Express Scripts 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2013 Annual Report 74

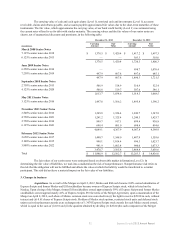

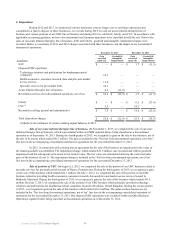

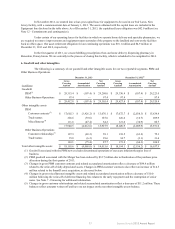

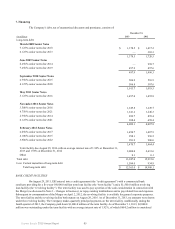

4. Dispositions

During 2012 and 2013, we determined various businesses were no longer core to our future operations and

committed to a plan to dispose of these businesses. As a result, during 2013 we sold our acute infusion therapies line of

business and various portions of our UBC line of business and during 2012 we sold EAV, Liberty and CYC. In accordance with

applicable accounting guidance, we have also determined our European operations to be classified as held for sale. Prior to the

sales of our acute infusion therapies line of business, EAV and Liberty, goodwill and intangible impairment charges were

recorded. Below is a summary of 2013 and 2012 charges associated with these businesses and the impact to our consolidated

statement of operations:

