Express Scripts 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2013 Annual Report 72

consideration) by (2) an amount equal to the average of the closing prices of ESI common stock on the Nasdaq for each of the

15 consecutive trading days ending with the fourth complete trading day prior to the completion of the Merger.

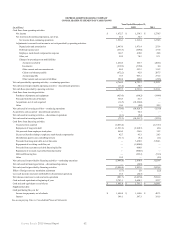

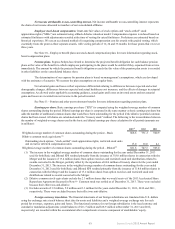

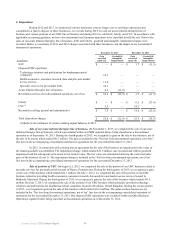

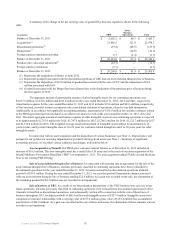

Based on the opening price of Express Scripts’ stock on April 2, 2012, the purchase price was comprised of the

following:

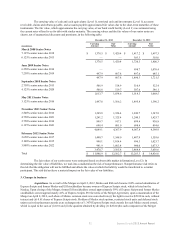

(in millions)

Cash paid to Medco stockholders(1) $ 11,309.6

Value of shares of common stock issued to Medco stockholders(2) 17,963.8

Value of stock options issued to holders of Medco stock options(3)(4) 706.1

Value of restricted stock units issued to holders of Medco restricted stock units(3) 174.9

Total consideration $ 30,154.4

(1) Equals Medco outstanding shares multiplied by $28.80 per share.

(2) Equals Medco outstanding shares immediately prior to the Merger multiplied by the exchange ratio of 0.81, multiplied

by the Express Scripts opening share price on April 2, 2012 of $56.49.

(3) In accordance with applicable accounting guidance, the fair value of replacement awards attributable to pre-

combination service is recorded as part of the consideration transferred in the Merger, while the fair value of

replacement awards attributable to post-combination service is recorded separately from the business combination and

recognized as compensation cost in the post-acquisition period over the remaining service period.

(4) The fair value of the Company’s equivalent stock options was estimated using the Black-Scholes valuation model

utilizing various assumptions. The expected volatility of the Company’s common stock price is a blended rate based on

the average historical volatility over the expected term based on daily closing stock prices of ESI and Medco common

stock. The expected term of the option is based on Medco historical employee stock option exercise behavior as well as

the remaining contractual exercise term.

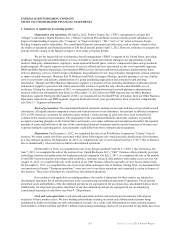

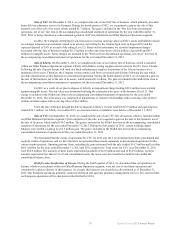

The consolidated statement of operations for Express Scripts for the year ended December 31, 2012 following

consummation of the Merger on April 2, 2012 includes Medco’s total revenues for continuing operations of $45,763.5 million

and net income of $290.7 million, which includes integration expense and amortization.

The following unaudited pro forma information presents a summary of Express Scripts’ combined results of

continuing operations for the years ended December 31, 2012 and 2011 as if the Merger and related financing transactions had

occurred at January 1, 2011. The following pro forma financial information is not necessarily indicative of the results of

operations as it would have been had the transactions been effected on the assumed date, nor is it necessarily an indication of

trends in future results for a number of reasons, including, but not limited to, differences between the assumptions used to

prepare the pro forma information, basic shares outstanding and dilutive equivalents, cost savings from operating efficiencies,

potential synergies and the impact of incremental costs incurred in integrating the businesses:

Year Ended December 31,

(in millions, except per share data) 2012 2011

Total revenues $ 109,639.2 $ 115,463.4

Net income attributable to Express Scripts 1,345.5 719.8

Basic earnings per share from continuing operations 1.69 0.88

Diluted earnings per share from continuing operations $ 1.66 $ 0.87

Pro forma net income for the year ended December 31, 2011 includes total non-recurring amounts of $1,192.2

million related to severance payments, accelerated stock-based compensation and transaction and integration costs incurred in

connection with the Merger.

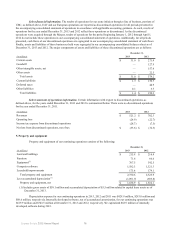

The Merger was accounted for under the acquisition method of accounting with ESI treated as the acquirer for

accounting purposes. The purchase price was allocated based on the estimated fair value of net assets acquired and liabilities

assumed at the date of the acquisition.

During the first quarter ended March 31, 2013, the Company made refinements to its preliminary allocation of

purchase price related to accrued liabilities due to the finalization of assumptions utilized to value the liabilities acquired. These

adjustments had the effect of increasing current assets and other noncurrent liabilities and decreasing goodwill, deferred tax

liabilities and current liabilities.