Express Scripts 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2013 Annual Report 50

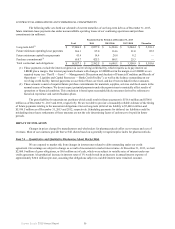

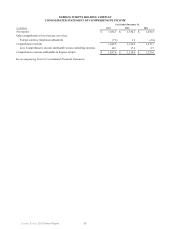

NET LOSS FROM DISCONTINUED OPERATIONS, NET OF TAX

During 2012, we sold our EAV business. In addition, we determined our European operations and portions of our

UBC line of business were not core to our future operations and committed to a plan to dispose of these businesses.

Subsequently, during 2013, we sold all portions of our UBC line of business classified as discontinued operations. During

2013, we also sold our acute infusion therapies line of business. These lines of business are classified as discontinued

operations. In accordance with applicable accounting guidance, the results of our acute infusion therapies line of business for

the year ended December 31, 2012 have been reclassed to reflect these operations as discontinued. As these businesses were

acquired with the Merger, results of operations for the period beginning January 1, 2012 through April 1, 2012 and for the year

ended December 31, 2011 do not include these operations.

The net loss from discontinued operations, net of tax, increased $21.3 million, or 65.9%, in 2013 as compared to

2012. This increase is due to a total gain of $52.3 million recognized in connection with the sale of the discontinued operations

portions of our UBC business and our acute infusion therapies line of business, as well as impairment charges associated with

our EAV line of business of $11.5 million during the year ended December 31, 2012, which was sold in the fourth quarter of

2012. These increases are partially offset by a $32.9 million impairment on our acute infusion therapies line of business and

charges recognized of $16.0 million for the year ended December 31, 2013.

The loss from discontinued operations for the year ended December 31, 2012 is due primarily to the impairment

charges associated with EAV totaling $11.5 million to reflect the write-down of $2.0 million of goodwill and $9.5 million of

intangible assets, partially offset by a $3.7 million gain recognized in connection with the sale of EAV.

See Note 6 - Goodwill and other intangibles and Note 4 - Dispositions for further information regarding the

businesses discussed above.

NET INCOME ATTRIBUTABLE TO NON-CONTROLLING INTEREST

Net income attributable to non-controlling interest represents the share of net income allocated to members in our

consolidated affiliates. Increases in these amounts are primarily driven by increased profitability.

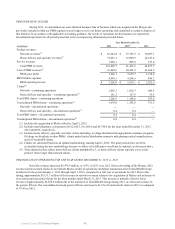

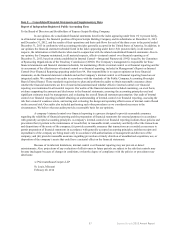

NET INCOME AND EARNINGS PER SHARE ATTRIBUTABLE TO EXPRESS SCRIPTS

Net income attributable to Express Scripts increased $531.7 million, or 40.5%, for the year ended December 31,

2013 over 2012 and increased $37.1 million, or 2.9%, for the year ended December 31, 2012 over 2011.

Basic and diluted earnings per share attributable to Express Scripts increased 26.7% and 27.8%, respectively, for

the year ended December 31, 2013 over 2012. These increases are primarily due to increased operating income during 2013, as

well as treasury shares repurchased through the 2013 Share Repurchase Program (including the 2013 ASR Program as defined

below), as discussed in Note 9 - Common stock, partially offset by amortization of intangible assets and financing and

commitment fees. Basic and diluted earnings per share attributable to Express Scripts decreased 29.4% and 30.4%,

respectively, for the year ended December 31, 2012 over 2011. The decrease is primarily due to amortization of intangibles and

integration costs, offset by the addition of Medco operating results, improved operating performance and synergies.

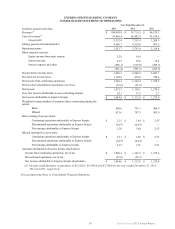

LIQUIDITY AND CAPITAL RESOURCES

OPERATING CASH FLOW AND CAPITAL EXPENDITURES

In 2013, net cash provided by continuing operations increased $17.8 million to $4,768.9 million. Changes in

operating cash flows from continuing operations in 2013 were impacted by the following factors:

• Net income from continuing operations increased $563.9 million in 2013 over 2012.

• Net income is reduced by depreciation and amortization expense, which is non-cash and therefore added back

to cash flows from operating activities to reconcile net income to net cash provided. Total depreciation and

amortization expense was $2,447.0 million in 2013, an increase of $575.6 million over 2012.

• Deferred income taxes increased by $184.7 million in 2013 when compared to 2012 reflecting a net change in

temporary differences primarily attributable to book amortization on customer contracts acquired in the

Merger that are not deductible for tax purposes.

• Net income is reduced by employee stock-based compensation expense, which is non-cash and therefore

added back to cash flows from operating activities to reconcile net income to net cash provided. Total

employee stock-based compensation expense was $164.7 million in 2013, a decrease of $245.3 million over