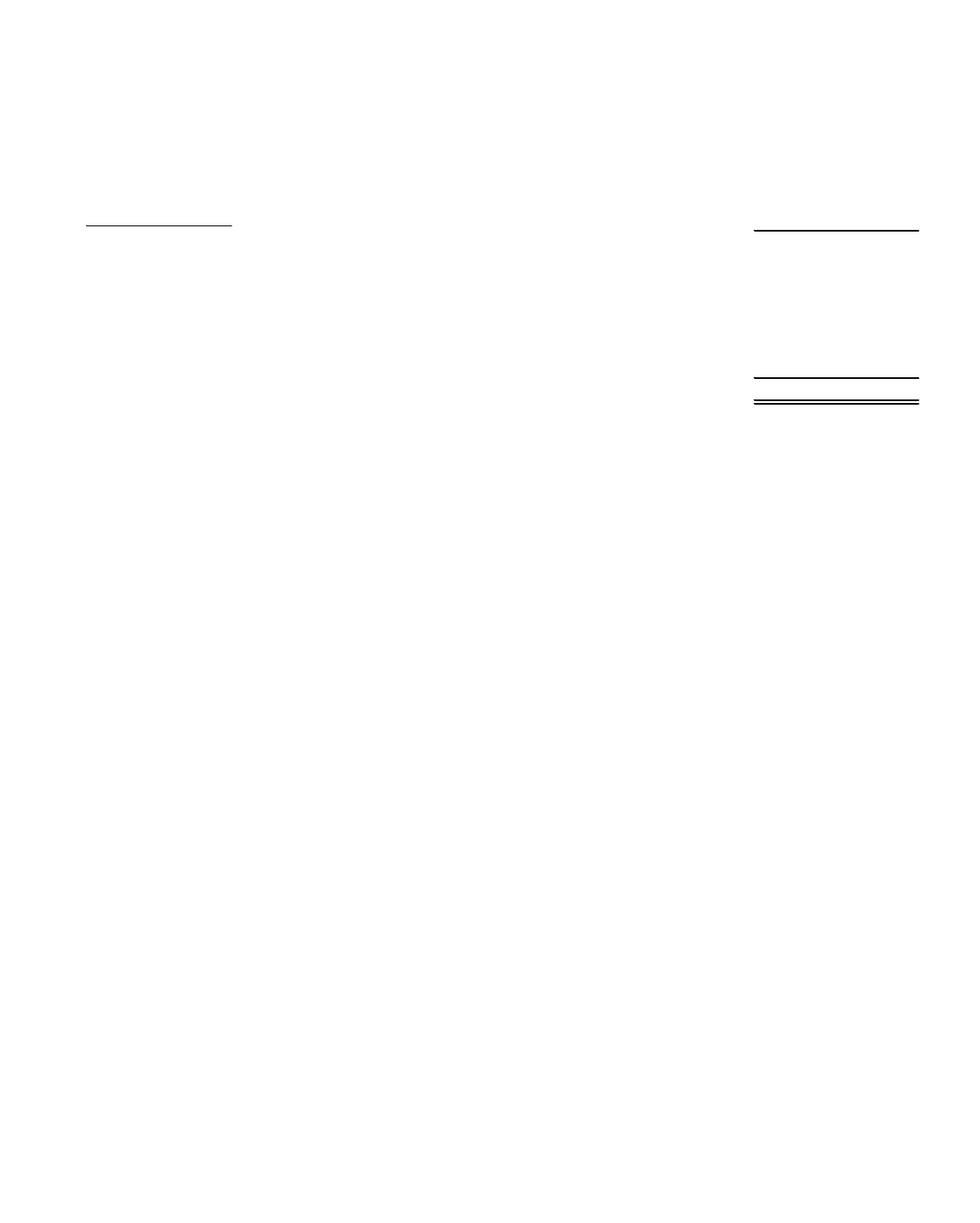

Year Ended December 31,

Future

Purchase Commitments

2014 $ 425.3

2015 102.8

2016 57.3

2017 25.3

2018 —

Thereafter —

Total $ 610.7

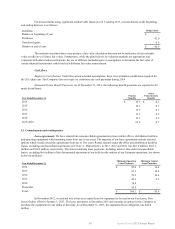

Other contingencies. For the year ended December 31, 2013, approximately 47.0% of our pharmaceutical

purchases were through one wholesaler. We believe other alternative sources are readily available. Except for customer

concentration described in Note 13 - Segment information below, we believe no other concentration risks exist at December 31,

2013.

In the ordinary course of business there have arisen various legal proceedings, investigations, government inquiries

or claims now pending against us or our subsidiaries, including, but not limited to, those relating to regulatory, commercial,

employment, employee benefits and securities matters. In accordance with applicable accounting guidance, we record accruals

for certain of our outstanding legal proceedings, investigations or claims when we believe it is probable that a liability will be

incurred and the amount of loss can be reasonably estimated. We evaluate, on a quarterly basis, developments in legal

proceedings, investigations or claims that could affect the amount of any accrual, as well as any developments that would make

a loss contingency both probable and reasonably estimable. We disclose the amount of the accrual if the consolidated financial

statements would be otherwise misleading, which was not the case for the years ended December 31, 2013, 2012 and 2011.

We record self-insurance accruals based upon estimates of the aggregate liability of claim costs in excess of our

insurance coverage. Accruals are estimated using certain actuarial assumptions followed in the insurance industry and our

historical experience (see Note 1 - Summary of significant accounting policies, “Self-insurance accruals”). The majority of

these claims are legal claims and our liability estimate is primarily related to the cost to defend these claims. We do not accrue

for settlements, judgments, monetary fines or penalties until such amounts are probable and estimable. Under authoritative

guidance, if the range of possible loss is broad, the liability accrual is based on the low end of the range.

When a loss contingency is not believed to be both probable and estimable, we do not establish an accrued liability.

However, if the loss (or an additional loss in excess of the accrual) is believed to be at least a reasonable possibility and

material, then we disclose an estimate of the possible loss or range of loss, if such estimate can be made, or disclose that an

estimate cannot be made.

The assessments of whether a loss is probable or a reasonable possibility, and whether the loss or a range of loss is

estimable, often involve a series of complex judgments about future events. We are often unable to estimate a range of

reasonably possible loss, particularly where (i) the damages sought are substantial or indeterminate, (ii) the proceedings are in

the early stages, or (iii) the matters involve novel or unsettled legal theories or a large number of parties. In such cases, there is

considerable uncertainty regarding the timing or ultimate resolution of such matters, including a possible eventual loss, fine,

penalty or business impact, if any. Accordingly, for many proceedings, we are currently unable to estimate the loss or a range of

possible loss. For a limited number of proceedings, we may be able to reasonably estimate the possible range of loss in excess

of any accruals. However, we believe that such matters, individually and in the aggregate, when finally resolved, are not

reasonably likely to have a material adverse effect on our cash flow or financial condition. We also believe that any amount that

could be reasonably estimated in excess of accruals, if any, for such proceedings is not material. However, an adverse

resolution of one or more of such matters could have a material adverse effect on our results of operations in a particular

quarter or fiscal year.

While we believe our services and business practices are in compliance with applicable laws, rules and regulations

in all material respects, we cannot predict the outcome of these claims at this time. An unfavorable outcome in one or more of

these matters could result in the imposition of judgments, monetary fines or penalties, or injunctive or administrative remedies.