Express Scripts 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2013 Annual Report 102

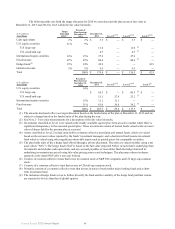

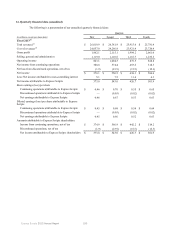

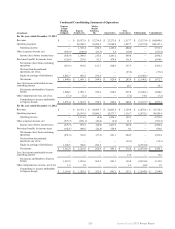

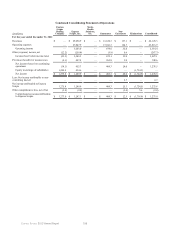

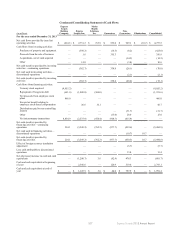

subsequent to the date of the Merger, April 2, 2012 (revised to reflect the operations as discontinued operations as applicable).

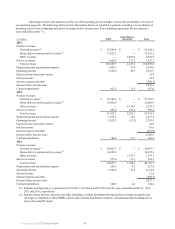

The following presentation reflects the structure that exists as of the most recent balance sheet date and also includes certain

retrospective revisions to conform prior periods to current period presentation (discussed and presented in further detail below).

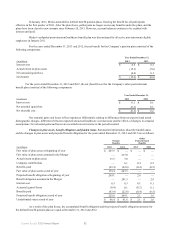

The condensed consolidating financial information is presented separately for:

(i) Express Scripts (the Parent Company), the issuer of certain guaranteed obligations;

(ii) ESI, guarantor, the issuer of additional guaranteed obligations;

(iii) Medco, guarantor, the issuer of additional guaranteed obligations;

(iv) Guarantor subsidiaries, on a combined basis (but excluding ESI and Medco), as specified in the indentures

related to Express Scripts’, ESI’s and Medco’s obligations under the notes;

(v) Non-guarantor subsidiaries, on a combined basis;

(vi) Consolidating entries and eliminations representing adjustments to (a) eliminate intercompany transactions

between or among Express Scripts, ESI, Medco, the guarantor subsidiaries and the non-guarantor subsidiaries,

(b) eliminate the investments in our subsidiaries and (c) record consolidating entries; and

(vii) Express Scripts and subsidiaries on a consolidated basis.

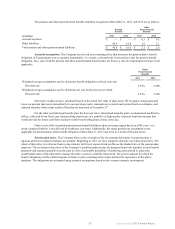

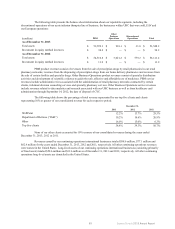

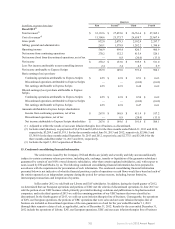

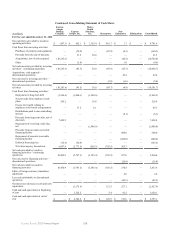

Certain amounts from prior periods have been revised to conform to current period presentation:

(i) With respect to the condensed consolidating balance sheet as of December 31, 2012, amounts related to the

goodwill allocated to Medco Health Solutions, Inc. and certain of its guarantor and non-guarantor subsidiaries

have changed as we finalized the purchase price allocation in the first quarter of 2013. The impact of the

measurement period adjustment is to reallocate goodwill and intercompany amounts as follows:

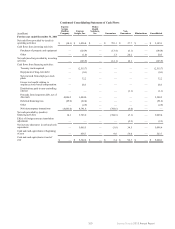

(in millions)

Medco Health

Solutions, Inc. Guarantors Non-guarantors Eliminations

Intercompany assets $ (2,040.0) $ 2,000.5 $ — $ 39.5

Goodwill $ 2,040.0 $ (2,000.5) $ 39.5 $ —

Intercompany liabilities $ — $ — $ (39.5) $ 39.5