Express Scripts 2013 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2013 Annual Report 28

legislation that severely restricts or prohibits our use of patient identifiable or other information could limit our ability to use

information critical to the operation of our business. Furthermore, if we violate a patient’s privacy or are found to have violated

any federal or state statute or regulation with regard to confidentiality or dissemination or use of protected health information,

we could be liable for significant damages, fines or penalties and suffer reputational harm, any one of which could have a

material adverse effect on our business and results of operations.

Difficulty in integrating the business of Express Scripts, Inc. and Medco or uncertainty around realization of the anticipated

benefits of the Merger, including the expected amount and timing of cost savings and operating synergies and difficulty in

retaining clients of the respective companies, could have a material adverse effect on our business and results of operations as

well as cause a decline of our stock price.

The success of the Merger depends, in part, on our ability to fully realize the anticipated benefits from the

combination, including synergies, cost savings, innovation and operational efficiencies. If we are unable to fully achieve these

objectives, the anticipated benefits may not be fully realized or at all, and the value of our common stock may decline.

The combination of Medco’s business and ESI’s business has been, and will continue to be, a complex, costly and

time-consuming process. The ongoing integration of the two companies has resulted, and may continue to result, in challenges,

some of which may be material, including, without limitation:

• the diversion of management’s attention from ongoing business concerns and performance shortfalls at one or

both of the companies as a result of the devotion of management’s attention to the completion of the

integration

• managing a larger combined company

• the possibility of faulty assumptions underlying expectations regarding the integration process

• retaining existing clients and attracting new clients on profitable terms

• retaining long-term client relationships which comprise a substantial portion of our revenues

• unanticipated issues in integrating information technology, communications and other systems

• managing tax costs or inefficiencies associated with integrating the operations of the combined company

• unforeseen expenses associated with the Merger

Any one or more of these factors could result in increased costs, decreases in the amount of expected revenues,

diversion of management’s time and energy or other negative impacts on the business. Delays or issues encountered in the

ongoing integration process could have a material adverse effect on the revenues, expenses, operating results and financial

condition of the combined company and there can be no assurance that we will fully realize these anticipated benefits.

Further, we have incurred and will continue to incur significant costs in connection with the integration process.

The substantial majority of these costs are non-recurring expenses related to the facilities and systems consolidation costs. We

may also incur other unanticipated integration costs as well as costs to maintain employee morale and additional costs related to

formulating and revising integration plans.

If, among other things, we are unable to fully achieve the expected growth in earnings, or if our operational cost

savings estimates are not fully realized, or if the integration costs are greater than expected, the market price of our common

stock may decline. The market price also may decline if we do not fully achieve the perceived benefits of the Merger as rapidly

or to the extent anticipated by financial or industry analysts or if the financial results of the combined company are not

consistent with the expectations of financial or industry analysts.

Our debt service obligations reduce the funds available for other business purposes, and the terms and covenants relating to

our indebtedness could adversely impact our financial performance and liquidity.

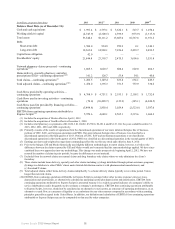

We currently have debt outstanding (see summary of indebtedness within Note 7 - Financing), including

indebtedness of ESI and Medco guaranteed by us. Our debt service obligations reduce the funds available for other business

purposes. Increases in interest rates on variable rate indebtedness would increase our interest expense and could materially

adversely affect our financial results. At December 31, 2013, we had $2,000.0 million of gross obligations, or $8.6 million net

of cash, which were subject to variable rates of interest under our credit agreement. A hypothetical increase in interest rates of

1% would result in an increase in annual interest expense of approximately $20.0 million (pre-tax), assuming that obligations

subject to variable interest rates remained constant.

We are subject to risks normally associated with debt financing, such as the insufficiency of cash flow to meet

required debt service payment obligations and the inability to refinance existing indebtedness. In addition, certain of our debt

instruments contain covenants which include limitations on our ability to incur additional indebtedness, create or permit liens