Express Scripts 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2013 Annual Report 42

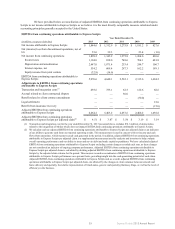

For our 2013 impairment test, we did not perform a qualitative assessment for any of our reporting units, and

instead began with Step 1 of the goodwill impairment analysis, as allowed under authoritative Financial Accounting Standards

Board (“FASB”) guidance. No impairment charges were recorded as a result of our annual impairment test. However, an

impairment charge of $32.9 million was recorded in 2013 based on the contracted sales price of the business (Level 2)

associated with our acute infusion therapies line of business due to entering into an agreement for the sale of the business. Our

acute infusion therapies line of business was subsequently sold on November 1, 2013. An impairment charge of $2.0 million

was recorded in 2012 associated with our subsidiary Europa Apotheek Venlo B.V. (“EAV”), based on a change in business

environment related to an adverse court ruling by the German high court in August 2012 and the expected disposal of EAV as a

result of the ruling (Level 2). EAV was subsequently sold on December 4, 2012. No other goodwill impairment charges existed

for any of our other reporting units at December 31, 2013 or December 31, 2012.

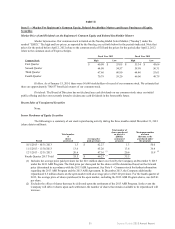

Other intangible assets include, but are not limited to, customer contracts and relationships, deferred financing fees

and trade names. Deferred financing fees are recorded at cost. Customer contracts and relationships are valued at fair market

value when acquired using the income method. Customer contracts and relationships related to our 10-year contract with

WellPoint, Inc. (“WellPoint”) under which we provide pharmacy benefit management services to WellPoint and its designated

affiliates (“the PBM agreement”) are being amortized using a modified pattern of benefit method over an estimated useful life

of 15 years. Customer contracts and relationships intangible assets related to our acquisition of Medco are being amortized

using a modified pattern of benefit method over an estimated useful life of 2 to 16 years. The customer contract related to our

asset acquisition of the SmartD Medicare Prescription Drug Plan is being amortized over an estimated useful life of 10 years.

All other intangible assets, excluding legacy ESI trade names which have an indefinite life, are amortized on a straight-line

basis, which approximates the pattern of benefit, over periods from 5 to 20 years for customer-related intangibles, 10 years for

trade names and 2 to 30 years for other intangible assets.

In 2012, upon reassessment of the carrying values of assets and liabilities of EAV based on the events described

above, we recorded impairment charges associated with this line of business totaling $9.5 million of intangibles assets. The

write-off of intangible assets was comprised of customer relationships with a carrying value of $3.6 million (gross value of $5.0

million less accumulated amortization of $1.4 million) and trade names with a carrying value of $5.9 million (gross value of

$7.0 million less accumulated amortization of $1.1 million). EAV was subsequently sold on December 4, 2012.

In 2012, as a result of our plan to dispose of our PolyMedica Corporation (“Liberty”) line of business, an

impairment charge totaling $23.0 million was recorded against intangible assets to reflect fair value based on the contracted

sales price of the business (Level 2). The write-down was comprised of customer relationships with a carrying value of $24.2

million (gross value of $35.0 million less accumulated amortization of $10.8 million) and trade names with a carrying value of

$6.6 million ($7.0 million less accumulated amortization of $0.4 million). This charge was allocated to these assets on a pro

rata basis using the carrying values as of September 30, 2012. Liberty was subsequently sold on December 3, 2012. See Note 4

- Dispositions and Note 6 - Goodwill and other intangibles for further discussion of these lines of business.

FACTORS AFFECTING ESTIMATE

The fair values of reporting units, asset groups or acquired businesses are measured based on market prices, when

available. When market prices are not available, we estimate fair value using the income approach and/or the market approach.

The income approach uses cash flow projections which require inputs and assumptions that reflect current market conditions as

well as management judgment. We base our fair values on projected financial information which we believe to be reasonable.

However, actual results may differ from those projections and those differences may be material.

The key assumptions included in our income approach include, but are not limited to, earnings growth rates,

discount rates and inflation rates. Assessment of these factors could be impacted by internal factors and/or external economic

conditions. We performed various sensitivity analyses on the key assumptions which did not indicate any potential impairment.

CONTRACTUAL GUARANTEES

ACCOUNTING POLICY

Many of our contracts contain terms whereby we make certain financial and performance guarantees, including the

minimum level of discounts or rebates a client may receive, generic utilization rates and various service guarantees. These

clients may be entitled to performance penalties if we fail to meet a financial or service guarantee. Actual performance is

compared to the guarantee for each measure throughout the period, and accruals are recorded if we determine that our

performance against the guarantee indicates a potential liability. These estimates are adjusted to actual when the guarantee

period ends and we have either met the guaranteed rate or paid amounts to clients.