Express Scripts 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2013 Annual Report 94

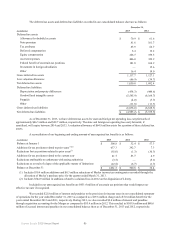

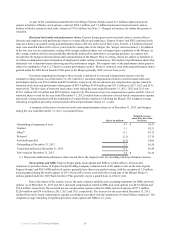

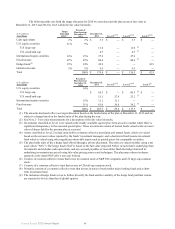

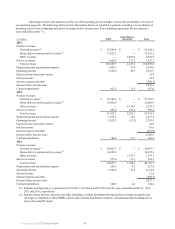

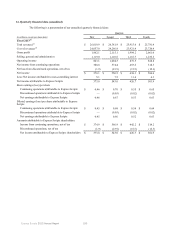

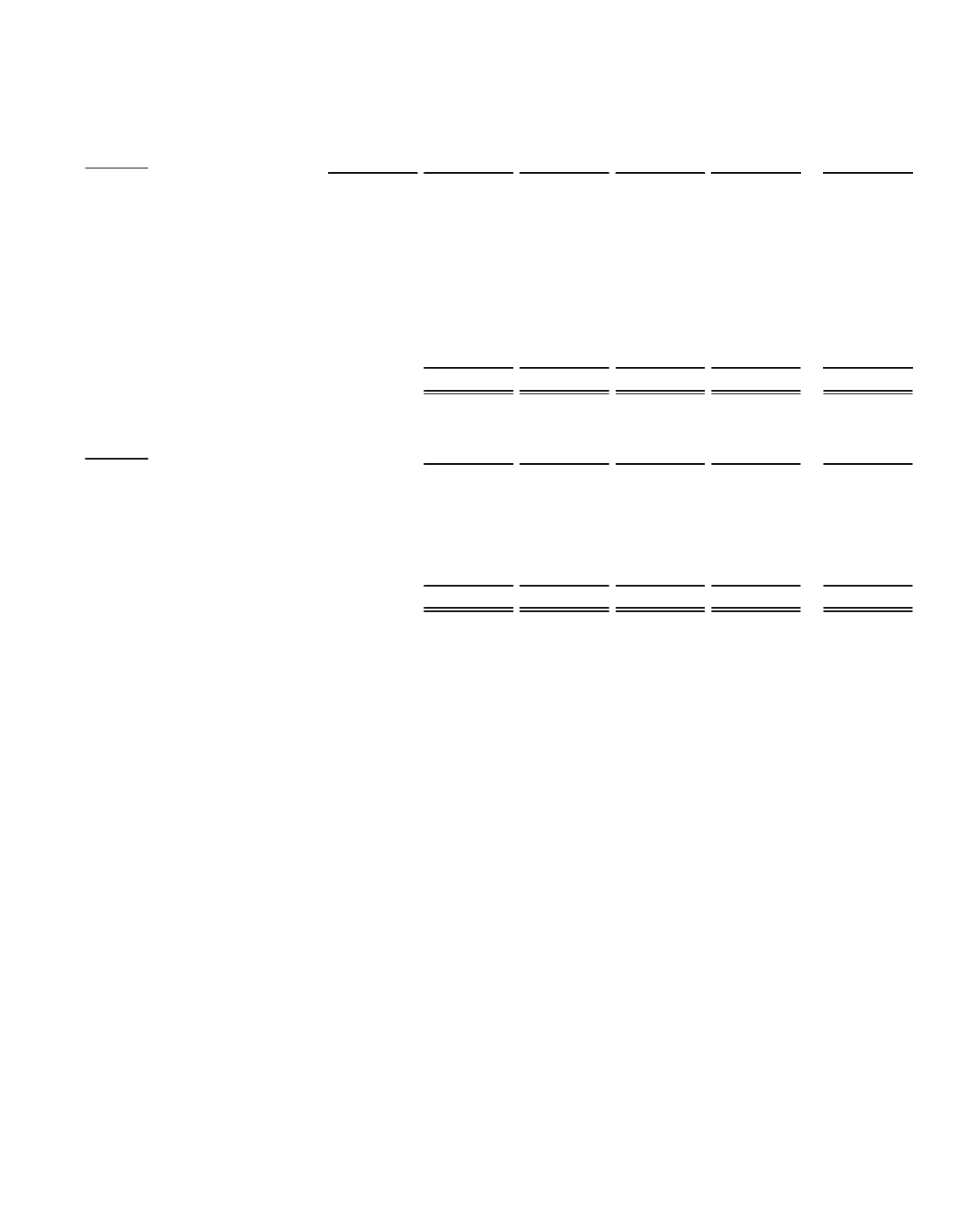

The following table sets forth the target allocation for 2014 by asset class and the plan assets at fair value at

December 31, 2013 and 2012 by level within the fair value hierarchy:

($ in millions)

Asset Class

Target

Allocation

2014(1)

Percent of

Plan Assets at

December 31,

2013

December 31,

2013 Level 1(2)(3) Level 2(2)(4) Level 3(2)(5)

Cash equivalents 2% 2% $ 3.3 $ — $ 3.3 $ —

U.S. equity securities 11% 9%

U.S. large-cap 11.0 — 11.0 (6) —

U.S. small/mid-cap 4.7 — 4.7 (7) —

International equity securities 12% 15% 27.9 — 27.9 —

Fixed income 47% 45% 80.6 — 80.6 (8) —

Hedge funds(9) 23% 24% 42.9 — — 42.9

Global real estate 5% 5% 9.0 — 9.0 —

Total 100% $ 179.4 $ — $ 136.5 $ 42.9

($ in millions)

Asset Class

Percent of

Plan Assets at

December 31,

2012

December 31,

2012 Level 1(2)(3) Level 2(2)(4) Level 3(2)

U.S. equity securities 54%

U.S. large-cap $ 60.3 $ — $ 60.3 (6) $—

U.S. small/mid-cap 51.1 27.9 23.2 (7) —

International equity securities 15% 31.1 31.1 — —

Fixed income 31% 65.0 30.8 34.2 (8) —

Total 100% $ 207.5 $ 89.8 $ 117.7 $ —

(1) The amounts disclosed reflect our target allocation based on the funded ratio of the plan at December 31, 2013 and are

subject to change based on the funded ratio of the plan during the year.

(2) See Note 2 - Fair value measurements for a description of the fair value hierarchy.

