Express Scripts 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63 Express Scripts 2013 Annual Report

EXPRESS SCRIPTS HOLDING COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

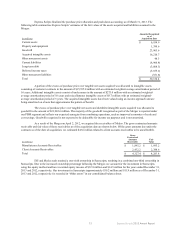

1. Summary of significant accounting policies

Organization and operations. On April 2, 2012, Express Scripts, Inc. (“ESI”) consummated a merger (the

“Merger”) with Medco Health Solutions, Inc. (“Medco”) and both ESI and Medco became wholly-owned subsidiaries of

Express Scripts Holding Company (the “Company” or “Express Scripts”). “We,” “our” or “us” refers to Express Scripts

Holding Company and its subsidiaries. The consolidated financial statements (and other data, such as claims volume) reflect

the results of operations and financial position of ESI for all periods prior to April 1, 2012. However, references to amounts for

periods after the closing of the Merger on April 2, 2012 relate to Express Scripts.

We are the largest full-service pharmacy benefit management (“PBM”) company in the United States, providing

healthcare management and administration services on behalf of clients that include managed care organizations, health

insurers, third-party administrators, employers, union-sponsored benefit plans, workers’ compensation plans and government

health programs. We report segments on the basis of services offered and have determined we have two reportable segments:

PBM and Other Business Operations. Our integrated PBM services include retail network pharmacy administration, home

delivery pharmacy services, benefit design consultation, drug utilization review, drug formulary management, clinical solutions

to improve health outcomes, Medicare Part D, Medicaid and Public Exchange offerings, specialty pharmacy services, fertility

services to providers and patients, administration of a group purchasing organization and consumer health and drug

information. Through our Other Business Operations segment, we provide services including distribution of pharmaceuticals

and medical supplies to providers and clinics and scientific evidence to guide the safe, effective and affordable use of

medicines. During the second quarter of 2012, we reorganized our international retail network pharmacy administration

business (which was substantially shut down as of December 31, 2012) from our PBM segment into our Other Business

Operations segment. During the third quarter of 2011, we reorganized our FreedomFP line of business from our Other Business

Operations segment into our PBM segment. Segment disclosures for all years presented have been revised for comparability

(see Note 13 - Segment information).

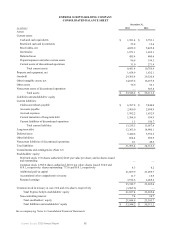

Basis of presentation. The consolidated financial statements include our accounts and those of our wholly-owned

subsidiaries. All significant intercompany accounts and transactions have been eliminated. Investments in affiliated companies

20% to 50% owned are accounted for under the equity method. Certain amounts in prior years have been reclassified to

conform to the current year presentation. The preparation of the consolidated financial statements conforms to generally

accepted accounting principles in the United States and requires us to make estimates and assumptions that affect the reported

amounts of assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and

expenses during the reporting period. Actual amounts could differ from those estimates and assumptions.

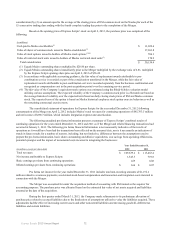

Dispositions. On December 3, 2012, we completed the sale of our PolyMedica Corporation (“Liberty”) line of

business. We retain certain cash flows associated with Liberty following the sale which preclude classification of this business

as a discontinued operation. On September 14, 2012, we completed the sale of our ConnectYourCare (“CYC”) line of business.

Due to immateriality, it has not been included in discontinued operations.

On December 4, 2012, we completed the sale of our Europa Apotheek Venlo B.V. (“EAV”) line of business. On

June 7, 2013, we completed the sale of the portion of our United BioSource LLC (“UBC”) business which primarily provided

technology solutions and publications for biopharmaceutical companies. On July 1, 2013, we completed the sale of the portion

of our UBC business related to providing health economics, outcomes research, data analytics and market access services. On

August 15, 2013, we completed the sale of the portion of our UBC business related to specialty services for pre-market trials.

On November 1, 2013, we completed the sale of our acute infusion therapies line of business. During 2012, we determined that

our operations in Europe (“European operations”) were not core to our future operations and committed to a plan to dispose of

this business. These lines of business are classified as discontinued operations.

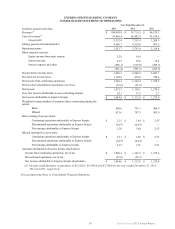

In accordance with applicable accounting guidance, the results of operations for these entities are reported as

discontinued operations for all periods presented in the accompanying consolidated statement of operations. For all periods

presented, assets and liabilities of the discontinued operations are segregated in the accompanying consolidated balance sheet.

Additionally, for all periods presented, cash flows of our discontinued operations are segregated in our accompanying

consolidated statement of cash flows (see Note 4 - Dispositions).

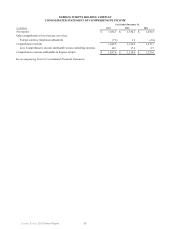

Cash and cash equivalents. Cash and cash equivalents include cash on hand and investments with original

maturities of three months or less. We have banking relationships resulting in certain cash disbursement accounts being

maintained by banks not holding our cash concentration accounts. As a result, cash disbursement accounts carrying negative

book balances of $684.4 million and $545.3 million (representing outstanding checks not yet presented for payment) have been