Express Scripts 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65 Express Scripts 2013 Annual Report

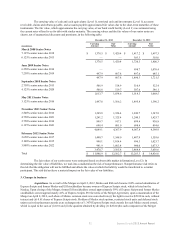

Securities bought and held principally for the purpose of selling them in the near term are classified as trading

securities. Trading securities are reported at fair value, which is based upon quoted market prices, with unrealized holding gains

and losses included in earnings. We held trading securities, consisting primarily of mutual funds, totaling $18.7 million and

$15.8 million at December 31, 2013 and 2012, respectively. We maintain our trading securities to offset changes in certain

liabilities related to our deferred compensation plan discussed in Note 10 - Employee benefit plans and stock-based

compensation plans. Net gain (loss) recognized on the trading portfolio was $1.2 million, $1.0 million and $(0.1) million in

2013, 2012 and 2011, respectively.

Securities not classified as trading or held-to-maturity are classified as available-for-sale securities. Available-for-

sale securities are reported at fair value, which is based upon quoted market prices, with unrealized holding gains and losses

reported through other comprehensive income, net of applicable taxes. We held no securities classified as available for sale at

December 31, 2013 or 2012.

Impairment of long-lived assets. We evaluate whether events and circumstances have occurred which indicate the

remaining estimated useful life of long-lived assets, including other intangible assets, may warrant revision or the remaining

balance of an asset may not be recoverable. The measurement of possible impairment is based on a comparison of the fair value

of the related assets to the carrying value using discount rates that reflect the inherent risk of the underlying business.

Impairment losses, if any, would be recorded to the extent the carrying value of the assets exceeds the implied fair value

resulting from this calculation.

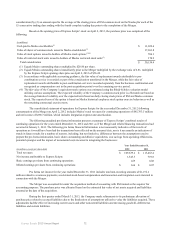

During 2012, we recorded impairment charges of $9.5 million of intangible assets as a result of a change in

business environment and our plan to dispose of EAV. Furthermore, we recorded an impairment charge totaling $23.0 million

as a result of our plan to dispose of Liberty (see Note 4 - Dispositions and Note 6 - Goodwill and other intangibles).

Goodwill. Goodwill is evaluated for impairment annually or when events or circumstances occur indicating that

goodwill might be impaired. Guidance related to goodwill impairment testing provides an option to first assess qualitative

factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. We

determine reporting units based on component parts of our business one level below the segment level. Our reporting units

represent businesses for which discrete financial information is available and reviewed regularly by segment management. If

we perform a qualitative assessment, the Company considers various events and circumstances when evaluating whether it is

more likely than not that the fair value of a reporting unit is less than its carrying amount and whether the first step of the

goodwill impairment test (“Step 1”) is necessary.

If we were to perform Step 1, the measurement of possible impairment would be based on a comparison of the fair

value of each reporting unit to the carrying value of the reporting unit’s net assets. Impairment losses, if any, would be

determined based on the fair value of the individual assets and liabilities of the reporting unit, using discount rates that reflect

the inherent risk of the underlying business. We would record an impairment charge to the extent the carrying value of goodwill

exceeds the implied fair value of goodwill resulting from this calculation. This valuation process involves assumptions based

upon management’s best estimates and judgments that approximate the market conditions experienced for our reporting units at

the time the impairment assessment is made. Actual results may differ from these estimates due to the inherent uncertainty

involved in such estimates.

For our 2013 impairment test, we did not perform a qualitative assessment for any of our reporting units, and

instead began with Step 1 of the goodwill impairment analysis. No impairment existed for any of our reporting units at

December 31, 2013 or 2012.

During 2013, we wrote off $32.9 million of goodwill based on a reassessment of the carrying values of assets and

liabilities within our acute infusion therapies line of business (see Note 6 - Goodwill and other intangibles).

During 2012, we wrote off $2.0 million of goodwill based on a reassessment of the carrying values of assets and

liabilities within EAV’s line of business (see Note 6 - Goodwill and other intangibles).

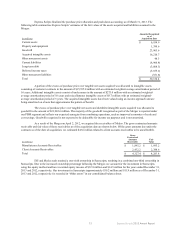

Other intangible assets. Other intangible assets include, but are not limited to, customer contracts and

relationships, deferred financing fees and trade names. Deferred financing fees are recorded at cost. Customer contracts and

relationships are valued at fair market value when acquired using the income method. Customer contracts and relationships

related to our 10-year contract with WellPoint, Inc. (“WellPoint”) under which we provide pharmacy benefit management

services to WellPoint and its designated affiliates (“the PBM agreement”) are being amortized using a modified pattern of

benefit method over an estimated useful life of 15 years. Customer contracts and relationships intangible assets related to our

acquisition of Medco are being amortized using a modified pattern of benefit method over an estimated useful life of 2 to 16

years, respectively. The customer contract related to our asset acquisition of the SmartD Medicare Prescription Drug Plan is

being amortized over an estimated useful life of 10 years. All other intangible assets, excluding legacy ESI trade names which