Express Scripts 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124

|

|

Express Scripts 2013 Annual Report 114

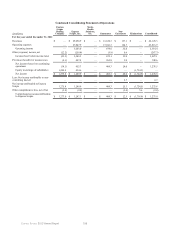

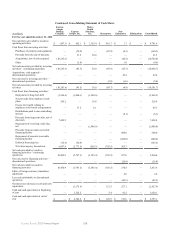

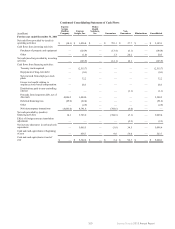

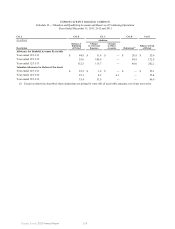

EXPRESS SCRIPTS HOLDING COMPANY

Schedule II — Valuation and Qualifying Accounts and Reserves of Continuing Operations

Years Ended December 31, 2013, 2012 and 2011

Col. A Col. B Col. C Col. D Col. E

(in millions) Additions

Description

Balance at

Beginning

of Period

Charges

to Costs and

Expenses

Charges

to Other

Accounts Deductions(1) Balance at End

of Period

Allowance for Doubtful Accounts Receivable

Year ended 12/31/11 $ 64.8 $ 11.6 $ — $ 20.8 $ 55.6

Year ended 12/31/12 55.6 145.8 — 68.9 132.5

Year ended 12/31/13 132.5 115.7 — 46.0 202.2

Valuation Allowance for Deferred Tax Assets

Year ended 12/31/11 $ 23.2 $ 1.9 $ — $ — $ 25.1

Year ended 12/31/12 25.1 4.2 6.1 — 35.4

Year ended 12/31/13 35.4 31.5 — — 66.9

(1) Except as otherwise described, these deductions are primarily write-offs of receivable amounts, net of any recoveries.