Express Scripts 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2013 Annual Report 70

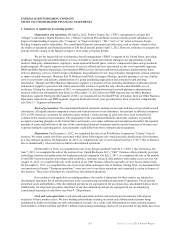

Comprehensive income. In addition to net income, comprehensive income (net of taxes) includes foreign currency

translation adjustments. We recognized foreign currency translation adjustments of $(7.2) million, $1.9 million and $(2.8)

million for the years ending December 31, 2013, 2012 and 2011, respectively.

New accounting guidance. In July 2013, the Financial Accounting Standards Board (“FASB”) issued authoritative

guidance containing changes to the presentation of an unrecognized tax benefit when a loss or credit carryforward exists. This

statement is effective for financial statements issued for annual periods beginning after December 15, 2013, with early adoption

permitted. Adoption of the standard is not expected to impact our financial position, results of operations, or cash flows.

In February 2013, the FASB issued authoritative guidance containing changes to the presentation of amounts

reclassified out of accumulated other comprehensive income. This statement is effective for financial statements issued for

annual periods beginning after December 15, 2012. Adoption of the standard impacts the presentation of certain information

within the consolidated financial statements, but will not impact our consolidated financial position, consolidated results of

operations or consolidated cash flows. The Company has not reclassified amounts out of accumulated other comprehensive

income; as such, no additional information is presented for the years ended December 31, 2013, 2012 or 2011.

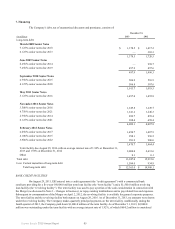

2. Fair value measurements

FASB guidance regarding fair value measurement establishes a three-tier fair value hierarchy, which prioritizes the

inputs used in measuring fair value. These tiers include: Level 1, defined as observable inputs such as quoted prices in active

markets for identical assets or liabilities; Level 2, defined as inputs other than quoted prices for similar assets and liabilities in

active markets that are either directly or indirectly observable; and Level 3, defined as unobservable inputs for which little or

no market data exists, therefore requiring an entity to develop its own assumptions.

Financial assets accounted for at fair value on a recurring basis include cash equivalents of $845.2 million and

$1,572.3 million, restricted cash and investments of $22.8 million and $19.6 million, and trading securities (included in other

assets) of $18.7 million and $15.8 million, at December 31, 2013 and 2012, respectively. These assets are carried at fair value

based on quoted market prices in active markets for identical securities (Level 1 inputs). Cash equivalents include investments

in AAA-rated money market mutual funds with maturities of less than 90 days.

FASB guidance allows a company to elect to measure eligible financial assets and financial liabilities at fair value.

Unrealized gains and losses on items for which the fair value option has been elected are reported in earnings at each

subsequent reporting date. Eligible items include, but are not limited to, accounts and loans receivable, equity method

investments, accounts payable, guarantees, issued debt and firm commitments. Currently, we have not elected to account for

any of our eligible items using the fair value option under this guidance.