Express Scripts 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87 Express Scripts 2013 Annual Report

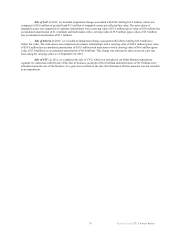

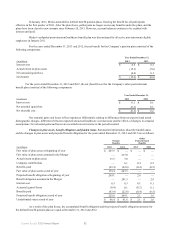

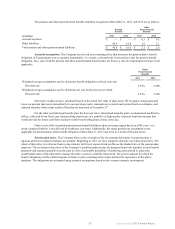

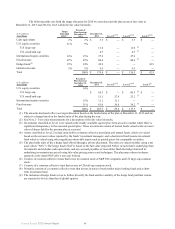

The Internal Revenue Service (“IRS”) is currently examining Medco’s 2008, 2009 and 2010 consolidated U.S.

federal income tax returns. This examination is expected to conclude in early 2014 and is not expected to result in a material

change to our financial position. In 2013, the IRS commenced its examination of ESI’s 2010, 2011 and 2012 consolidated U.S.

federal income tax returns. Our federal income tax audit uncertainties primarily relate to the timing of deductions while various

state income tax audit uncertainties primarily relate to the attribution of overall taxable income to those states. We have taken

positions in certain taxing jurisdictions for which it is reasonably possible that the total amounts of unrecognized tax benefits

may change within the next twelve months. The possible change could result from the finalization of income tax audits and

lapses of statutes of limitation. An estimate of the range of the reasonably possible change in the next 12 months cannot be

made. The majority of the open tax years subject to examination by taxing authorities are for years subsequent to 2007.

As of December 31, 2013, management intends to pursue a $544.9 million potential tax benefit related to the

disposition of Liberty. Based on information currently available, no net benefit has been recognized. Pending the resolution of

certain matters, including but not limited to examinations by taxing authorities, all or a part of the deduction may become

realizable in the future. We cannot predict with any certainty the exact amount.

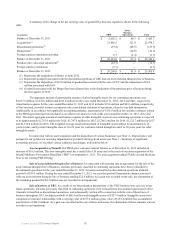

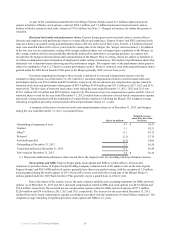

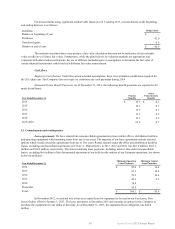

9. Common stock

Accelerated share repurchases. On December 9, 2013, as part of our 2013 Share Repurchase Program (as defined

below), we entered into an agreement to repurchase shares of our common stock for an aggregate purchase price of $1,500.0

million (the “2013 ASR Program”) under an Accelerated Share Repurchase agreement (the “2013 ASR Agreement”). Under the

terms of the 2013 ASR Agreement, upon payment of the purchase price, we received an initial delivery of 20.1 million shares

of our common stock at a price of $67.16 per share, which represents, based on the closing share price of our common stock on

Nasdaq on December 9, 2013, approximately 90% of the $1,500.0 million amount of the 2013 ASR Program. The final

purchase price per share (the “forward price”) and the final number of shares received will be determined using the arithmetic

mean of the daily volume-weighted average price of the Company’s common stock (the “VWAP”) over the term of the 2013

ASR Program less a discount granted under the ASR Agreement. The 2013 ASR Program will be completed in the second

quarter of 2014, subject to the right of the investment bank to accelerate the settlement of the program.

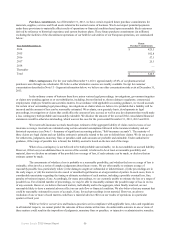

Upon settlement of the 2013 ASR Program we may receive additional shares, including for the remaining 10% of

the $1,500.0 million amount of the 2013 ASR Program, or we may be required to pay additional cash for the initial shares

received or re-deliver shares (at our option), based on the forward price beginning after the effective date of the 2013 ASR

Agreement and ending on or about May 5, 2014, subject to the right of the investment bank to accelerate settlement of the 2013

ASR Agreement. Under the terms of the contract, the maximum number of shares that could be delivered by us under the

contract is 44.7 million. If the 2013 ASR Program had been settled as of December 31, 2013, based on the VWAP since the

effective date of the agreement, the investment bank would have been required to deliver an additional 2.3 million shares to us.

These shares are not included in the calculation of diluted weighted-average common shares outstanding during the period

because their effect was anti-dilutive.

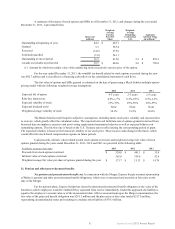

The 2013 ASR Agreement is accounted for as an initial treasury stock transaction and a forward stock purchase

contract. We recorded this transaction as an increase to treasury stock of $1,350.1 million, and recorded the remaining $149.9

million as a decrease to additional paid-in capital in the consolidated balance sheet at December 31, 2013. The $149.9 million

recorded in additional paid-in capital will be reclassified to treasury stock upon completion of the 2013 ASR Program. The

forward stock purchase contract is classified as an equity instrument under applicable accounting guidance and was deemed to

have a fair value of zero at the effective date of the 2013 ASR Agreement. The initial delivery of shares resulted in an

immediate reduction of the outstanding shares used to calculate the weighted-average common shares outstanding for basic and

diluted net income per share on the effective date of the 2013 ASR Agreement.

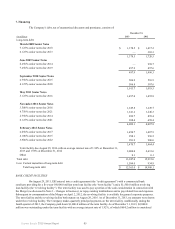

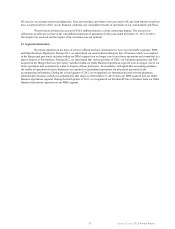

On May 27, 2011, ESI entered into agreements to repurchase shares of its common stock for an aggregate purchase

price of $1,750.0 million under an Accelerated Share Repurchase agreement (“2011 ASR Agreement”). The 2011 ASR

Agreement consisted of two agreements, providing for the repurchase of shares of ESI’s common stock worth $1,000.0 million

and $750.0 million, respectively. Upon payment of the purchase price on May 27, 2011, ESI received 29.4 million shares of

ESI’s common stock at a price of $59.53 per share. During the third quarter of 2011, ESI settled the $1,000.0 million portion of

the 2011 ASR Agreement and received 1.9 million shares at a final forward price of $53.51 per share. During the fourth quarter

of 2011, ESI settled $725.0 million of the $750.0 million portion of the 2011 ASR Agreement and received 2.1 million shares at

a weighted-average final forward price of $50.69. On April 27, 2012, ESI settled the remaining portion of the 2011 ASR

Agreement and received 0.1 million additional shares, resulting in a total of 33.5 million shares received under the 2011 ASR

Agreement.