Express Scripts 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2013 Annual Report 54

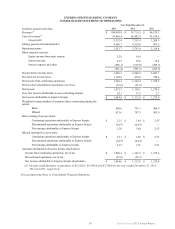

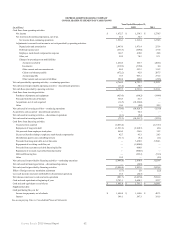

On May 2, 2011, ESI issued $1,500.0 million aggregate principal amount of 3.125% senior notes due 2016. ESI

used the proceeds to repurchase treasury shares.

On September 10, 2010, Medco issued $1,000.0 million of senior notes, including:

• $500.0 million aggregate principal amount of 2.750% senior notes due 2015

• $500.0 million aggregate principal amount of 4.125% senior notes due 2020

Medco used the net proceeds for general corporate purposes.

On June 9, 2009, ESI issued $2,500.0 million of senior notes, including:

• $1,000.0 million aggregate principal amount of 5.250% senior notes due 2012

• $1,000.0 million aggregate principal amount of 6.250% senior notes due 2014

• $500.0 million aggregate principal amount of 7.250% senior notes due 2019

ESI used the net proceeds for the acquisition of WellPoint’s NextRx PBM Business. On June 15, 2012, $1,000.0

million aggregate principal amount of the 5.250% senior notes due 2012 matured and were redeemed. On March 29, 2013,

$1,000.0 million aggregate principal amount of the 6.250% senior notes due 2014 were redeemed.

On March 18, 2008, Medco issued $1,500.0 million of senior notes, including:

• $300.0 million aggregate principal amount of 6.125% senior notes due 2013

• $1,200.0 million aggregate principal amount of 7.125% senior notes due 2018

Medco used the net proceeds to reduce debts held on Medco’s revolving credit facility. On March 18, 2013, $300.0

million aggregate principal amount of the 6.125% senior notes due 2013 matured and were redeemed.

In August 2003, Medco issued $500.0 million aggregate principal amount of 7.250% senior notes due 2013 (the

“August 2003 Senior Notes”). On May 7, 2012, the Company redeemed the August 2003 Senior Notes. Total cash payments

related to these notes were $549.4 million comprised of principal, redemption costs and interest.

See Note 7 - Financing for more information on our Senior Notes borrowings.

BANK CREDIT FACILITY

On August 29, 2011, we entered into a credit agreement (the “credit agreement”) with a commercial bank syndicate

providing for a five-year $4,000.0 million term loan facility (the “term facility”) and a $1,500.0 million revolving loan facility

(the “revolving facility”). The term facility was used to pay a portion of the cash consideration paid in connection with the

Merger, as discussed in Note 3 - Changes in business, to repay existing indebtedness and to pay related fees and expenses.

Subsequent to consummation of the Merger on April 2, 2012, the revolving facility is available for general corporate purposes.

The term facility and the revolving facility both mature on August 29, 2016. As of December 31, 2013, no amounts were drawn

under the revolving facility. The Company makes quarterly principal payments on the term facility. Additionally, during the

fourth quarter of 2012, the Company paid down $1,000.0 million of the term facility. As of December 31, 2013, $2,000.0

million was outstanding under the term facility with an average interest rate of 1.92%, of which $684.2 million is considered

current maturities of long-term debt. Upon consummation of the Merger, Express Scripts assumed the obligations of ESI and

became the borrower under the credit agreement.

Our credit agreements contain covenants which limit our ability to incur additional indebtedness, create or permit

liens on assets, and engage in mergers, consolidations or disposals. The covenants also include a minimum interest coverage

ratio and a maximum leverage ratio. At December 31, 2013, we believe we were in compliance in all material respects with all

covenants associated with our credit agreements.

See Note 7 - Financing for more information on our credit facilities.