Express Scripts 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55 Express Scripts 2013 Annual Report

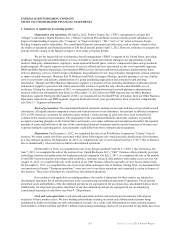

BRIDGE FACILITY

On August 5, 2011, ESI entered into a credit agreement with Credit Suisse AG, Cayman Islands Branch, as

administrative agent, Citibank, N.A., as syndication agent, and the other lenders and agents named within the agreement. The

credit agreement provided for a one-year unsecured $14,000.0 million bridge term loan facility (the “bridge facility”). No

amounts were withdrawn under the bridge facility, and subsequent to consummation of the Merger on April 2, 2012, the bridge

facility was terminated.

See Note 7 - Financing for more information on the bridge facility.

FIVE-YEAR CREDIT FACILITY

On April 30, 2007, Medco entered into a senior unsecured credit agreement, which was available for general

working capital requirements. The facility consisted of an $1,000.0 million, 5-year senior unsecured term loan and a $2,000.0

million, 5-year senior unsecured revolving credit facility. The facility was due to mature on April 30, 2012. Medco refinanced

the $2,000.00 million senior unsecured revolving credit facility on January 23, 2012. Upon completion of the Merger, the

$1,000.0 million senior unsecured term loan and all associated interest, and the $1,000.0 million then outstanding under the

senior unsecured revolving credit facility, were repaid in full and terminated.

See Note 7 - Financing for more information on the five-year credit facility.

ACCOUNTS RECEIVABLE FINANCING FACILITY

Upon consummation of the Merger, Express Scripts assumed a $600.0 million, 364-day renewable accounts

receivable financing facility that was collateralized by Medco’s pharmaceutical manufacturer rebates accounts receivable. On

September 21, 2012, Express Scripts terminated the facility and repaid all amounts drawn down.

See Note 7 - Financing for more information on the accounts receivable financing facility.

INTEREST RATE SWAP

Medco entered into five interest rate swap agreements in 2004. These swap agreements, in effect, converted $200.0

million of Medco’s $500.0 million of 7.250% senior notes due 2013 to variable interest rate debt. Under the terms of these

swap agreements, Medco received a fixed rate of interest of 7.250% on $200.0 million and paid variable interest rates based on

the six-month LIBOR plus a weighted-average spread of 3.050%. The payment dates under the agreements coincided with the

interest payment dates on the hedged debt instruments and the difference between the amounts paid and received was included

in interest expense. These swaps were settled on May 7, 2012. Express Scripts received $10.1 million for settlement of the

swaps and the associated accrued interest receivable through May 7, 2012 and recorded a loss of $1.5 million related to the

carrying amount of the swaps and bank fees.

See Note 7 - Financing for more information on the interest rate swap.