(3) Investments classified as Level 1 are valued at the readily available quoted price from an active market where there is

significant transparency in the executed quoted price. These investments consist of mutual funds valued at the net asset

value of shares held by the pension plan at year-end.

(4) Assets classified as Level 2 include units held in common collective trust funds and mutual funds, which are valued

based on the net asset values reported by the funds’ investment managers, and a short-term fixed income investment

fund which is valued using other significant observable inputs such as quoted prices for comparable securities.

(5) The plan holds units of the a hedge fund offered through a private placement. The units are valued monthly using a net

asset value (“NAV”). The hedge fund’s NAV is based on the fair value (reported NAVs) of each fund’s underlying fund

investments and includes cash equivalents, and any accrued payables or receivables. Both the hedge fund and its

underlying investments are priced using fair value pricing sources and techniques. The plan may redeem its shares

quarterly at the stated NAV after a one year lock-up.

(6) Consists of common collective trusts that invest in common stock of S&P 500 companies and US large-cap common

stock.

(7) Consists of a common collective trust that invests in US mid-cap common stock.

(8) Primarily consists of a common collective trust that invests in passive bond market index lending funds and a short-

term investment fund.

(9) The inclusion of hedge funds serves to further diversify the fund and the volatility of the hedge fund portfolio returns

are expected to be less than that of global equities.