Express Scripts 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89 Express Scripts 2013 Annual Report

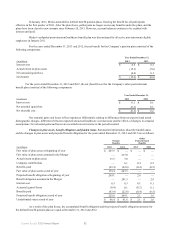

Employee stock purchase plan. We offer an employee stock purchase plan that qualifies under Section 423 of the

Internal Revenue Code and permits all domestic employees, excluding certain management level employees, to purchase shares

of our common stock. Participating employees may contribute up to 10% of their salary to purchase common stock at the end

of each monthly participation period at a purchase price equal to 95% of the fair market value of our common stock on the last

business day of the participation period. During 2013, 2012 and 2011, approximately 289,000, 229,000 and 200,000 shares of

our common stock were issued under the plan, respectively. Our common stock reserved for future employee purchases under

the plan is approximately 1.9 million shares at December 31, 2013.

Deferred compensation plan. We maintain a non-qualified deferred compensation plan (the “Executive Deferred

Compensation Plan”) that provides benefits payable to eligible key employees at retirement, termination or death. Benefit

payments are funded by a combination of contributions from participants and us. Participants may elect to defer up to 50% of

their base earnings and 100% of specific bonus awards. Participants become fully vested in our contributions on the third

anniversary of the end of the plan year for which the contribution is credited to their account. For 2013, our contribution was

equal to 6% of each qualified participant’s total annual compensation, with 25% being allocated as a hypothetical investment in

our common stock and the remaining being allocated to a variety of investment options elected by the participants. We have

chosen to fund our liability for this plan through investments in trading securities, which primarily consist of mutual funds (see

Note 1 - Summary of significant accounting policies). We incurred net compensation expense of approximately $1.2 million,

$1.0 million and $0.6 million in 2013, 2012 and 2011, respectively. At December 31, 2013, approximately 5.9 million shares of

our common stock have been reserved for future issuance under the plan. We have $0.3 million and $0.2 million of unearned

compensation related to unvested shares that are part of our deferred compensation plan at December 31, 2013 and 2012,

respectively.

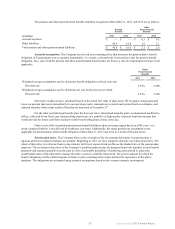

Stock-based compensation plans in general. In March 2011, ESI’s Board of Directors adopted the ESI 2011 Long-

Term Incentive Plan (the “2011 LTIP”), which provides for the grant of various equity awards with various terms to our

officers, directors and key employees selected by the Compensation Committee of the Board of Directors. The 2011 LTIP was

approved by ESI’s stockholders in May 2011 and became effective June 1, 2011. Upon consummation of the Merger, the

Company assumed sponsorship of the 2011 LTIP. Under the 2011 LTIP, we may issue stock options, stock-settled stock

appreciation rights (“SSRs”), restricted stock units, restricted stock awards, performance share awards and other types of

awards. The maximum number of shares available for awards under the 2011 LTIP is 30.0 million. The maximum term of stock

options, SSRs, restricted stock units, restricted stock awards and performance shares granted under the 2011 LTIP is 10 years.

As of December 31, 2013, approximately 22.6 million shares of our common stock are available for issuance under this plan.

Subsequent to the effective date of the 2011 LTIP, no additional awards have been or will be granted under the

2000 Long-Term Incentive Plan (the “2000 LTIP”), which provided for the grant of various equity awards with various terms to

ESI’s officers, directors and key employees selected by the Compensation Committee. However, this plan is still in existence as

there are outstanding grants under this plan. Under the 2000 LTIP, ESI issued stock options, SSRs, restricted stock units,

restricted stock awards and performance share awards, which awards were converted into awards relating to Express Scripts

common stock upon closing of the Merger. Prior to the Merger, awards were typically settled using treasury shares. Upon close

of the Merger, treasury shares of ESI were cancelled and subsequent awards were settled by issuance of new shares. The

maximum term of stock options, SSRs, restricted stock units, restricted stock awards and performance shares granted under the

2000 LTIP is 10 years.

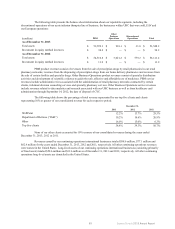

The provisions of both the 2000 LTIP and 2011 LTIP allow employees to use shares to cover tax withholding on

stock awards. Upon vesting of restricted stock and performance shares, employees have taxable income subject to statutory

withholding requirements. The number of shares issued to employees may be reduced by the number of shares having a market

value equal to our minimum statutory withholding for federal, state and local tax purposes.

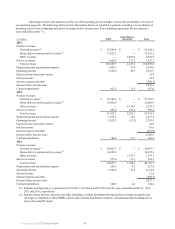

The tax benefit related to employee stock compensation recognized during the years ended December 31, 2013,

2012 and 2011 was $60.0 million, $153.9 million and $17.7 million, respectively.

Effective upon the closing of the Merger, the Company assumed the sponsorship of the Medco Health Solutions,

Inc. 2002 Stock Incentive Plan (the “2002 Stock Incentive Plan”), allowing Express Scripts to issue awards under this plan. As

of December 31, 2013, 13.5 million shares are available under this plan. Under the Medco Health Solutions, Inc. 2002 Stock

Incentive Plan, Medco granted, and, following the Merger, Express Scripts has granted and may continue to grant, stock

options, restricted stock units and other types of awards to officers, employees and directors. Medco’s awards granted under the

2002 Stock Incentive Plan are subject to accelerated vesting upon change in control and termination.