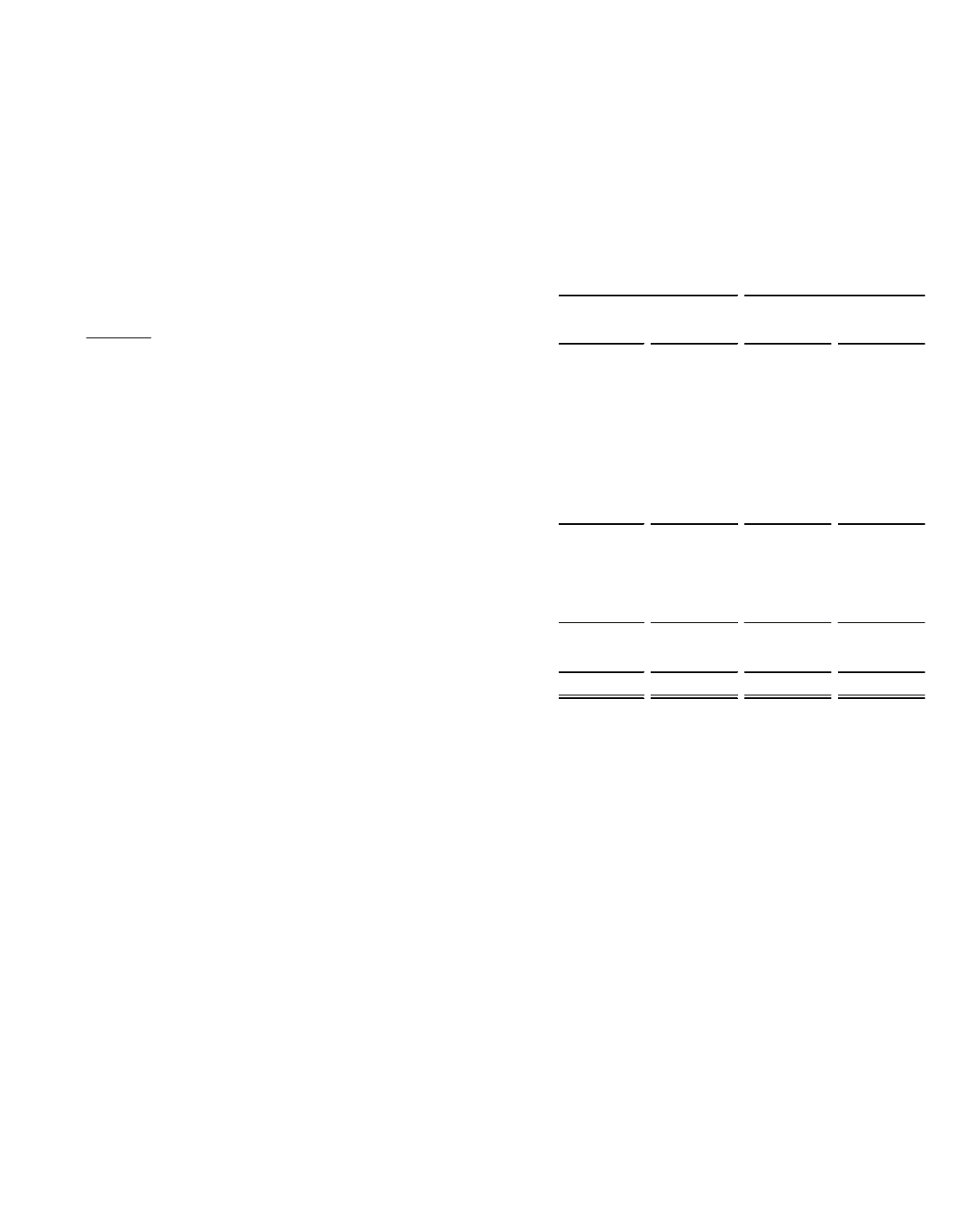

December 31, 2013 December 31, 2012

(in millions)

Gain

recorded

upon sale

Goodwill &

Intangible

Impairments

Gain

recorded

upon sale

Goodwill &

Intangible

Impairments

EAV $ — $ — $ 3.7 $ (11.5)

Disposed UBC operations

Technology solutions and publications for biopharmaceutical

companies 18.3———

Health economics, outcomes research, data analytics and market

access services 11.4———

Specialty services for pre-market trials 22.1———

Acute infusion therapies line of business 0.5 (32.9)— —

Recorded in net loss from discontinued operations, net of tax $ 52.3 $ (32.9) $ 3.7 $ (11.5)

Liberty $ — $ — $ 0.5 $ (23.0)

CYC(1) 3.5 — 14.3 —

Recorded in selling, general and administrative $ 3.5 $ — $ 14.8 $ (23.0)

Total disposition charges $ 55.8 $ (32.9) $ 18.5 $ (34.5)

(1) Reflects the settlement of certain working capital balances in 2013.

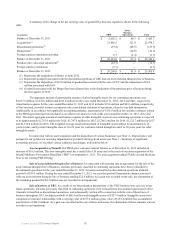

Sale of our acute infusion therapies line of business. On November 1, 2013, we completed the sale of our acute

infusion therapies line of business, which was included within our PBM segment before being classified as a discontinued

operation as of September 30, 2013. During the fourth quarter of 2013, we recognized a gain on the sale of this business, net of

the sale of its assets, which totaled $0.5 million. The gain is included in the “Net loss from discontinued operations, net of tax”

line item in the accompanying consolidated statement of operations for the year ended December 31, 2013.

In 2013, in connection with entering into an agreement for the sale of the business, an impairment in the value of

the related goodwill was identified. The impairment charge, which totaled $32.9 million, was recorded and reflects goodwill

impairment and the subsequent write-down to fair market value. The fair value was determined utilizing the contracted sales

price of the business (Level 2). The impairment charge is included in the “Net loss from discontinued operations, net of tax”

line item in the accompanying consolidated statement of operations for the year ended December 31, 2013.

Sale of portions of UBC. On August 15, 2013, we completed the sale of the portion of our UBC business related to

specialty services for pre-market trials located in Wayne, Pennsylvania. During the third quarter of 2013, we recognized a gain

on the sale of this business which totaled $22.1 million. On July 1, 2013, we completed the sale of the portion of our UBC

business related to providing health economics, outcomes research, data analytics and market access services located in

Bethesda, Maryland. During the third quarter of 2013, we recognized a gain on the sale of this business which totaled $11.4

million. On June 7, 2013, we completed the sale of the portion of our UBC business which primarily provided technology

solutions and publications for biopharmaceutical companies located in Horsham, United Kingdom. During the second quarter

of 2013, we recognized a gain on the sale of this business which totaled $18.3 million. The gains on these businesses are

included in the “Net loss from discontinued operations, net of tax” line item in the accompanying consolidated statement of

operations for the year ended December 31, 2013. Our disposed UBC operations were included within our Other Business

Operations segment before being classified as discontinued operations as of December 31, 2012.