Express Scripts 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2013 Annual Report 88

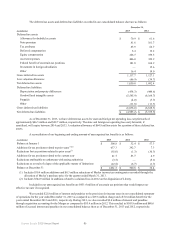

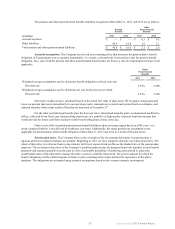

The 2011 ASR Agreement was accounted for as an initial treasury stock transaction and a forward stock purchase

contract. The forward stock purchase contract was classified as an equity instrument under applicable accounting guidance and

was deemed to have a fair value of zero at the effective date. The initial repurchase of shares resulted in an immediate reduction

of the outstanding shares used to calculate the weighted-average common shares outstanding for basic and diluted net income

per share on the effective date of the agreements. The remaining 4.0 million shares and 0.1 million shares received for the

portions of the 2011 ASR Agreement that were settled during 2011 and 2012, respectively, reduced weighted-average common

shares outstanding for the years ended December 31, 2011 and 2012, respectively.

Treasury share repurchases. Upon consummation of the Merger on April 2, 2012, all ESI shares held in treasury

were no longer outstanding and were cancelled and retired and ceased to exist. Express Scripts eliminated the value of treasury

shares, at cost, immediately prior to the Merger as a reduction to retained earnings and paid-in capital.

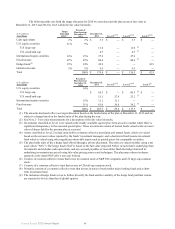

On March 6, 2013, the Board of Directors of Express Scripts approved a share repurchase program (the “2013

Share Repurchase Program”), authorizing the repurchase of up to 75.0 million shares (as adjusted for any subsequent stock

split, stock dividend or similar transaction) of the Company’s common stock. There is no limit on the duration of the 2013

Share Repurchase Program.

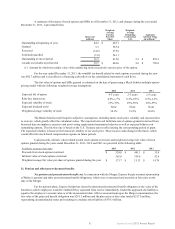

Including the shares repurchased through the 2013 ASR Program, we repurchased 60.4 million shares for $3,905.3

million during the year ended December 31, 2013. Repurchases during the second quarter included 1.2 million shares of

common stock for an aggregate purchase price of $68.4 million that were held on behalf of participants who acquired such

shares upon the consummation of the Merger as a result of conversion of Medco shares previously held in Medco’s 401(k)

plan. As previously announced, the Express Scripts 401(k) Plan no longer offers an investment fund option consisting solely of

shares of Express Scripts common stock, and previously held shares were to be sold on or about the first anniversary of the

Merger. This repurchase was not considered part of the 2013 Share Repurchase Program. As of December 31, 2013, there were

15.8 million shares remaining under the 2013 Share Repurchase Program, including shares repurchased under the 2013 ASR

Program. Additional share repurchases, if any, will be made in such amounts and at such times as the Company deems

appropriate based upon prevailing market and business conditions and other factors. Current year repurchases were funded

through internally generated cash.

ESI had a stock repurchase program, originally announced on October 25, 1996. In addition to the shares

repurchased through the 2011 ASR Agreement, ESI repurchased 13.0 million shares under its existing stock repurchase

program during the second quarter of 2011 for $765.7 million.

Preferred share purchase rights. In July 2001, ESI’s Board of Directors adopted a stockholder rights plan which

declared a dividend of one right for each outstanding share of ESI’s common stock. The rights plan expired on March 15, 2011

and no additional plan has been adopted by the Board of Directors.

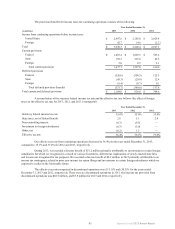

10. Employee benefit plans and stock-based compensation plans

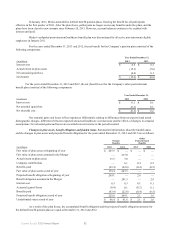

Retirement savings plans. We sponsor retirement savings plans under Section 401(k) of the Internal Revenue Code

for substantially all of our full-time employees. Upon consummation of the Merger, the Company assumed sponsorship of the

plans historically sponsored by ESI (the “ESI 401(k) Plan”) and Medco (the “Medco 401(k) Plan”).

Effective January 1, 2013, the Medco 401(k) Plan merged into the ESI 401(k) Plan. The combined plan (the

“Express Scripts 401(k) Plan”) is applicable to all full-time and part-time employees of the Company. Under the Express

Scripts 401(k) Plan, eligible employees may elect to contribute up to 50% of their salary, and the Company matches up to 6%

of the employees’ compensation contributed to the plan for substantially all employees after one year of service.

Prior to January 1, 2013, under the ESI 401(k) Plan, employees were able to elect to enter into a salary deferral

agreement under which a maximum of 25% of their salary could be contributed to the plan. Under the Medco 401(k) Plan,

employees were able to elect to contribute up to 50% of their salary. The Company matched 200% of the first 1% and 100% of

the next 3% of the employees’ compensation contributed to the plan for substantially all employees under the ESI 401(k) Plan

after one year of service. The Company matched up to 6% of the employees’ compensation contributed to the plan for

substantially all employees under the Medco 401(k) Plan.

For the years ended December 31, 2013, 2012 and 2011, we had contribution expense of approximately $79.9

million, $67.6 million and $25.7 million, respectively. The increase for the year ended December 31, 2012 is the result of

contributions to the Medco 401(k) Plan from the date of the Merger. Contributions under all plans are subject to aggregate

limits required under the Internal Revenue Code.