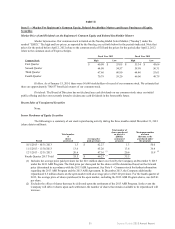

Express Scripts 2013 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29 Express Scripts 2013 Annual Report

on assets, and engage in mergers, consolidations or disposals. The covenants under our credit agreement also include, among

others, a minimum interest coverage ratio and a maximum leverage ratio. If we fail to satisfy one or more of the covenants

under our credit agreement or the senior notes indentures, we would be in default under the credit agreement and/or the senior

notes indentures, and may be required to repay such debt with capital from other sources or otherwise not be able to draw down

against our revolving credit facility. Under such circumstances, other sources of capital may not be available to us, or be

available only on unattractive terms. See Note 7 - Financing to our consolidated financial statements included in Part II —

Item 8 of this Annual Report on Form 10-K.

A delay, reduction, suspension or cancellation of government spending or appropriations could have a material adverse effect

on our business and results of operations.

Certain of our revenues are ultimately sourced from government spending and appropriated funds. The failure to

provide for continued appropriations or regular ongoing scheduled payments to us could have a material adverse effect on our

business and results of operations.

If we lose our relationship with one or more key pharmaceutical manufacturers, or if the payments made or discounts provided

by pharmaceutical manufacturers decline, our business and results of operations could be adversely affected.

We maintain contractual relationships with numerous pharmaceutical manufacturers which provide us with, among

other things:

• discounts for drugs we purchase to be dispensed from our home delivery pharmacies

• rebates based upon distributions of drugs from our home delivery pharmacies and through pharmacies in our

retail networks

• administrative fees for managing rebate programs, including the development and maintenance of formularies

which include the particular manufacturer’s products

• access to limited distribution specialty pharmaceuticals

If several of these contractual relationships are terminated or materially altered by the pharmaceutical

manufacturers or we are otherwise unable to renew such contracts or enter into similar contracts on favorable terms, our

business and results of operations could be materially adversely affected. In addition, formulary fee programs have been the

subject of debate in federal and state legislatures and various other public and governmental forums. Adoption of new laws,

rules or regulations or changes in, or new interpretations of, existing laws, rules or regulations, relating to any of these

programs could materially adversely affect our business and results of operations.

Changes in industry pricing benchmarks could materially impact our financial performance.

Contracts in the prescription drug industry, including our contracts with retail pharmacy networks and with PBM

and specialty pharmacy clients, generally use “average wholesale price” or “AWP,” which is published by a third party as a

benchmark to establish pricing for prescription drugs. In the event that AWP is no longer published by third parties or if we

adopt other pricing benchmarks for establishing prices within the industry, we can give no assurance that the short- or long-

term impact of such changes to industry pricing benchmarks will not have a material adverse effect on our business and results

of operations.

Legislation and other regulations affecting drug prices are discussed in more detail under “Part I — Item 1 —

Business — Government Regulation and Compliance — Legislation and Regulation Affecting Drug Prices” above.

Pending and future litigation or other proceedings could subject us to significant monetary damages or penalties and/or

require us to change our business practices, which could have a material adverse effect on our business and results of

operations.

We are subject to risks relating to litigation, enforcement action, regulatory proceedings, government inquiries and

investigations and other similar actions in connection with our business operations, including without limitation the dispensing

of pharmaceutical products by our specialty and home delivery pharmacies, services rendered in connection with our disease

management offering, our pharmaceutical services operations, pharmacy benefit management services and mergers and

acquisitions activity. A list of the significant proceedings pending against us is included under “Part I — Item 3 — Legal

Proceedings,” including certain proceedings that purport to be class action lawsuits. These proceedings seek unspecified

monetary damages and/or equitable relief. While we believe these proceedings are without merit and intend to contest them

vigorously, we cannot predict with certainty the outcome of any such proceedings. If one or more of these proceedings has an

unfavorable outcome, we cannot provide any assurance that it would not have a material adverse effect on our business and

results of operations, including our ability to attract and retain clients as a result of the negative reputational impact of such an