Express Scripts 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49 Express Scripts 2013 Annual Report

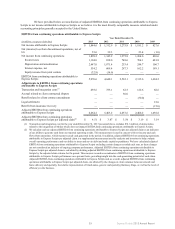

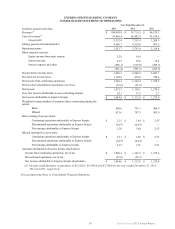

Other Business Operations operating income decreased $33.0 million in 2012 over 2011. This decrease is due

primarily to the inclusion of amounts related to Medco, the impact of impairment charges, less the gain upon sale associated

with Liberty, netting to a loss of $22.5 million, and losses attributed to other international businesses. Offsetting these losses is

a $14.3 million gain associated with the sale of CYC for the year ended December 31, 2012.

OTHER (EXPENSE) INCOME, NET

Net other expense decreased $72.1 million, or 12.1%, in 2013 as compared to 2012. This decrease is primarily due

to reduced interest for the year ended December 31, 2013 due to the early redemption of ESI’s $1,000.0 million aggregate

principal amount of 6.250% senior notes due 2014, and a $35.4 million contractual interest payment received from a client. In

addition, this decrease was partially due to greater undistributed gains from our joint venture of $32.8 million for the year

ended 2013 compared to $14.9 million for the year ended 2012, which we began recording under the equity method due to our

increased consolidated ownership following the Merger as discussed in Note 3 - Changes in business. These net decreases are

partially offset by the acquisition of Medco and inclusion of its interest expense for the three months ended March 31, 2013

related to the senior notes acquired in the Merger, as well as $68.5 million of redemption costs and write-off of deferred

financing fees incurred for early redemption of debt as discussed below for the year ended December 31, 2013.

Net other expense increased $306.2 million, or 106.6%, in 2012 as compared to 2011 due to the following items:

$85.2 million of financing fees related to the bridge facility (defined below) and senior note interest incurred in 2012 prior to

the Merger; $12.4 million of financing fees related to the credit agreement (defined below) entered into upon consummation of

the Merger; and interest expense incurred subsequent to the Merger related to the credit agreement, February 2012 Senior

Notes, November 2011 Senior Notes, May 2011 Senior Notes, and senior notes acquired from Medco on April 2, 2012. These

increases were partially offset by the redemption of Medco’s $500.0 million aggregate principal amount of 7.250% senior notes

due 2013, the redemption of ESI’s $1,000.0 million aggregate principal amount of 5.250% senior notes due 2012, early

repayment of $1,000.0 million associated with the credit agreement and termination of the bridge facility. Other net expense

includes equity income of $14.9 million attributable to our joint venture, Surescripts, which is accounted for using the equity

method due to our increased consolidated ownership following the Merger.

For the definitions of the agreements and senior notes referenced above, see “Part II — Item 7 — Management’s

Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources.”

PROVISION FOR INCOME TAXES

Our effective tax rate from continuing operations attributable to Express Scripts was 36.4% for the year ended

December 31, 2013, compared to 38.1% and 37.0% for 2012 and 2011, respectively.

During 2013, we recorded a discrete benefit of $51.2 million primarily attributable to investments in certain foreign

subsidiaries for which we recognized as a result of various divestitures, deferred tax implications of newly enacted state laws

and income not recognized for tax purposes. We recorded a discrete benefit of $8.2 million in 2012 primarily attributable to an

income tax contingency related to prior year income tax return filings and investments in certain foreign subsidiaries for which

we expected to realize in the foreseeable future.

As of December 31, 2013, management intends to pursue a $544.9 million potential tax benefit related to the

disposition of Liberty. Based on information currently available, no net benefit has been recognized. Pending the resolution of

certain matters, including but not limited to examinations by taxing authorities, all or a part of the deduction may become

realizable in the future. We cannot predict with any certainty the exact amount.

We believe that it is reasonably possible that our unrecognized tax benefits could significantly change within the

next twelve months due to the anticipated conclusion of various examinations. At this time, an estimate of the range of the

reasonably possible change in the next 12 months cannot be made.